The interest and demand in the derivatives market had increased significantly in 2019 with major mainstream organizations entering the frame. The spike in institutional interest was evident but the year closed on a relatively low point in December.

According to Crypto Compare’s recent report, it was indicated that regulated bitcoin derivatives product volume of CME had dipped by almost 6.2 percent in December, estimating around $3.96 billion USD. CME continued to dominate the product’s volume in December but the slump indicated the reduced activity of investors in December.

Grayscale’s bitcoin trust product (GBTC) registered a drop 3 times more than CME, accounting for a 19.56 percent depreciation.

Source: Crypto Compare

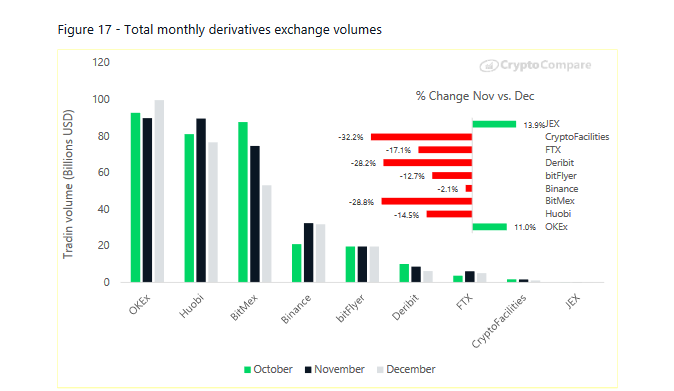

In terms of total monthly derivatives exchange volume, OKEx led the way with a market majority of 35.8 percent, which was equivalent to over $3.3 billion worth of trading/day. Huobi followed with a 29.16 percent share($2.7 billion tradings) with BitMEX and Binance completing the major shareholder in trading volume with 19.7% and 11.4 percent respectively.

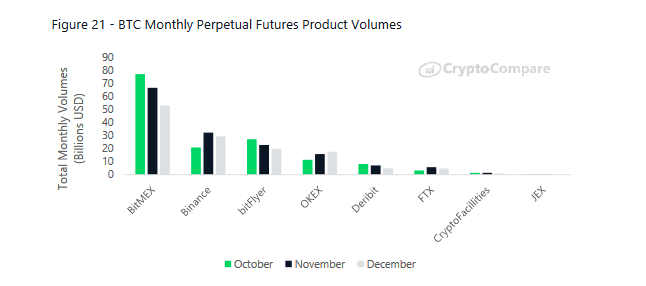

However, despite registering a lesser daily derivatives volume trading than Huobi and OKEx, BitMEX and Binance registered the highest BTC perpetual futures market volume together, accumulating a total of 62.5 percent of the market. Although keeping up with the bearish narrative in December, the post stated,

“BitMEX traded $53.1 Bn (down 20% since November while Binance traded a total of $29.3 Bn (down 8.9%).”

Source: Crypto Compare

BitMEX also represented the majority of ETH perpetual futures volumes at 44 percent, establishing a total dominance over both BTC and ETH perpetual futures.

The exchanges’ BTC perpetual futures were also the most-traded product, incurring a total volume of over $50 billion. Huobi’s Quarterly BTC future took over the 2nd spot with $42.4 billion.

The post appeared first on AMBCrypto