Proof of Work, a consensus mechanism, has proved to be the backbone of some of the leading and widely-adopted blockchain networks. These include Ethereum, Litecoin, and, of course, Bitcoin.

Many from the blockchain industry have wondered how come Proof of Work (PoW) remained so resilient over all these years. Some are even baffled by its resilience as it has withstood a long list of challenges like growth, performance, and security issues over the years.

Key Takeaways From 5 Years PoW

The below takeaways are taken from Consensys’ report that reviews 5 years of proof of work for Ethereum.

Takeaway #1

51% of Ethereum network’s hash rate was owned by two mining pools and this has happened twice in all of Ethereum’s existence until now.

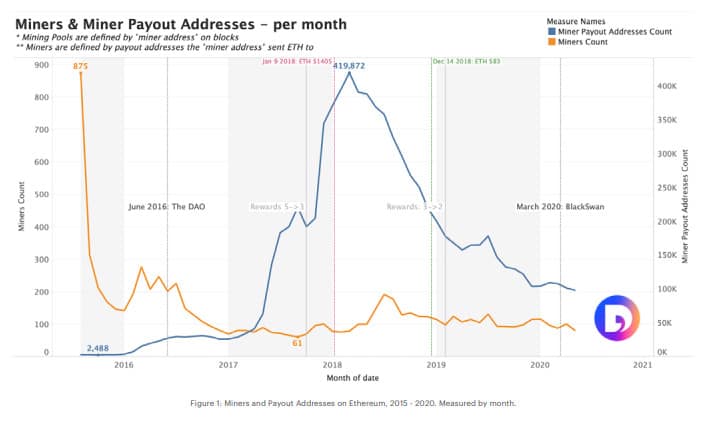

There’s one really interesting occurrence that has been found with Ethereum mining. The miner count declined in the year after the DAO. This decline happened at the time when the number of payout addresses was rising. The price of Ethereum was soaring in the middle of 2017 but the number of mining counts was at an all-time low with just 61 active mining pools.

The number of active mining pools started increasing in mid-2018 with the fall in the prices of ETH. This meant that there was an inverse relationship between the mining pool count and ETH price. The reason behind this could be the increase and decrease in the block reward incentive among the miners.

With the decrease in the number of block rewards from 5 to 3, there is an increase in the price of ETH. This leads to an increase in the required hash rate, which, in turn, causes a decrease in miner incentives. Thus, a majority of miners now move to a blockchain which offers higher chances of rewards.

ow, the remaining individual miners join the mining pool as that increases the probability of earning block rewards – directly leading to a decline in the number of active miners.

Takeaway #2

For the past 2 years, 56 of the known mining pools account for the overwhelming majority of all block rewards that were won by miners on the Ethereum blockchain.

The same 56 known mining pools also account for the overwhelming majority of ETH’s hash rate for the past two years. This acts as a sign of stability but also acts as a strong argument for the centralization PoW creates.

Why Did Consensys Create Such a Data-driven Analysis of Proof Work?

Consensys is continuing its work to develop Ethereum 2.0 and retire the PoW chain in the process. Hence, they need to have a clear understanding of the benefits of Proof of Work consensus, along with its shortcomings.

Another major reason behind this data-driven analysis is that the majority of Ethereum will continue to operate on the PoW chain for at least the next few years. Therefore, the Consensys team wants to collect as much data as possible about the consensus mechanism that is supporting the Ethereum ecosystem before retiring it.

Ethereum 2.0 Will Go Live With Proof of Stake

In this section, we will talk about the challenges that are faced by Proof of Work and how Proof of Stake is better and more advanced compared to it. Proof of Stake will solve the key issues of accessibility, scalability, and centralization, that is associated with the Proof of Work consensus algorithm.

The upcoming Ethereum 2.0 will soon go live with Proof of Stake but this does not mean that Proof of Work will cease to exist. It will continue to operate for a few more years. The reason behind this is that the new network of Proof of Stake will be tested and further developed for the next few years.

Until phase 1.5, the Ethereum blockchain will continue to operate on the Proof of Work chain. However, the PoW chain will merge with the PoS chain after phase 1.5.

Why is Proof of Work Important?

Proof of Work hasn’t behaved like the other emerging technologies in the face of growing challenges. Now, the question that arises is how important is Proof of Work?

The most important role that Proof of Work plays is that it supports decentralized networks and has proven to be a very secured mechanism for it.

Why do decentralized networks even require PoW’s support? The answer is pretty straightforward – The decentralized network cannot function without the proactive participation of many competing and unconnected node operators.

Issues With Proof of Work

Proof of Work has proven quite secure overall and has remained resilient regardless of being in operation for some of the most widely adopted blockchain networks. There is only one exception to it and this incident occurred in January 2019 with Ethereum Classic experiencing a 51% attack.

We have described all good things about Proof of Work so far but does it mean that everything is good and dandy so far with it? Of course not. There are some major issues with it that we will explore in this article.

Proof of Work is not very flexible in terms of use as it cannot be implemented in networks that have a lot more complex utility. Straightforwardly speaking, there’s no use of Proof of Work in anything other than the transfer of wealth. The issues faced by the PoW networks can be categorized under three categories and these are Accessibility, Centralization, and Scalability.

Ethereum’s Three main Problems With Proof of Work

Accessibility

The current mining process is not accessible to the majority as it is pretty expensive and only rich people can afford it. This is wrong as it goes against what blockchain stands for. Proof of Stake will solve this issue as it will offer everyone a chance to participate in securing the network.

Need for Scalability

Proof of Work maintains the integrity of the Ethereum network and PoW is throttled by this need. On the other hand, PoS is benefited from the decrease in the block confirmation latency as there is no computation work involved. However, it does not solve the throughput limitations completely.

Centralization

The fact that two mining pools have accounted for over 51% of the Ethereum network’s hash rate twice in the timeline of Ethereum’s existence proves how major the issue of centralization is. On top of that, the expensive mining process acts as a barrier for new miners to join and causes further centralization of the miners in the Ethereum network.

Migrating from PoW to PoS

Proof of Stake removes the high-cost barriers as there’s no need for the costly hardware and the validators don’t even have to worry about the costs of electricity like they used to do on PoW chains. However, there’s still a notable barrier of entry for Proof of Stake.

The validators must stake a fixed amount of crypto to run a full node in PoS. This minimum staking requirement stands at 32 ETH for Ethereum 2.0. However, validators can become part of mining pools if they cannot stake 32 ETH on their own.

As for scalability, the PoS architecture will lead to a process known as sharding without reducing security. The sharding process will create multiple shard chains and each of them is capable of processing blocks. Thus, benefiting the blockchain by processing multiple blocks at once.

PoS is also beneficial as it will lead to a decrease in centralization that PoW faces today. One only requires an internet connection, a PC or even a smartphone, and crypto in a non-zero amount for participation in Proof of Stake chain. This benefits a larger number of people instead of just a handful of them benefiting from the mining.

Conclusion

Proof of Work has proved it’s worth and has been the backbone of Ethereum blockchain for years. It is expected to continue its successful momentum in years to come and will maintain its usefulness for the next few years.

However, Proof of Stake and Ethereum 2.0 will bring many benefits to the Ethereum network, one of which is an improvement to the centralization issues.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato