The BTC consolidation continues: for the past four days, Bitcoin’s price range had been shrunk to $150 only. From above $7300, from below $7150. This is coming after almost two weeks, since December began, of nearly zero volatility.

The only people who benefit from such a market are those who run crypto margin exchanges. However, they can’t be that happy since the trading volume is also declining.

Following price consolidation, declining volume, and on top – Bollinger Bands, which are very tight and close to each other (shown on the daily chart, marked with turquoise), we can expect a HUGE Bitcoin price move very soon.

How soon? It might take place at any moment during this weekend or during the coming up few days.

The last time the bands were so tight was around the 22nd of October, shortly before Bitcoin spiked approximately 42% in just one day marking $10,350 as the current 2-month high.

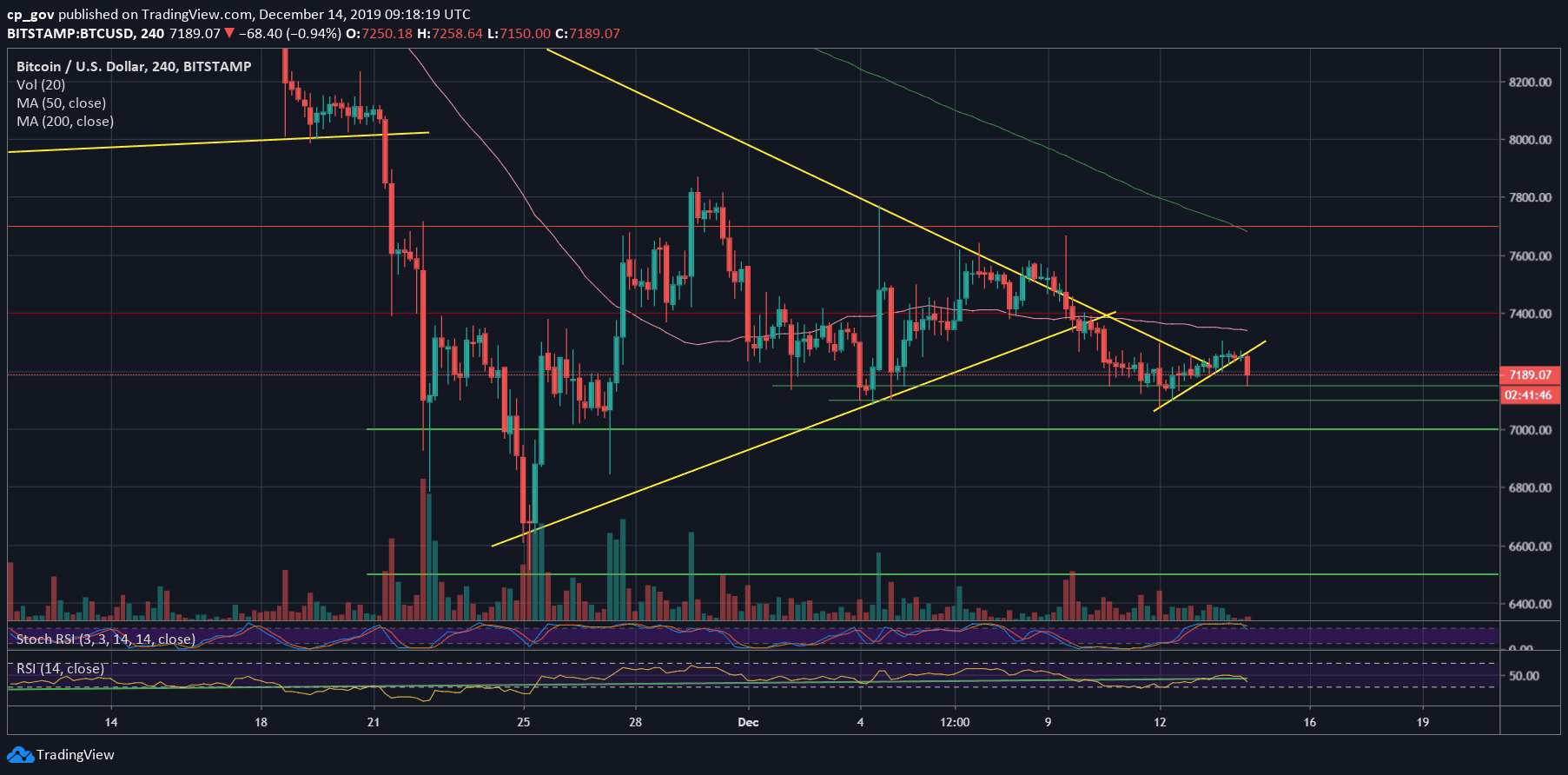

The direction is unclear yet, even though on the lower timeframe (the 4-hour chart), Bitcoin seemed to break down from the short-term ascending trend-line. As of writing this, the last days’ support at $7150 holds. However, it can be changed at any given moment.

Total Market Cap: $196.4 billion

Bitcoin Market Cap: $130.6 billion

BTC Dominance Index: 66.5%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance: Following the recent price action, Bitcoin is now facing the horizontal support area of $7000 – $7100. This could be a considerable demand zone, which kept the price of Bitcoin for the past four days.

In case of a break-down from the above-mentioned price area, we can expect a quick move to $6800 – $6900, where lies the next significant horizontal support along with the mid-term descending trend-line (on the 1-day chart). The next level would be the $6500 area, which is Bitcoin’s 6-month low.

From the bullish side, Bitcoin is facing the first level of resistance at the mid-term descending orange trend-line along with $7300 (the daily high); however, the real resistance in the range lies around $7400 (together with the 4-hour MA-50 marked with pink). Further above lies the $7700 – $7800 horizontal resistance.

– The RSI Indicator: Looking at the momentum indicator, it seems like it follows the price in its dullness and un-decision.

– Trading volume: As discussed above, the trading volume is declining since November 22. As been said, we’re expecting some colossal price move probably during the weekend.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

You might also like:

The post appeared first on CryptoPotato