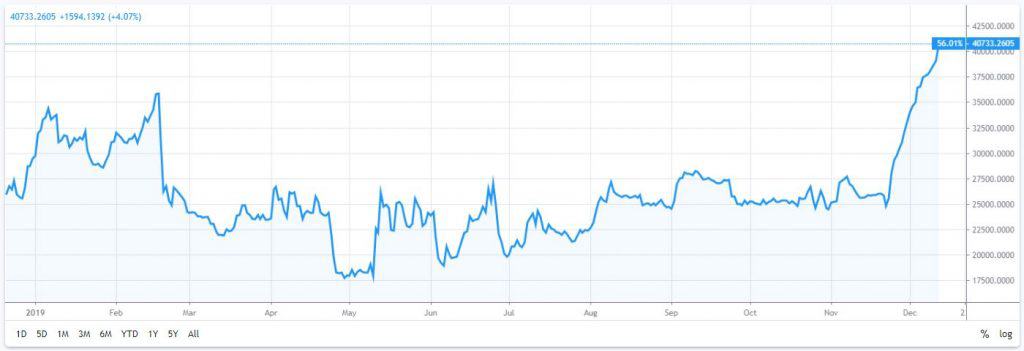

Bitcoin, just as any other asset that’s being traded, goes through different market cycles. As we approach the end of 2019, which is also the end of the current decade, some industry experts seem to believe that right now is a historic time for Bitcoin accumulation.

Time To Buy Bitcoin?

The current market sentiment doesn’t seem to be very bullish for Bitcoin. The cryptocurrency is trading below major moving averages and is continuously marking lower highs on the charts, which is usually a sign of bearish momentum.

However, industry expert Matt D’Souza has brought up some interesting facts regarding institutional involvement and the overall attention that Bitcoin currently gets. According to him, Bitcoin is currently in the first third of a bull market and there are conditions representing an “excellent” signal to buy.

First things first, Souza outlines that institutions are getting more involved in the market. This is evident by the fact that volume on the CME Bitcoin futures contract, which is more or less geared towards larger investors, trumps that of popular cryptocurrency exchanges such as Coinbase and Bitfinex.

Many people in crypto are getting depressed so in an effort to remain objective and data driven rather than emotional I would like to share some of our data (@blockwareteam) that I presented in Chengdu, China during the @minerupdate Global Miners Summit in October. pic.twitter.com/zxVodVUfjQ

— Matt D’Souza (@mjdsouza2) December 11, 2019

According to him, this is a sign that the “smart” money, which is how institutional inflows are commonly referred to, is more than the money coming retail investors.

He also talks about the fact that Bitcoin has outperformed a lot of the altcoins and that the latter is generally a retail product. Indeed, Bitcoin’s dominance has increased by more than 15% since the beginning of the year.

Bitcoin Dominance. Source: CoinMarketCap

In a recent exclusive interview for CryptoPotato, Anthony Pompliano, a well-known Bitcoin proponent, shared similar views. He also considers that, right now, the cryptocurrency is in the first stage of a bull market which will extend to about two years, ultimately reaching $100,000 in December 2021.

A Comparison For Interest In Bitcoin

Another comparison that he brought up is the interest toward Bitcoin coming from regular, everyday conversations. This is not something new and a lot of proponents have talked about it before.

Souza says that there aren’t a lot of people, friends, or family, asking about Bitcoin right now. He compares this period to November 2017, when the opposite happened – people were eager to know more about it, showing the overall levels of retail interest.

When there are no more interested retail investors or they are simply exhausted, the price tends to formulate a top. That’s what we saw back in 2017 when Bitcoin reached its ATH of $20,000.

The situation right now, according to the expert, is the exact opposite.

“We are presently in the opposite environment where the institutions are accumulating, while the retail shows zero interest.” All of this builds up to his point that now is a good time to buy bitcoin.

Not Without Worries

On another note, however, it’s also important to consider some technical indicators. As CryptoPotato reported, Bitcoin currently faces the horizontal support area of $7,000 – $7,100, which could be a serious demand zone.

The number of opened long positions on Bitcoin is also at an all-time high.

Bitcoin Long Positions. Source: TradingView

When the amount of opened long positions surges to levels of the high, it is entirely impossible for this to be indicative of the so-called long squeeze. This is an event during which the price of Bitcoin could be heading south.

You might also like:

The post appeared first on CryptoPotato