When Bitcoin began gaining prominence, few bodies were as concerned as the United States’ Securities and Exchange Commission [SEC]. A currency that is not tethered to a single person or entity, operating on something that cannot be shut down, and plied by a technology that is immutable, irreversible and transparent, it was the perfect problem for regulators.

From being touted as the currency of the Dark Web, to having derivatives contracts in its name being traded on the CBOE and CME, the regulatory journey of Bitcoin has been like no other. One would think regulators have eased their concerns with cryptocurrencies, but things were just getting started.

ICO: Initial Coin Onslaught

Regulators were not immediately taken aback by the 2017-price surge. Instead, they remained on their toes and began a severe crackdown on the digital assets market.

In 2019, many crypto-entrepreneurs began registering their issuances as “tokens” and hence, escaped the regulatory hassle that would follow a security registration, which was when the SEC began to take a closer look. Stephanie Avakian, the SEC’s Co-director of Enforcement, said in a statement following one such case,

“We have made it clear that companies that issue securities through ICOs are required to comply with existing statutes and rules governing the registration of securities…we continue to be on the lookout for violations of the federal securities laws with respect to digital assets.”

Some were genuine cases, however, there were multiple cases of deliberate manipulation. Take the case of Maksim Zaslaviky, who raised money for two separate projects, “RECoin” and “Diamond,” tokens allegedly backed by real estate and diamonds. Zaslaviky pleaded guilty to the charge of conspiracy to commit securities fraud and argued that laws surrounding digital currencies were “unconstitutionally vague.”

Jay Clayton, the SEC’s Chairman, made it clear that the SEC will not budge on the definition of a “security.” Months after clarifying that all ICOs are securities and “if it’s a security, we’re regulating it,” Clayton stated,

“If you have an ICO or a stock, and you want to sell it in a private placement, follow the private placement rules. If you want to do any IPO with a token, come see us.”

In fact, the ICO fervor got so tense that the SEC created a new role to oversee cryptocurrencies. Valerie Szczepanik, who previously served in the SEC’s cyber-unit, was given the brand new position of Associate Director of the Division of Corporation Finance and Senior Advisor for Digital Assets and Innovation. In the SEC’s press release, her role was defined as,

“Ms. Szczepanik will coordinate efforts across all SEC Divisions and Offices regarding the application of U.S. securities laws to emerging digital asset technologies and innovations, including Initial Coin Offerings and cryptocurrencies.”

SEC’s home turf

Due to increased regulatory oversight of the SEC, projects began leaving the US in search of other markets. The main concern for entrepreneurs was the definition of their issuance and if that would lead to the SEC stepping in, especially if they confer a “security” tag. Robert Greene, a former member of the Chamber of Digital Commerce’s Token Alliance, told Longhash,

“The SEC’s regulatory posture has certainly driven projects seeking to conduct an open digital token offering to locate outside of the United States.”

Some projects went a step further. BitTorrent, which saw its early-2019 token sale finish in 15 minutes and generated $7.1 billion, restricted US residents from taking part, owing to increased regulatory scrutiny.

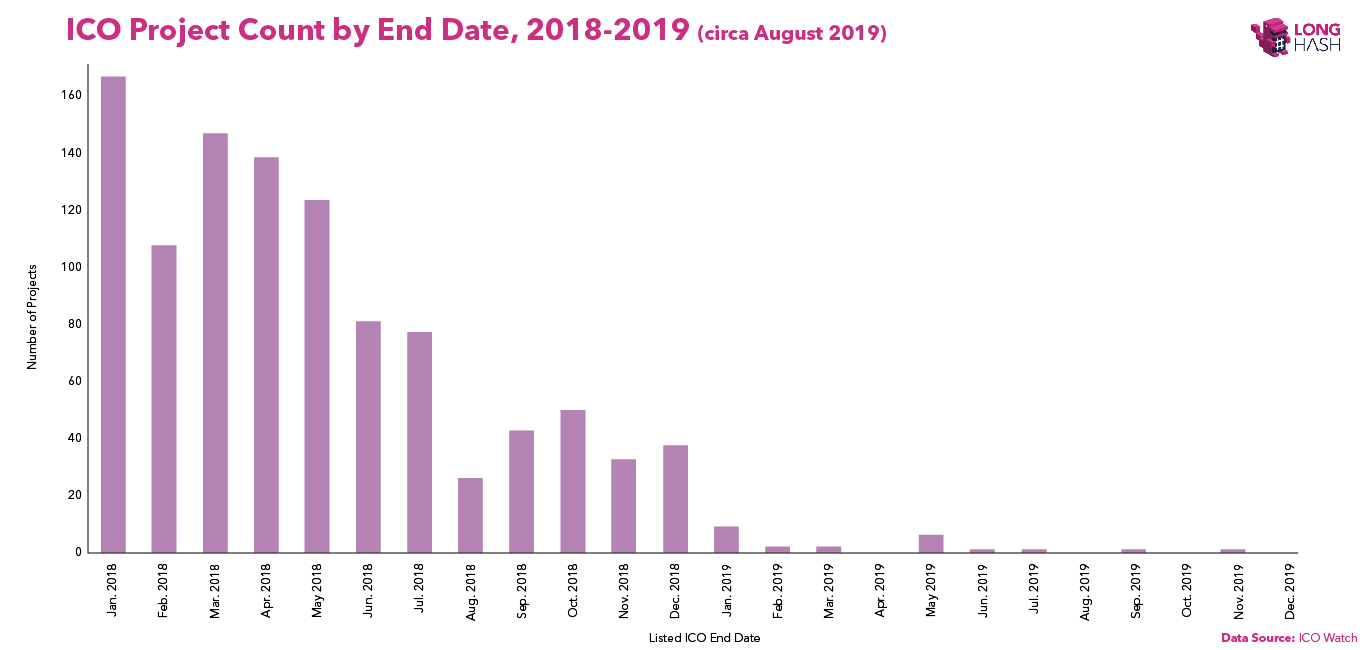

The ICO craze didn’t continue to 2019, particularly in the US. As seen in the chart below, the number of projects from January 2018 to November 2019 almost dropped to 0.

Source: ICO Project Count, Longhash

Token Problem

The setting in 2018 was vastly different from the one in 2019. ICOs were on a decline, moving to the premise of Initial Exchange Offerings [IEO] where internal governance of partnered exchanges come into play, rather than external regulation. The SEC’s focus hence waned from nabbing ICO criminals to defining a “token.”

Even though issuances present different regulatory cases, they’re unified by a common theme – the SEC is concerned not with the tag “security” or “token,” but the underlying means of fundraising and its purpose, said Chainalysis’ Chief Technical Officer, Michael Moiser.

In a joint statement, the three most important financial regulatory bodies of the United States – the SEC, the Commodity Futures Trading Commission [CFTC], and the Financial Crimes Enforcement Network [FinCEN] reiterated this principle,

“As such, regardless of the label or terminology that market participants may use, or the level or type of technology employed, it isthe facts and circumstances underlying an asset, activity or service, including its economic reality and use (whether intended or organically developed or repurposed),that determines the general categorization of an asset.”

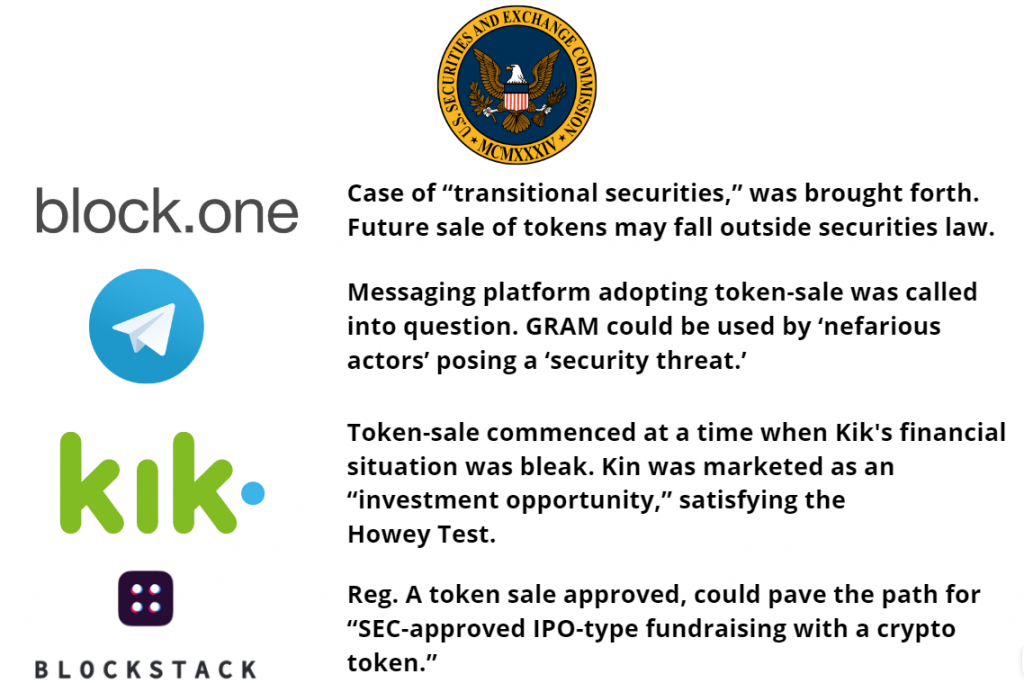

Four token issuances which caught the SEC’s attention and set the stage for regulation were – Block.one, Telegram, Kik, and Blockstack.

Block.one’s EOS

A previous piece covering Block.one’s regulatory issues can be found here.

Block.one was fined $24 million by the SEC for its EOS token sale in 2017-2018. The Brendan Blumer-led company clarified that the fine pertained to ERC-20 tokens issued on the Ethereum blockchain which are “no longer in circulation or traded.”

Stephen McKeon, Associate professor of finance at the University of Oregon and former Chief Strategy Officer at Security Token Academy, told AMBCrypto that this is an issue of “transitional securities,” based on when the token sale occurred and when the fine was imposed. He stated,

“The settlement could affirm the viewpoint that a network’s token should always be offered as a security during an initial raise, but a future sale of that asset might later be deemed to fall outside of securities laws once the asset’s network is “sufficiently decentralized.”

In relation to the Howey Test, once a network is “sufficiently decentralised,” it would not satisfy two of the determining factors and hence, “what was once a security is no longer treated that way by the SEC,” clarified McKeon.

Like the case of EOS, cryptocurrencies can essentially fall out of the “security” definition if it “evolves,” according to the SEC’s Director of Corporation Finance, Bill Hinman. Clayton seconded the ‘Hinman doctrine’ in a letter to cryptocurrency advocacy firm, Coincentre, stating,

“A digital asset may be offered and sold initially as a security because it meets the definition of an investment contract, but that designation may change over time if the digital asset later is offered and sold in such a way that it will no longer meet that definition.”

Telegram’s GRAM

The SEC halted Telegram’s GRAM token sale less than a month before its opening. Telegram told investors that discussions with the federal agency had been ongoing for eighteen months. Yet on 11 October, the SEC filed an emergency action against the platform for “conducting an alleged unregistered, ongoing digital token offering in the U.S.”

Steven Peikin, Co-director of the SEC’s Division of Enforcement, stated,

“Telegram seeks to obtain the benefits of a public offering without complying with the long-established disclosure responsibilities designed to protect the investing public.”

Moiser said that the case of Telegram directly ties to the SEC, CFTC and FinCEN’s joint statement [issued on the same day as the Telegram complaint], and is based on ‘function, not label.’ Next, the coming together of messaging and token sales is a case in its own regard, and hence, the SEC took the extra measure. Moiser added,

“The messaging app-to-crypto token space is an important one to watch, for fast adoption through existing networks, as well as natural synchronicity with privacy-oriented users.”

Telegram’s use as a covert-messaging device was also a concern. The Chainalysis CTO added that the messaging application came in for far more “scrutiny” owing to its alleged use by “nefarious actors.” The privacy messaging platform is the “number one source for terrorist organizations online,” according to Steven Stalinsky, Executive Director of the Middle Eastern Media Research Institute [MEMRI], a think-tank that released a 253-page report on how terror-outfits’ use of GRAM could be a “security threat.”

Moiser was surprised that Telegram, with its deep pockets and ability to put forth a strong legal team, could not, at the very least, avoid a “temporary restraining order.” He stated,

“Given their resources, knowledge of the publicly stated illicit finance concerns and ability to work through these issues in advance with regulators before market actions, the impact on investors from them not doing so makes this important in an unfortunate way.”

Kik’s KIN

In 2017, Kik, another lesser-known messaging platform, issued a token sale for their crypto Kin, raising $55 million from US investors in the process. Kin’s sale commenced during a period when the messaging service saw little use. The same was attested in the SEC’s June 2019 filing.

The crux of SEC’s complaint follows previous cases, stating that Kik “sold the tokens to U.S. investors without registering their offer.” The complaint was further divided into two parts – the value and the promotion. The value at the time of the complaint was “about half of the value that public investors paid in the offering.” Secondly, the SEC alleged that Kin was marketed as an “investment opportunity.”

Kik further told investors that a “profit” could be expected from their investment, which, according to the Chief of Enforcement in the Cyber Unit division of the SEC, Robert A. Cohen, satisfies the Howey Test. He stated,

“Future profits based on the efforts of others is a hallmark of a securities offering that must comply with the federal securities laws.”

Months after the complaint, Kik hit back, stating that the regulator has made a consistent effort to “twist the facts” by “misrepresenting the documents and testimony” gathered. Kik demanded a Jury trial and detailed 200 points of clarification against the SEC’s initial complaint.

The tussle got so heated that FT called it the “acid test for whether certain digital tokens count as securities.” It was hence, one of the most pivotal regulatory cases of 2019.

Blockstack’s STX

In July 2019, Blockstack saw its token offering – Stack [STX], approved by the SEC under Regulation-A. This was the first case of token issuances that was approved by the regulator. An alternative to an IPO, Regulation A is based on two tiers. Tier 1 pertains to offerings up to $20 million within a 12-month window, while Tier 2 has a ceiling of $50 million over the same period.

The case of Blockstack’s approval was hailed as being historical for token issuances under the purview of the SEC. The National Law board stated,

“The SEC’s decision to qualify Blockstack’s offering circular represents a milestone for Blockstack, as well as the blockchain industry as a whole. It is a key step down what may be a viable pathway for companies to raise capital to develop open, cryptographically secured networks powered by digital assets.”

Kraken’s Steven Ehrlich, in a piece for Forbes, stated that Blockstack’s approval was important for three reasons. The $28 million offering will be widespread between retail and institutional investors. Blockstack is ahead on development, having over 170 applications operating on its blockchain. Being over half a decade old, Blockstack belongs to the ‘old-guard’ of crypto-companies and serves as a “good barometer to assess the industry’s progress as a whole.”

With the cases of Kik and Telegram happening before and after Blockstack’s approval, the SEC took a more nuanced view with the blockchain company, compared to the messaging giants. Blockstack’s fundraising could be a “path to SEC-approved IPO-type fundraising with a crypto-token,” stated Moiser. He added,

“While many noted the $2mm that Blockstack spent to achieve this, it sets a precedent and blueprint that can be replicated on the shoulders of that capital investment.”

Lowering of the Iron-Fist

Token issuances were the most important regulatory decisions that the SEC had to make this year, and their approach from 2018 to 2019 has evolved. While in 2018, retail fever was pushing projects towards ICOs, the basket was spoiled by a few bad apples that used the method of raising funds for nefarious reasons, which rightly ushered scrutiny.

Moving on from the iron-fist decisions, the SEC immediately came out and stated that the ‘tag’ is secondary to ‘activity’ and ‘means.’ Four token security decisions dominated the sphere, with the messaging giants getting the short-end of the stick, more so due to other reasons surrounding their issuances, rather than the method itself.

For Kik, it was the financial situation and Kin’s drop in valuation, while for Telegram, it was the platform’s reported use by terror-elements. The regulatory decision for Block.one underlined the case for a more nuanced approach to token regulations, which looked at the lifetime of a token. Blockstack’s case also spelled out the alternative to IPO-means towards securing an SEC green light for crypto-fundraising.

All-in-all, it can be stated that the SEC is looking at the complete picture of token issuance, issuer, network, means, and amount before regulations are meted out.

Token issuances are not dead, they’re evolving.

The post appeared first on AMBCrypto