In our Wanchain price prediction for January 2020, we will be looking at some of the past price trends and market opinions.

Wanchain Overview

Wanchain was launched by Wanglu Tech, a Chinese company founded by Jack Lu, who also co-founded Factom. The Wanchain blockchain was forked from the Ethereum code.

Wanchain was designed to be a cross-chain blockchain infrastructure that would enable asset transfers as well as dApp and smart contract creation and functionality for financial applications.

The native coin of the Wanchain environment is the WAN coin. The project’s mainnet went live in January 2018, and in July 2018, the Wanchain 2.0 version was released.

Wanchain Price Prediction: Analysis

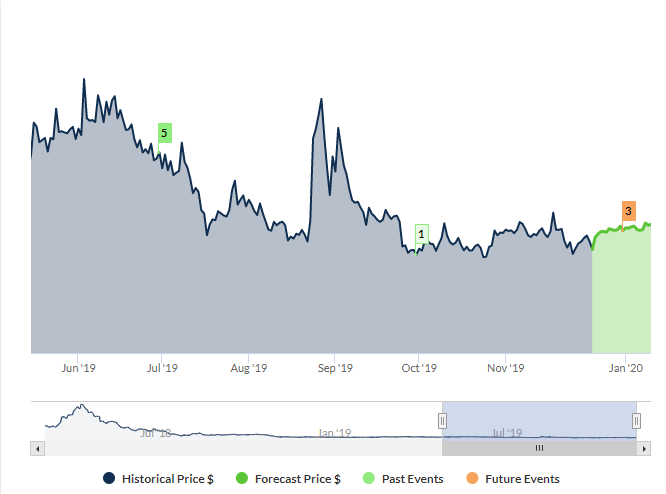

WAN started trading in December at a price of $0,208133, continuing the downward trend that began in November. The coin continued to lose its value throughout the day and closed at $0,192872.

Unfortunately, the highest value of December so far is still the opening price. Wanchain has continued losing value over the past weeks. From December 2nd to December 10th, WAN has been trading between $0.19 and $0.18, continuously declining.

On December 10th, the coin went below support levels of $0.18, trading at $0,176023. The following day, Wanchain tested $0.18 levels, but it continued to descend once more, closing the day at $0,173546.

On December 12th, Wanchain started to rise towards the end of the day, closing at $0,182931. The coin’s rebound to $0.18 was short, lasting only a few days, going back to $0,176134. On December 15th, WAN reached a new multi-month low of $0,169652. But surprisingly, WAN bounced back to close at $0,180391.

After testing $0.19 levels for several days, the coin reached $0,192182 on December 18th. Then, on December 19th, WAN was trading at $0,194112, which indicates that the coin might recover.

Below are the pivot, resistance, and support levels calculated by WalletInvestor:

Resistance Level (R3): 0.215

Resistance Level (R2): 0.2053

Resistance Level (R1): 0.199

Pivot Point: 0.189

Support Level (S1): 0.182

Support Level (S2): 0.172

Support Level (S3): 0.166

Developments

In September, WAN transitioned from a Permission Proof-of-Work (PoW) consensus algorithm to a Proof-of-Stake consensus algorithm. The PoS consensus model is based on Galaxy Consensus, a variant of PoS proposed by Wanchain’s research and development team.

At the time, Wanchain also enabled Validator nodes on its network, which would enable WAN staking on the Wanchain network.

The Wanchain team then went on to release a tool to aid Validator node monitoring. When the new tool was launched, the price of WAN saw an increase of 11% in the last 24-hour period, reaching a high of 0.0000282 BTC, but then, the price corrected itself. The trading volume also saw a significant boost.

“POS can get a lot of involvement from the community. Once they get used to the POS, some people will be more encouraged to use their token power to participate in all the on-chain governance and events,” said Wanchain’s CEO Jack Lu.

2019 was a busy year for Wanchain, but there have been several delays before their developments were finally implemented.

The team announced that in 2020, they will be “making a major pivot to focus on making Wanchain a better choice for dApp developers. This will be done both through additional tools which make the Wanchain dApp building process easier than ever, as well as upgrades to GWAN, the Wanchain core protocol client.”

Wanchain Price Prediction: Market Opinion for January 2020

Various crypto forecasting outlets have made their own Wanchain price prediction for January 2020, so we decided to feature them as well in order to better convey market sentiment.

CoinSwitch

The crypto website CoinSwitch stated that:

“Wanchain might increase its partnerships with coins and businesses, which might take it to a new level of milestones. Wanchain follower ratio and the adoption rate might also increase exponentially, which is one of the ways to move forward and gain a newer outlook in the cryptocurrency market. By the end of 2020, Wanchain might reach $9.06, which will give it a fresh perspective to perform and increase its margin.”

Coinpredictor

Coinpredictor forecasted that the WAN value will increase with 24.2%, which would lead to a value of $0.239582 by January 12, 2020.

TradingBeasts

TradingBeasts projected that the Wanchain price would reach $0.2841022 by the beginning of January 2020. For January, the site forecasted that the highest value would be at $0.3741445, while the minimum price at $0.2544183. The crypto prediction site expects WAN to close the month at a price of $0.2993156.

Cryptorating

Cryptorating’s Wanchain price prediction is that the price would reach $0.302099 in January 2020, signifying an increase of 53.52%.

Bitverzo

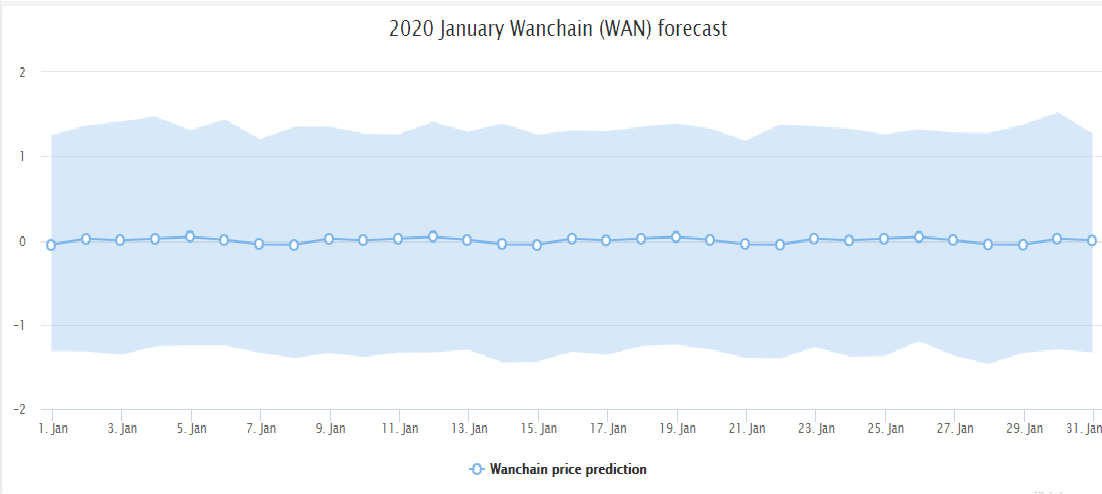

Bitverzo expected that on January 1, 2020, Wanchain would have an average price of $0.047060, with a low of -1.309891, and a high of 1.252352. On January 31, 2020, WAN was estimated that it would have an average price of $0.002467, with a minimum of $-1.325079, and a high of $1.276630.

The site has calculated the average, minimum, and maximum values that Wanchain is expected to have in the first month of 2020, with these values being featured for every day of January.

CryptoGround

CryproGround estimated that WAN would be trading at $0.2499 in the first month of 2020, with an increase of 41.88%.

Digitalcoinprice

The crypto forecasting website, Digitalcoinprice, estimated that the value of Wanchain in January would be of $0.41559936, which would signify an increase of 117.73%.

Wanchain Price Prediction: Verdict

Wanchain is most likely not going to see amazing surges at the beginning of 2020, but the project has demonstrated that it is working towards making more implementations on its blockchain.

This has been our Wanchain price prediction for January 2020. We hope that the information we provided in our article will be able to service you in your trading exploits.

The post appeared first on Coindoo