The novel coronavirus took the world by a storm. Starting in China, the virus has now spread throughout the globe, with thousands of cases being reported in Europe, Asia, and even the US.

This brought a catastrophe on the traditional financial and stock markets, as major global indexes crashed in a way that was more vicious and quicker than the recession of 2008.

Cryptocurrencies, unfortunately, weren’t left out, and they were no exception. In less than a month, the market lost half of its capitalization, wiping $150 billion off existence. In the past 30 days, Bitcoin lost 50% of its dollar value. The thing that caught everyone’s attention was how sudden the crash was. In just one day, Bitcoin charted a 40% loss.

Needless to say, Bitcoin wasn’t the only cryptocurrency that lost a significant chunk of its value. Altcoins followed. Ethereum, Tezos, Chainlink, Litecoin, Dash, Binance Coin – all of these lost half or more of their price.

However, what some see as a flat-out crisis, can also create opportunities. It’s true that the prices now, compared to just one month ago, are severely discounted. With Bitcoin’s halving just around the corner, it’s important to note that once the coronavirus crisis is over, the market could stage an impressive recovery. And if that happens, there are certain altcoins that might be interesting to watch.

DASH

Dash reached its all-time high value back in December 2018 when it peaked at $158. Like all other altcoins, however, it went through a prolonged bear market in 2019 before starting its recovery. In 2020, DASH reached a yearly high of around $133 before the recent market sell-off.

Since its yearly high in February 2020, Dash lost more than 50% of its value, as it currently trades at around $45. The sudden and quick drop from its recent highs means that there is plenty of room for growth.

The cryptocurrency might be one of the most interesting to watch because it is privacy-oriented. The coronavirus spread brought some severe concerns in this regard. As CryptoPotato reported, some countries are already tracking their citizens’ mobile phones to monitor the movement of the coronavirus. While this might be seen as an appropriate step in times of crisis, it also raises some very serious privacy concerns. It’s a very sensitive matter, and people might want to be in complete control of their privacy, including when it comes to financial transactions. It is then altcoins such as DASH that could see a serious boost.

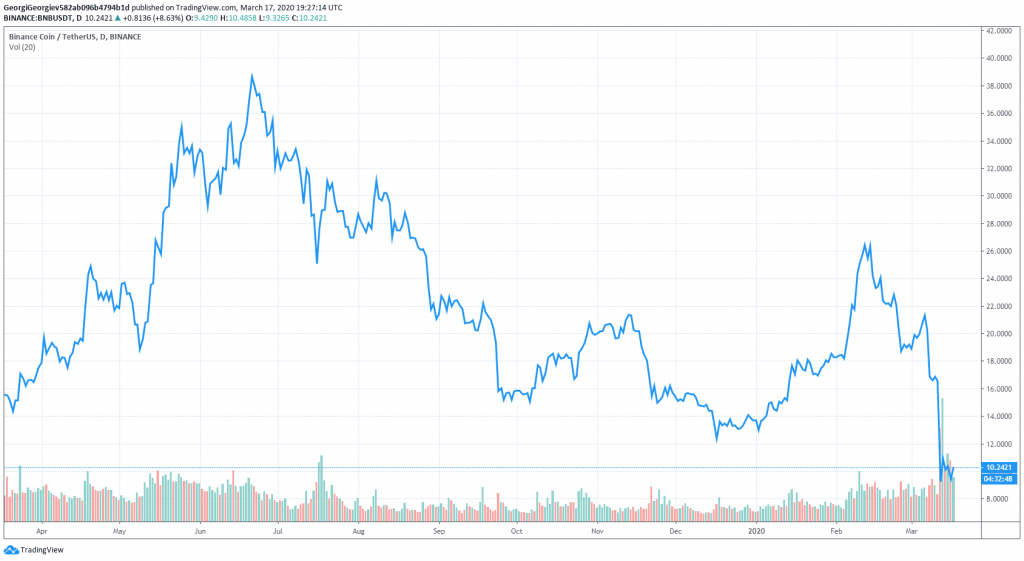

Binance Coin (BNB)

Binance has managed to establish itself as the most trusted cryptocurrency exchange. Not only this, but it has also proven that it’s a stellar company with an appropriate and well-devised corporate structure.

Going further, Binance Futures sees a tremendous and continuous increase in its traded volumes, and it’s on its way to leading the cryptocurrency derivatives trading market as well. As its native cryptocurrency, Binance Coin is likely to be among those with a very bright long-term future.

From a technical perspective, BNB is acting relatively stable against Bitcoin. It decreased sharply during last week’s major sell-off, but it has managed to recover, and it’s performing consistently around the 0.002 BTC mark. This might provide a stable foundation for another leg up, once the coronavirus crisis passes.

BNB’s all-time high was in June 2019 when it reached about $38. In 2020, it peaked at around $26, but the recent crash brought its price below $10.

WazirX (WRX)

WRX is the native cryptocurrency of the WazirX exchange. They had an IEO on Binance Launchpad back in February, and it was the first project in a while that brought notable 600% ROI to its investors.

It’s important to note that WazirX is touted as India’s most trusted Bitcoin exchange. This is one of the largest and most populated countries in the world. Most recently, the country’s Supreme Court lifted the ban on cryptocurrencies, and this could have a huge impact on Indian-based projects such as WRX.

WRX reached its ATH on March 7 this year, trading at $0.21. It also crashed last week, losing about 50% of its value as it currently trades at around $0.09. However, it’s worth noting that its price has been performing stable during the last few days, providing merits for a serious growth on the way up.

Just today, Binance and WazirX announced the setup of a new $50 million fund to help the further adoption of cryptocurrencies in India. Kraken, which is also one of the well-known exchanges, also plans to invest in the country following the removal of the ban.

Tezos (XTZ)

Tezos has been the best performing altcoin in 2020 until the sudden crash. To many investors, the quick crash is likely to be seen as a rare opportunity to buy XTZ at severely discounted prices. XTZ surged to slightly less than $4 about one month ago after starting the year at around $1.3.

The recent drop brought its price back to where it started, as XTZ currently trades at $1.4. Yet, it managed to keep its position as the 10th largest cryptocurrency, and it has its fundamentals in place.

Tezos activated Carthage this month – its third protocol upgrade. It aims to increase the user’s gas limits. This should allow new users to execute an increased number of smart contracts, expanding the network’s capabilities even further. Once the coronavirus crisis goes away, XTZ is likely to start marching forward with full steam.

On another note, the protocol of Tezos is governed in a way where those who stake XTZ get a proportionate vote and a reward. This provides additional incentives for people to hold XTZ and as such, certain stability that can help on the way up.

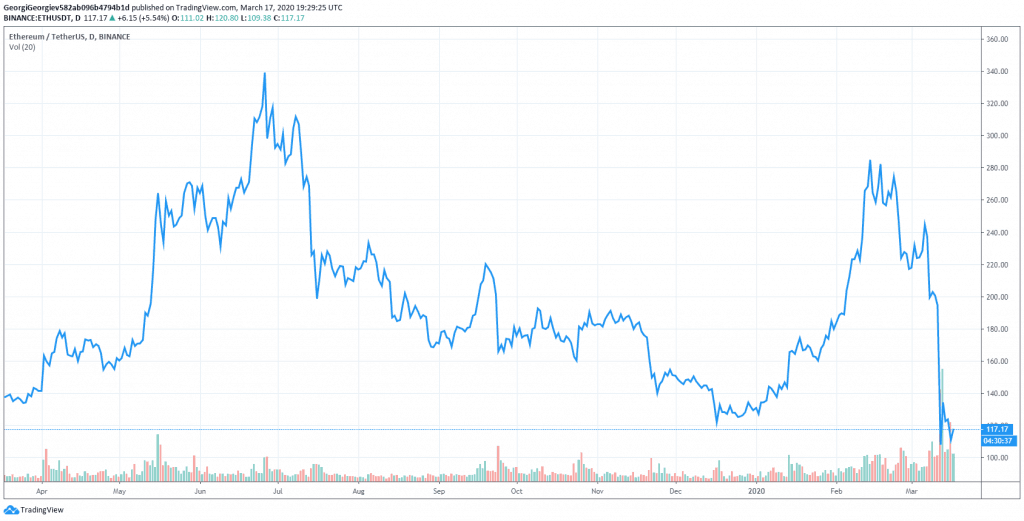

Ethereum (ETH)

Needless to say, Ethereum is the second-largest cryptocurrency for years, and this is for a reason. This is the largest decentralized network for the creation of smart contracts and decentralized applications (DApps). It remains king in terms of active DApps, even though the competition is growing rapidly.

Ethereum is also expected to see a significant update this year – Ethereum 2.0. This will see the network transition from its current Proof-of-Work (PoW) consensus algorithm to Proof-of-Stake (PoS), which should enhance its capabilities and performance.

ETH didn’t go untouched by the recent crash. After reaching an all-time high of around $1,400 back in December 2018, in 2020, it peaked at slightly less than $300. At the time of this writing, ETH is trading at $115, which shows that there is a lot of room for growth.

The post 5 Best Cryptocurrencies Besides Bitcoin To Watch Once Coronavirus Crisis Is Over appeared first on CryptoPotato.

The post appeared first on CryptoPotato