Recently emerged public documents indicate that the largest US-based cryptocurrency exchange –Coinbase – plans to sell blockchain analytics software to two US government agencies.

At the same time, a Twitter poll suggests that almost 50% of participants would delete their Coinbase accounts.

Coinbase To Sell Analytic Software To Government Agencies?

The public records link the popular cryptocurrency exchange with the Drug Enforcement Administration (DEA) and the Internal Revenue Service (IRS). More specifically, the two agencies intend to buy licenses from the company’s analytics platform called Coinbase Analytics.

The IRS document, published in April this year, outlines the connection between Coinbase Analytics and Neutrino – the blockchain intelligence platform that Coinbase purchased last year. Shortly after the acquisition, however, controversy emerged as some of Neutrino’s founders were previously involved with an Italian spyware firm – Hacking Team.

Later, Coinbase said that it would part ways with those particular staff members.

“As law enforcement techniques evolve and other cryptocurrencies gain acceptance, criminals are using other types of cryptocurrencies, not just Bitcoin, to facilitate their crimes. In addition to the Bitcoin Blockchain, Coinbase Analytics (aka Neutrino) allows for the analysis and tracking of cryptocurrency flows across multiple blockchains that criminals are currently using.

Coinbase Analytics also provides some enhanced law enforcement sensitive capabilities that are not currently found in other tools on the market. This action will result in a Firm Fix Priced purchase order, Period of Performance: One base year from date of award with one 12-month option.” – reads the IRS document.

On the other hand, the DEA document notes that Coinbase Analytics (CA) “provides investigators with identity attribution and de-anonymities virtual currency addresses domestically and internationally. CA is known for its accuracy of attribution, which includes some of the most conservative heuristics used in commercial blockchain tracing tools. This is critical in avoiding false-positive during target identification.”

The paper from DEA also describes Coinbase Analytics as “the least expensive tool on the market” and has “the most features for the money.”

While the data is not conclusive, Coinbase could make up to $250,000 on the deal, per the documents.

Crypto Community Is Not Happy?

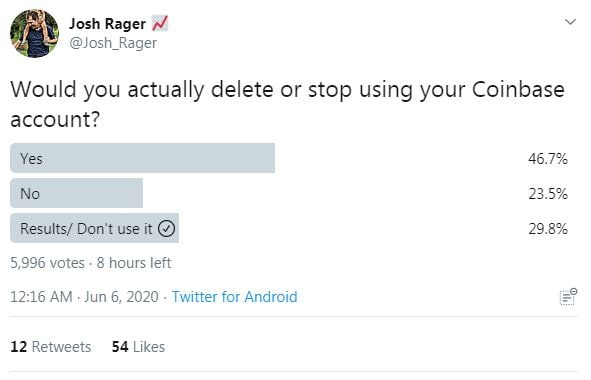

Popular cryptocurrency analyst Josh Rager conducted a Twitter poll earlier today asking the community if they would “delete or stop using your Coinbase account?”

With eight hours left until the poll ends, nearly 6,000 voters have participated so far, and 46.7% claim that they will indeed stop or delete their accounts.

It’s worth noting that the exchange has seen better publicity days. A few days ago, during Bitcoin’s surge from $9,500 to almost $10,500, Coinbase went offline. This was not the first time the platform had gone down during volatile price developments in the cryptocurrency market. The community expressed their dissatisfaction quite vocally.

Another blow to the company came recently when the popular economist and author of the best-seller book The Black Swan – Nassim Taleb – said that he closed his Coinbase account. Taleb complained that the support team of the exchange was uncooperative.

The post 47% Would Leave Coinbase As It Offers Crypto Surveillance Tools to the US Government appeared first on CryptoPotato.

The post appeared first on CryptoPotato