- Ethereum fell by a steep 7% this past day, causing it to break below the previous range-bound condition.

- ETH slipped beneath a symmetrical triangle against BTC as it tumbled below 0.02 BTC.

- The cryptocurrency has now lost a steep 30% this past month.

Key Support & Resistance Levels

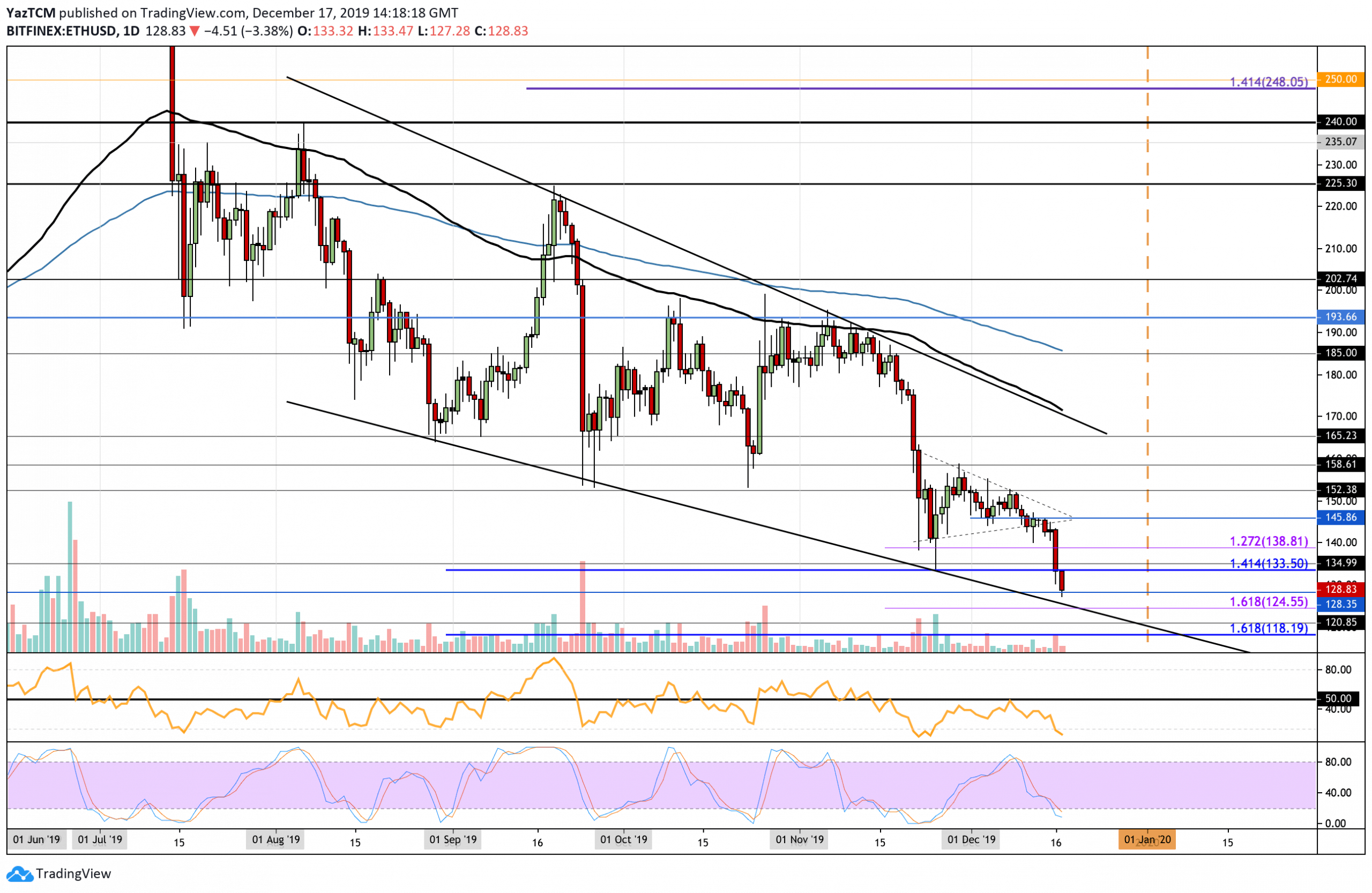

Support: $145, $138.80, $133.50

Resistance: $152, $158.60, $165, $170.

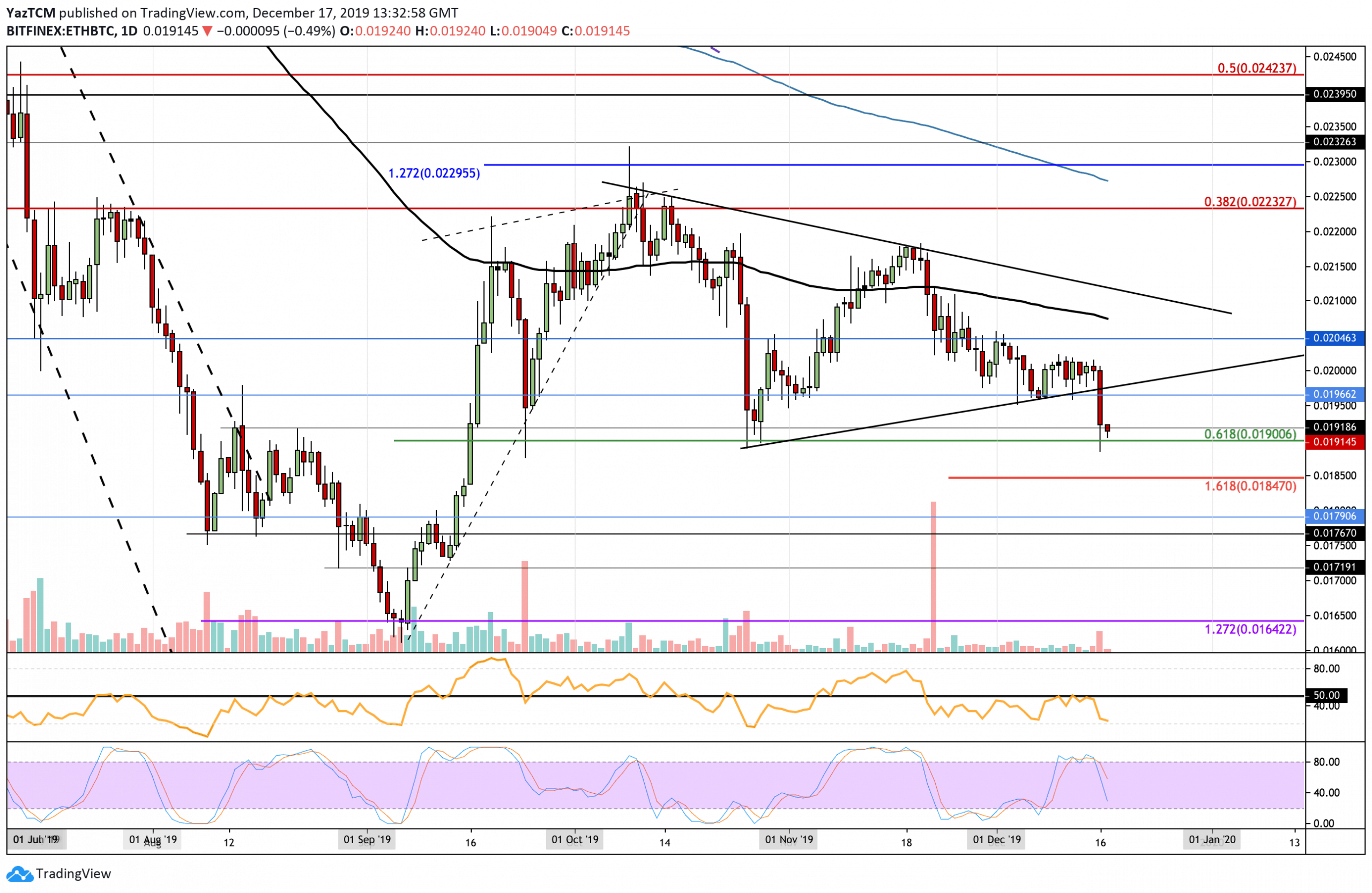

Support: 0.0196 BTC, 0.019 BTC, 0.0184 BTC

Resistance: 0.020 BTC, 0.021 BTC, 0.0215 BTC, 0.0223 BTC

ETH/USD: ETH Creates Fresh 8-Month Lows

Since our last analysis, ETH continued to struggle and eventually collapsed beneath the previous range in yesterday’s trading session. After dropping beneath the symmetrical triangle, it continued to slide lower until finding support at the $133.50 level (provided by the downside 1.414 Fibonacci Extension). Ethereum has decreased in today’s session and looks like there’s more pressure ahead.

The cryptocurrency remains within the wide 4-month old falling price channel with strong support incoming at the lower boundary.

Ethereum Short Term Price Prediction

The drop beneath $133.50 has created a fresh 8-month low for Ethereum, putting it in a bearish scenario. This market is a long way away from turning bullish as it would need to break above the December highs above $152.

Toward the downside, if sellers continue to push ETH beneath $128.82, we can expect immediate support to be located at $124.55, which is provided by a short term downside 1.618 Fib Extension and the lower boundary of the descending price channel. If the sellers drop beneath that level, support is found at $120 and $118.19. On the other hand, if the bulls bounce at the $128.82 support level, initial resistance is located at $133.50. Above this, resistance lies at $138.80, $145.80, and $152.38.

ETH/BTC: ETH Finds Strong Support at 0.019 BTC

Against Bitcoin, ETH fell beneath the previous trading range as it collapsed below the symmetrical triangle pattern. The cryptocurrency went on to drop considerably until finding strong support at 0.0192 BTC. This area of support is bolstered by the short term .618 Fib Retracement, which lies directly beneath at 0.019 BTC.

If Ethereum were to continue to drop beneath 0.019 BTC, the market would be considered as rather bearish. To be considered as bullish, ETH must rise above the 0.0204 BTC level.

Ethereum Short Term Price Prediction

If the buyers regroup at the current support and bounce higher from 0.019 BTC, immediate resistance is located at 0.0196 BTC and 0.02 BTC. Above this, resistance lies at 0.0207 BTC (100-days EMA). Alternatively, if the sellers push the market beneath 0.019 BTC, support is expected at 0.0185 BTC (downside 1.618 Fib Extension). Beneath this, support lies at 0.018 BTC, 0.01790 BTC, and 0.0175 BTC.

The RSI has dipped heavily beneath the 50 level to show that the bears dominate the market momentum. Furthermore, the Stochastic RSI recently produced a bearish crossover signal, which helped to send the market lower.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

You might also like:

The post appeared first on CryptoPotato