Bitcoin’s price has been treading under the $8k mark for a while now, and what once was considered to be a bullish coin is now limited in terms of price due to various reasons. One of the reasons that have often made the rounds are Bitcoin Futures pulling the price of the digital asset down.

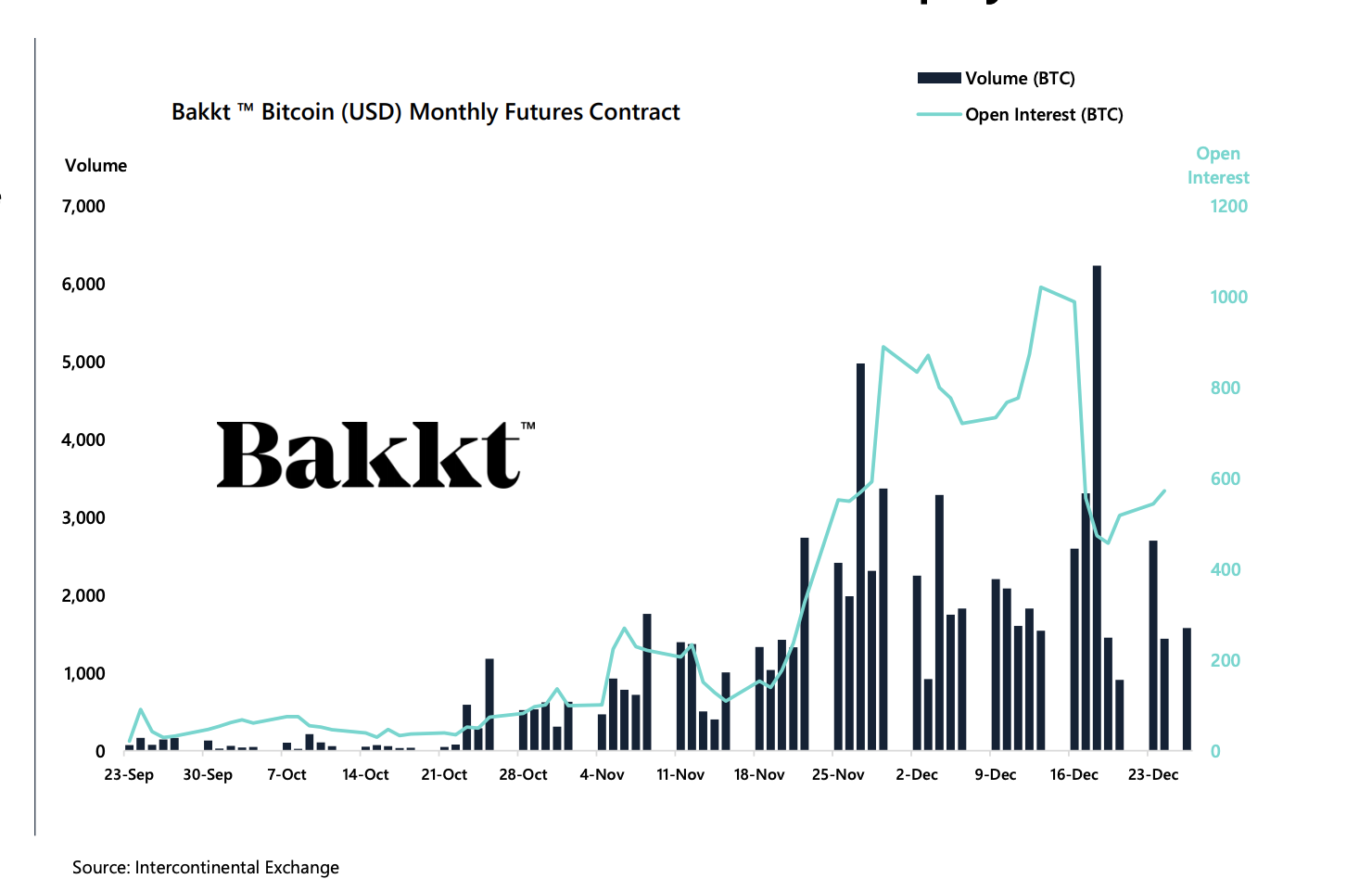

Bakkt, the derivatives platform the community was anxiously waiting, launched this year and registered record trading volumes. According to a recent report by Arcane Research, Bakkt has been setting new records every week and has managed to breach its previous record yet again. The report noted,

“The total weekly volume ended at 14,486 BTC last week, but the open interest was cut in half.”

Bakkt‘s previous week’s volume was 56.5% higher than the week before and close to the previous record of 15,046 BTC. It set a record for new daily volume on 18 December with 6,226 BTC traded. However, Open Interest ended and went down by over 50% as the December contracts expired last week. The report also noted that only 8 BTC contracts were held to expiry and delivered physically, a figure which was ten contracts lower than the number recorded in November. There were no trades done for the daily BTC futures contracts over the last ten weeks.

Source: Arcane Research

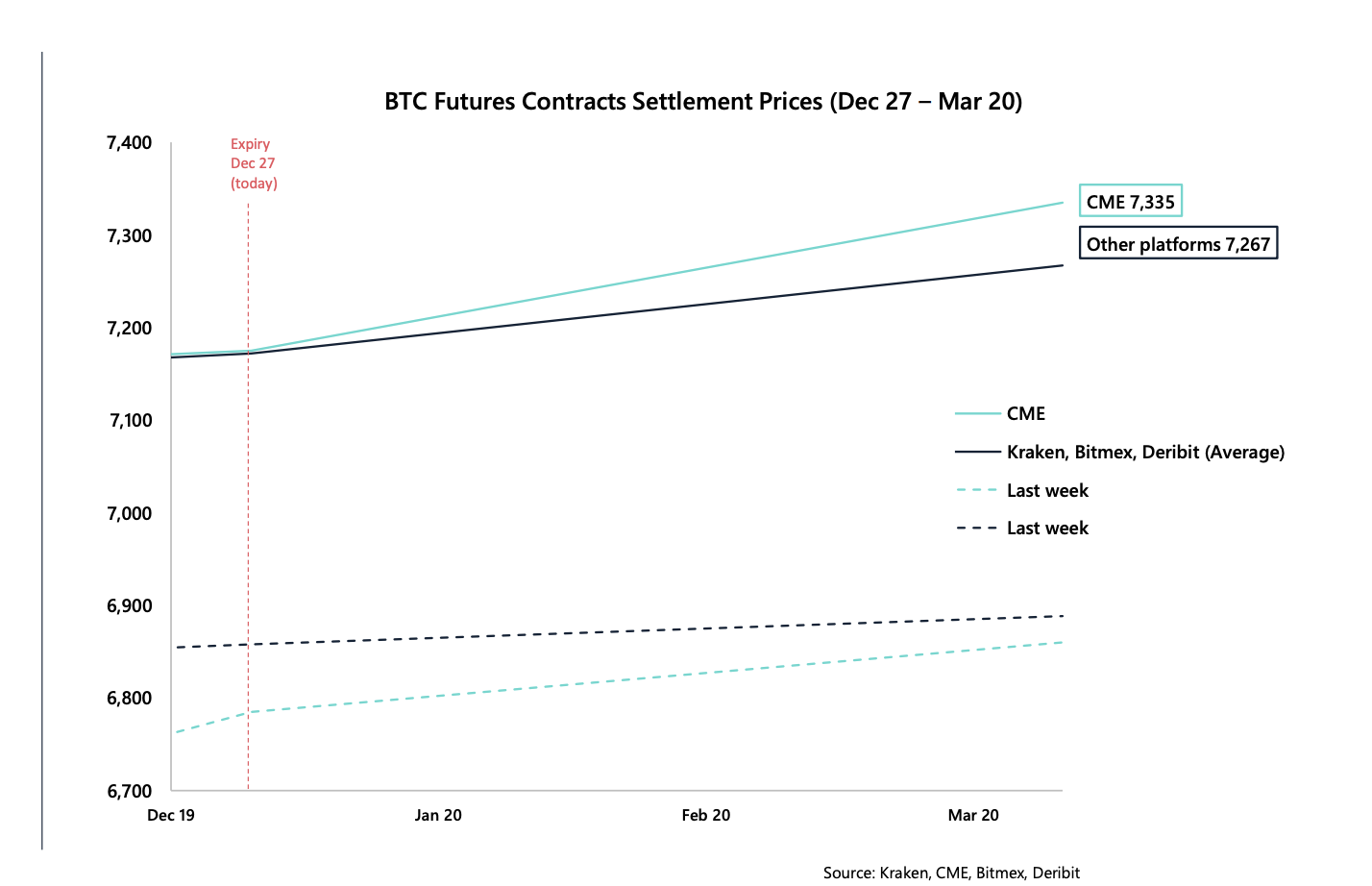

On the other hand, the Futures premium noted a recovery and was back at its previous level. Even though the price of the digital asset did not see much fluctuation week-to-week, there have been several spikes in BTC’s price since last week. The report added,

“With the BTC pumping from $6,500 to $7,600, investors are turning more positive, even though the price fell down to the lower $7,000 level again. The premium rates for the March 2020 contracts are now 2.3% on CME and only 1.4% for other platforms.”

Source: Arcane Research

At press time, Bitcoin was valued at $7,204.56 with a market cap of $1131.74 billion.

The post appeared first on AMBCrypto