Crypto derivatives exploded in the 2019 market as the cryptocurrency market entered a phase of maturity. In the relatively nascent space, the increasing availability of cryptocurrency derivative products has been one of the main attractions for institutional traders and investors.

With platforms entering the crypto-derivatives markets on the rise, Co-founder of CoinGecko, Bobby Ong believes that soon Bitcoin futures/options will soon replicate the positive figures exhibited by the traditional market. In a recent interview with AMBCrypto, Ong stated,

“In traditional markets, options take up 20% of the derivatives markets with the other 80% being Futures. We will probably see a similar trend for Bitcoin futures/options split too. Options will be useful in allowing institutional investors to further hedge or place their bets in this market. I think it may be slow and will eventually grow to 20% of the derivatives market mirroring traditional markets.”

A Recap

Source: CoinStats

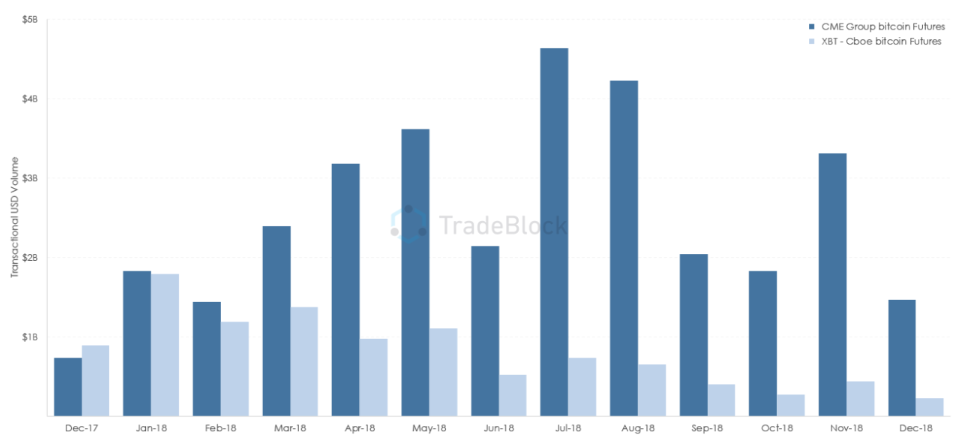

During the peak of Bitcoin’s bull run in December 2017, Chicago Board Options Exchange [CBOE] and the Chicago Mercantile Exchange [CME] launched Bitcoin futures trading. CBOE saw its highest-ever trading volume of 19,000 Bitcoin futures shortly after its launch. But it failed to retain positive figures. What was previously a head-on competition for CBOE soon turned to a loss as bullish sentiment on XBT Bitcoin Futures did not last long. CBOE abandoned Bitcoin futures trading in March this year.

CME, on the other hand, saw more market acceptance and posted staunching volume as compared to CBOE.

Source: Bitcoinist

One of the most high profile development in the space was undoubtedly Bakkt/ICE’s Bitcoin Monthly Futures.

As popularity in cryptocurrencies continued to grow, the products to trade the underlying asset is also expected to widen. Additionally, the refusal of the U.S. Securities and Exchange Commission to approve any Bitcoin exchange-traded funds [ETFs] has also prompted institutional players to opt for the derivative route.

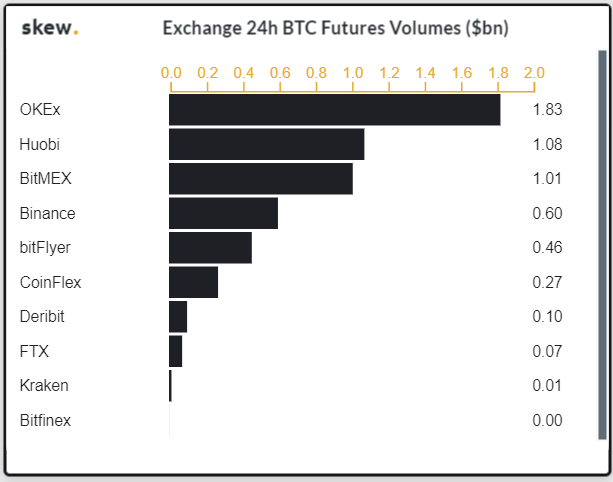

According to derivatives tracker Skew, among the prominent crypto platforms, OKEx continued to dominant BTC futures volumes.

Source: Skew | BTC Futures

Relatively unexplored is options trading since it offers protection against volatility risk. Many well-known crypto platforms have introduced options in addition to futures alongside existing margin trading and perpetual swaps markets in a bid to diversify the trading and hedging strategies for its users. The latest to jump on this bandwagon is the OKEx, which is all set to launch Bitcoin options trade in January 2020. CME’s upcoming Bitcoin options product is also something that the institutional traders are in a lookout for.

Exchanges such as BitMEX, Kraken, Binance, and BitFlyer have opened altcoin futures trading along with Bitcoin.

Bitcoin Options Market is Growing

Skew had previously revealed that the Bitcoin term structure steepened in the fourth quarter of 2019, meaning that the options market has evolved when it comes to hedging price risks. Implied volatility (IV) is an important metric for pricing options contracts. The price of options rises when IV goes up. Following a gradual decline in the IV, a mild uptick in the graph could be a positive sign for the options market.

Source: Skew

The post appeared first on AMBCrypto