We are almost over half of December, but so far, the last month of the year is very disappointing the Bitcoin traders.

Despite the bearish signs that Bitcoin is showing, the trading action is dull, followed by a relatively low amount of trading volume. Things are progressing very slowly.

In matters of the price, yes, we are at $7000 after we stated here just two days ago that Bitcoin is heading to re-test the $7,000 price area.

Low Volume Huge Manipulations

Because of the low amount of volume, it’s almost effortless for the whales to create those price manipulations as we see very often lately.

Hours ago, we saw another price manipulation, which can be seen on the 4-hour chart. Bitcoin spiked to $7300 only to dump even harder and find a new December low at $7070 (Bitstamp, as of writing this).

The reason for those manipulations could be the liquidation of short positions. The same kind of manipulation took place last Monday when the price wicked up to $7700 and even quicker dumped those $300 it had gained.

Bitcoin Bears Are Back

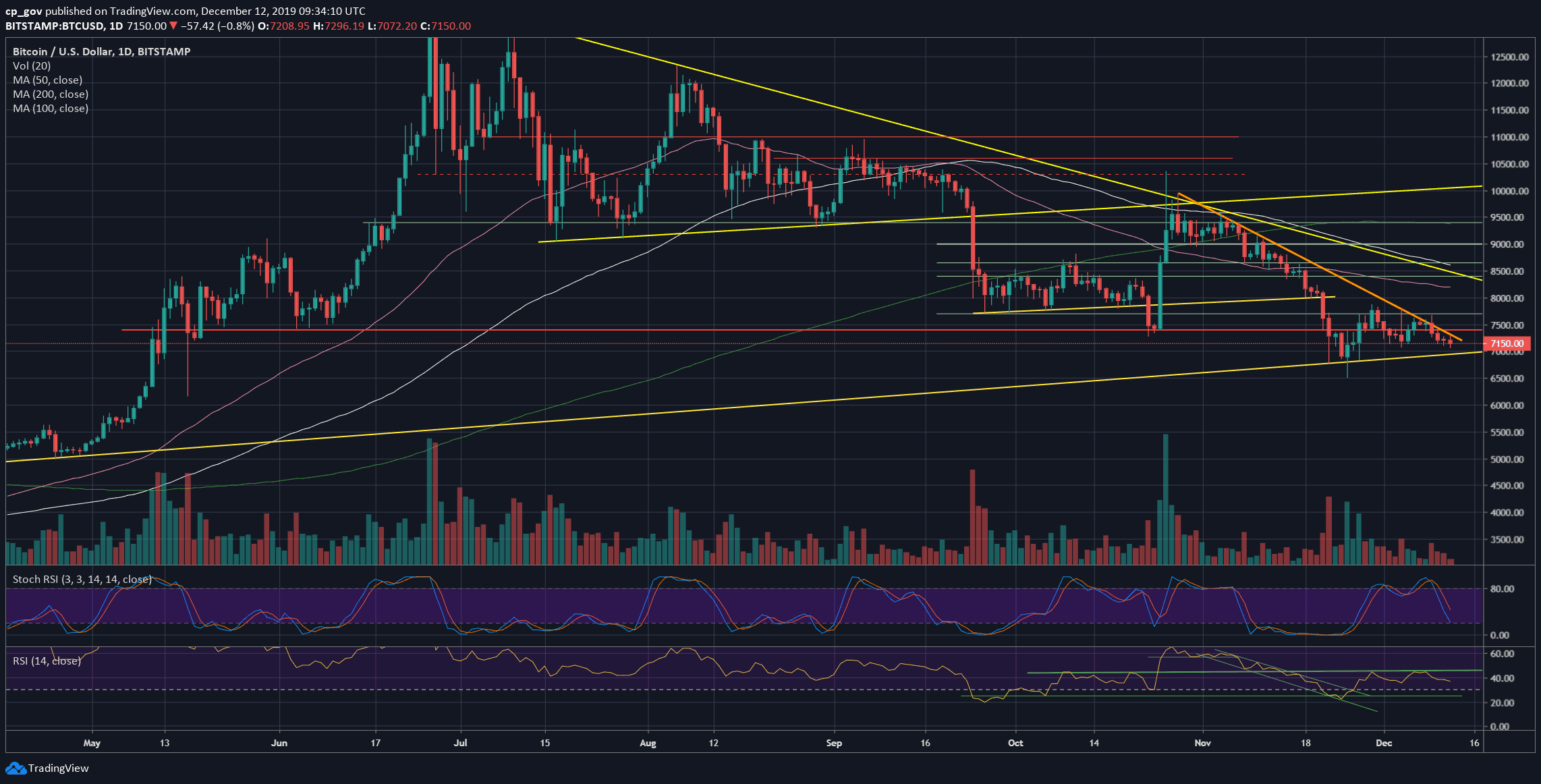

I know that things can change any minute in crypto, but so far, the Bitcoin chart doesn’t look so shiny. The latest price manipulation from today reached accurately the mid-term descending trend-line, marked by orange on the following daily chart.

This trend-line was started forming on October 28, while Bitcoin was trading for $9500.

Total Market Cap: $195 billion (below $200 billion again…)

Bitcoin Market Cap: $130 billion

BTC Dominance Index: 66.7%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance: Following the recent price action, Bitcoin is now facing a horizontal support area of $7000 – $7100. This could be a huge demand zone; however, as it looks now, the chances are with the Bears.

Further down is the $6800 horizontal support, before the $6500 area, which is Bitcoin’s 6-month low.

In the case of a correction, the first resistance is now the $7200, along with the orange descending trend-line (on the daily). A little above lies the $7400 resistance, along with the mid-term descending trend-line. Further above lies the $7700 – $7800 horizontal resistance.

– The RSI Indicator: If looking for bearish confirmations, then we can look at the RSI. The momentum indicator looks bearish after getting failing to breach the 45 resistance line.

Besides, The stochastic RSI oscillator is heading south. There is still room to go down, but it’s getting closer to the oversold territory.

– Trading volume: The trading volume continues declining over the past two weeks. Yes, we’re expecting some colossal price move probably during the weekend.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

You might also like:

The post appeared first on CryptoPotato