If the idiom ‘off to a fresh start’ needed an example, Bitcoin will be an ideal candidate at the moment.

After starting the year at a price under $6900 on 2nd January, the largest digital asset seemed to break away from its bearish shackles, registering a growth of over 19 percent in the past 9 days. The turnaround has been significant and its impact has been felt around the industry.

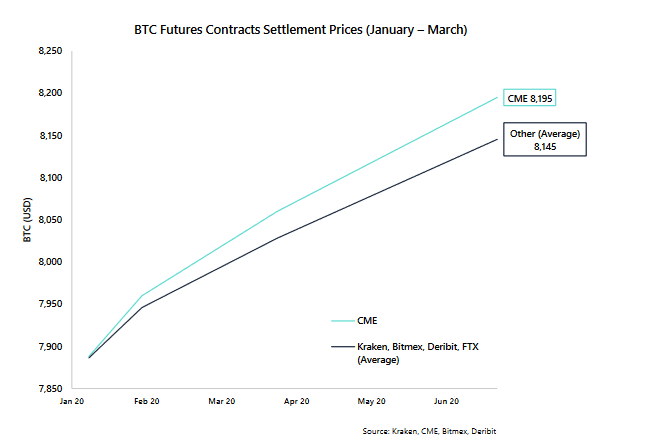

An evident difference was observed in the derivatives market after BTC premium rates indicated that a long-term bullish sentiment was back in the market.

Premium rates across various platforms for BTC futures contracts to be settled in March 2020 and June 2020 exhibited a positive outlook, especially on the CME platform. The increase in CME was interesting as the platform had recorded a dip of 1.6 percent on the March 2020 BTC contracts last week.

Source: Arcane Research

Arcane Research’s recent weekly report suggested that CME traders are trading higher on futures in comparison to traders on other platforms, as the gap between CME and the other platforms had increased. The premium on CME for June 2020 contracts was close to 4 percent, whereas other institutions registered an approx of 3.5 percent.

Nikolaos Panigirtzoglou, Managing Director at J.P Morgan, also observed the building market measures and identified that the dominance of CME in trading Bitcoin futures may change certain market dynamics. He recently noted and said,

“There has been a step increase in the activity of the underlying CME futures contract. This unusually strong activity over the past few days likely reflects the high anticipation among market participants of the option contract.”

He added that the open interest had increased by 69 percent from year-end and the growth of large open-interest holders has periodically increased.

The Arcane report also indicated that BTC futures on CME has been valued higher than other platforms in the past as well. In October 2019, Bitcoin averaged a valuation between $8300-$8700 as CME had an average annualized premium of 8.36 percent. Other platforms registered an average of 6.46 percent in the same time duration.

The higher premium rates on CME emphasized the fact that institutional traders are more bullish on Bitcoin’s movement.

The post appeared first on AMBCrypto