Bitcoin is an on-chain asset, meaning it offers unparalleled access to a mountain of data and financial models. But navigating the sheer number of indicators out there can be overwhelming, making it difficult to decide which ones truly matter.

If you’re searching for the best Bitcoin indicators to enhance your trading and investment strategies, look no further. In this guide, we’ll explore the top 5 Bitcoin indicators to help supercharge your trading decisions:

- Pi Cycle Top

- Stock-to-Flow (S2F) Model

- MVRV Z-Score

- Short-Term Holder Realised Price (STH RP)

- Hash Ribbons

Pi Cycle Top

The Pi Cycle Top Indicator has gained notoriety for accurately predicting several of Bitcoin’s major market tops. Historically, after the indicator flashes a “top signal,” Bitcoin has experienced significant drops, ranging from 52% to 86%.

Here’s how it works:

The Pi Cycle Top Indicator was developed by Philip Swift, a crypto analyst and the founder of LookIntoBitcoin, a crypto analytics website.

The indicator triggers a “top signal” when Bitcoin’s 111-day moving average (orange line) crosses above twice the value of its 350-day moving average (green line). In simple terms, a moving average calculates the average price of Bitcoin over a specific number of days and updates daily.

Source: Bitcoin Magazine Pro

As of August 2024, both moving average lines in the Pi Cycle Top Indicator are sloping upward. While the orange line is approaching the green line, it may still take some time for them to cross.

If you’re following this indicator strictly, it suggests that Bitcoin’s cycle isn’t over yet, and there could be more room for the bull run to continue. However, note that there were instances when Bitcoin’s price fell significantly even without the moving averages crossing over. When charts start trading above the 350-day moving average, it could suggest that the market is starting to get overheated and entering a euphoric stage.

For a more detailed guide on the Pi-Cycle Indicator, read our article about Moving Averages tied to Market Cycles here.

Stock-to-Flow (S2F) Model

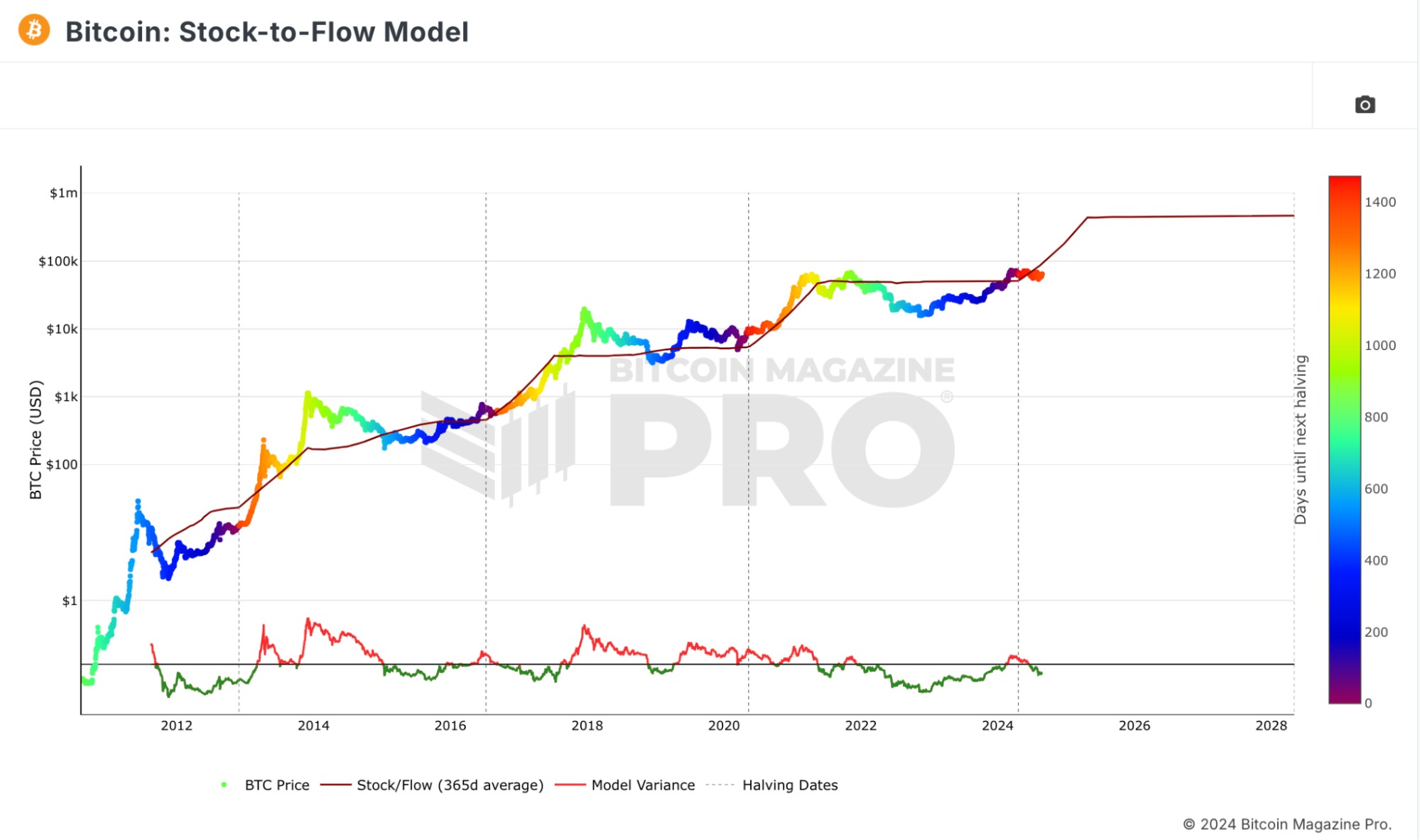

The Stock-to-Flow (S2F) model has gained significant attention for its ability to forecast Bitcoin’s potential future price. Originally designed for precious metals, this model applies just as well to Bitcoin due to its limited supply capped at 21 million coins.

Source: Bitcoin Magazine Pro

Here’s how It works:

As its name suggests, the S2F model evaluates two key elements of an asset to estimate its future value: stock and flow.

The stock represents the total existing supply of an asset, while the flow measures the new supply generated each year. By comparing these two attributes, the model assesses a commodity’s scarcity, which is a crucial factor in determining its price.

To grasp the nuances of the S2F model in detail, it’s important to understand the key differences between crypto (like Bitcoin) and TradFi currencies (fiat).

Crypto vs. Fiat

Fiat currencies, issued by central banks, are subject to inflation due to their unlimited supply. Central banks can print more money as needed, which, while ensuring liquidity, often leads to devaluation and inflation. Case in point? Venezuela, which has experienced severe hyperinflation due to excessive money printing.

In contrast, Bitcoin, like precious metals, cannot be replicated or endlessly produced. With a capped supply of 21 million coins, Bitcoin’s scarcity makes it an ideal candidate for the S2F model.

The stock in Bitcoin’s case refers to the total number of coins in existence—21 million. The flow is the rate at which new Bitcoin is mined annually. Currently, about 19 million Bitcoins have been mined, representing approximately 90% of the total supply. Each year, Bitcoin’s network produces around 328,500 new coins, as one block is mined every 10 minutes, yielding 6.25 Bitcoins.

By dividing Bitcoin’s existing supply by its annual production rate, we get a stock-to-flow ratio. As of now, Bitcoin’s S2F ratio is around 57.712, meaning it would take approximately 57 years to mine the total supply.

However, this doesn’t account for Bitcoin’s halvings—events that reduce the block reward by half every four years. When halvings are considered, the S2F ratio jumps to 124 years, further highlighting Bitcoin’s increasing scarcity.

In short, the S2F model doesn’t account for market volatility or unexpected economic shifts. Critics argue that the model relies on questionable assumptions, and as with any single tool, it should be used in conjunction with other indicators.

MVRV Z-Score

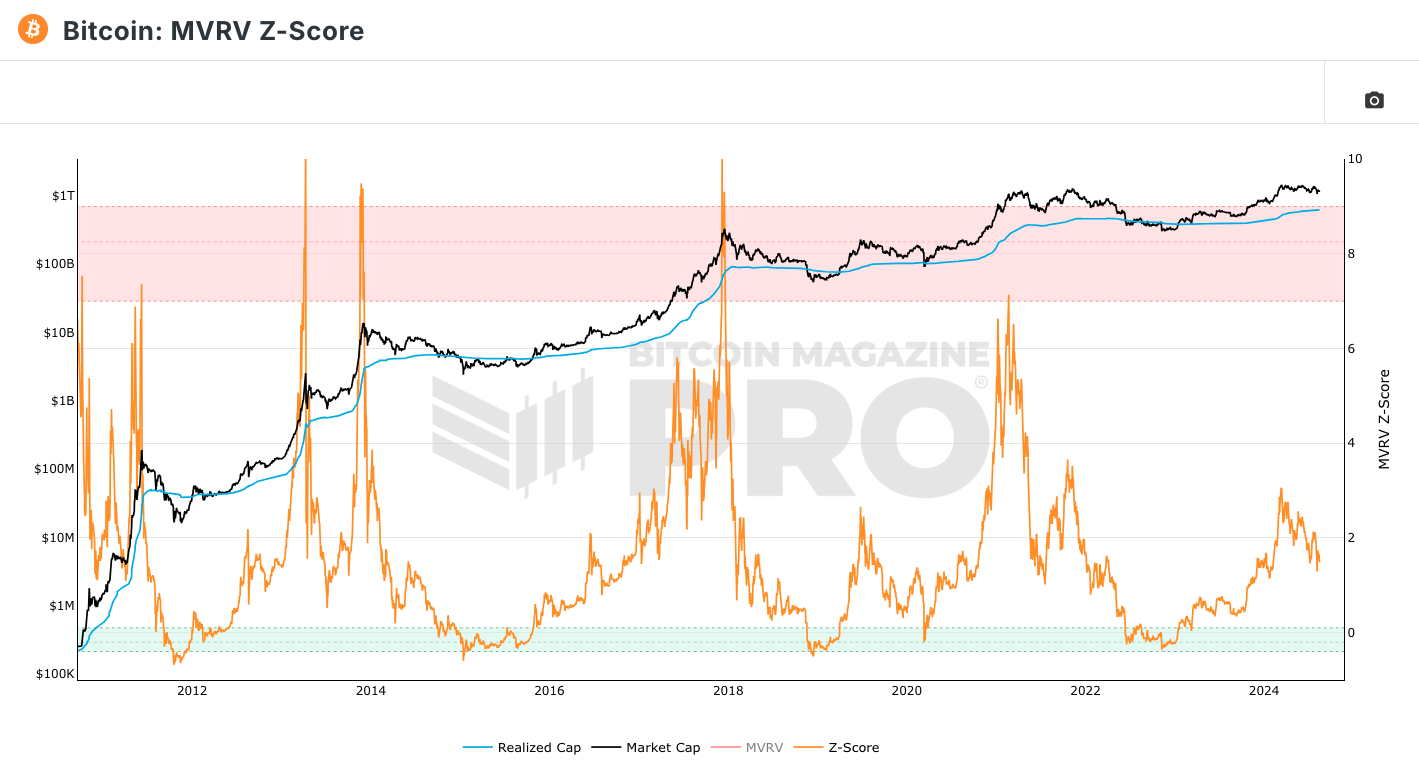

The MVRV Z-Score is a valuable metric for determining whether Bitcoin is overvalued or undervalued. By comparing Bitcoin’s market value to its realised value, the MVRV Z-Score provides a clearer perspective on its fair market price.

source : Bitcoin Magazine Pro

Here’s how it works:

The MVRV Z-score allows investors to assess how far Bitcoin’s current price deviates from its historical moving average, effectively showing whether Bitcoin’s price is behaving abnormally.

This makes it a crucial tool for answering the question, “What is Bitcoin really worth?”

How to Calculate the MVRV Z-Score:

- Market Cap: Start by finding Bitcoin’s market capitalisation, which is calculated by multiplying the current price by the total number of coins in circulation.

- Realised Value: Next, determine Bitcoin’s realised value. This is the sum of all Bitcoin prices when they last moved – this is tricky to calculate manually and is readily available online.

- Calculate the Difference: Subtract the realised value from the market cap.

- Divide by Standard Deviation: Finally, divide the result by the standard deviation of Bitcoin’s historical prices to get the MVRV Z-score.

The MVRV Z-score has become an essential tool for Bitcoin investors. It identifies whether Bitcoin is priced fairly, making it easier to spot buying opportunities or potential sell signals.

- Overvaluation: If the MVRV Z-score exceeds 6.9, Bitcoin is likely overvalued, often represented as a red or pink “danger zone” on charts. This signals that the market might be overheated, and a price correction could be imminent.

- Undervaluation: Conversely, when the score dips below 0.1, Bitcoin is considered undervalued, often shown as a green “safety zone.” This suggests it could be a good time to buy.

- Momentum Identification: The MVRV Z-score is particularly effective at detecting shifts in market momentum. Historically, when the weekly close has an MVRV Z-score above 5, there’s been a 94.36% chance of a market reversal. This predictive power makes it a valuable tool for anticipating trend changes.

Short-Term Holder Realised Price (STH RP)

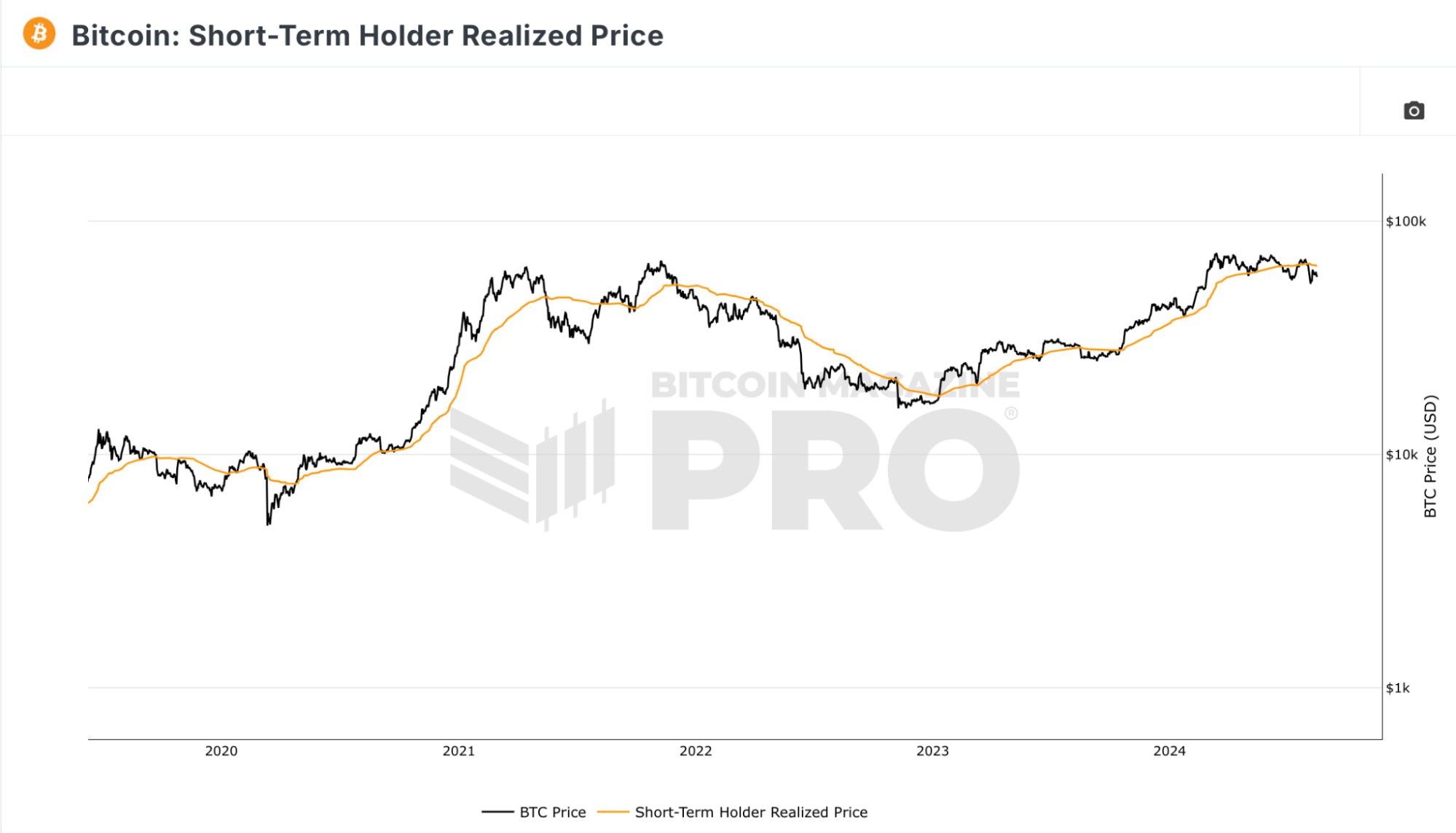

For traders focusing on short-term market movements, the Short-Term Holder Realised Price (STH RP) is a crucial indicator. It represents the average price at which Bitcoin was last transacted on-chain within the past 155 days, reflecting the cost basis for recent market participants.

Source: Bitcoin Magazine Pro

Here’s how It works:

STH RP is calculated by taking the average acquisition price of Bitcoin for investors who are considered short-term holders. This group is typically defined by coins that have been held for less than 155 days. The idea here is that these investors are more sensitive to market movements and tend to buy or sell based on short-term price trends.

When Bitcoin’s price is below the STH RP, short-term holders are at a loss, which may increase selling pressure. Conversely, prices above the STH RP indicate profit, often creating support levels. The STH RP also helps identify key resistance levels during declines, making it a vital tool for understanding short-term market dynamics. This indicator is especially useful in volatile markets, where the behaviour of recent entrants can significantly impact price trends.

The STH RP and MVRV Ratio

To dive deeper, the Short-Term Holder MVRV Ratio (STH MVRV) compares the market value of Bitcoin held by short-term investors to its realised value. This ratio helps to visualise unrealised profitability:

- A ratio of 2.0 suggests significant profits for short-term holders.

- A ratio of 1.0 means they are breaking even.

- A ratio of 0.85 indicates a 15% loss, highlighting increased risk of capitulation.

The STH RP plays a crucial role in identifying potential support levels during bull markets. When Bitcoin’s price returns to this average acquisition price, it often acts as a buying signal for short-term holders, creating a base of support that can help propel the price higher.

Additionally, the indicator provides insights into the sentiment and behaviour of more recent market entrants. Unlike long-term holders, short-term holders are more likely to sell during periods of volatility or price declines, making this metric useful for identifying potential resistance levels or points of increased selling pressure.

Hash Ribbons Indicator

Timing the market is a challenge for any trader, but the Hash Ribbons indicator offers a strategic advantage. Developed by Charles Edwards, this tool focuses on Bitcoin’s hash rate to identify potential market bottoms and bullish trends.

Source: BGeometrics.com

Here’s how It works:

The Hash Ribbons indicator uses the 30-day and 60-day Simple Moving Averages (SMAs) of Bitcoin’s hash rate. The hash rate is a key measure of the Bitcoin network’s health, reflecting the amount of computational power being used to process transactions. A higher hash rate generally indicates better network stability and security.

Derived from the chart below, there’s a positive correlation between Bitcoin’s price action and the hash rate.

Source: poolbay

When the 30-day SMA crosses above the 60-day SMA, it signals the end of miner capitulation and the beginning of a recovery. A classic example of this pattern is observed around the Bitcoin halving events, where the block reward paid to miners is cut in half.

Historically, the Hash Ribbons indicator has been reliable in predicting long-term bullish trends. For example, between 2016 and 2020, the indicator flashed several buy signals, each followed by a significant price rally. This makes it a favoured tool among traders looking to time their market entries during periods of extreme fear and uncertainty. As of August 2024, the Hash Ribbons have printed a buy signal.

For added accuracy, some traders incorporate the 10-day and 20-day SMAs of Bitcoin’s price to filter out false signals. While no indicator is foolproof, the Hash Ribbons has a strong track record and is a valuable addition to any trading strategy.

Conclusion

We hope this guide gives you a good overview of some of the leading Bitcoin indicators and brings useful insights to your trading journey. While trading indicators have a proven track record and provide valuable insights, they should still be approached with caution – they should complement your trades, not determine them.

Solely relying on one indicator without considering external market factors can lead to suboptimal decisions. The most successful traders always employ a multifaceted approach – combining trading indicators with fundamental analysis and risk management to gain a holistic understanding of market dynamics.

Theoreticals aside, if you wish to begin trading crypto derivatives or spot on BitMEX, you can find all our existing products here. For more educational resources on trading, visit this page.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

Related

The post appeared first on Blog BitMex