The Chicago Mercantile Exchange (CME) will launch options on Bitcoin futures starting today. This comes as a result of the increased interest in cryptocurrencies. Moreover, analysts from JP Morgan think that there’s a high-anticipation among institutional investors for CME’s newest product.

Anticipating CME’s Bitcoin Futures Options

CME recently announced the launch of its newest product that will allow customers to trade options on Bitcoin futures. It’s scheduled for release today, January 13th. Some believe that it will attract further attention from institutional investors.

In fact, a group of JP Morgan analysts, led by Nikolaos Panigirtzoglou, expressed their views on the matter. He noted that the total interest towards CME has grown with almost 70% from year-end. This could be coming as a result of the options contracts:

“There has been a step increase in the activity of the underlying CME futures contract. This unusually strong activity over the past few days likely reflects the high anticipation among market participants of the option contract.”

It’s worth noting that Bakkt, the Bitcoin Futures trading platform of the Intercontinental Exchange (ICE), previously launched Bitcoin’s monthly options. Panigirtzoglou acknowledges this, but he doesn’t consider Bakkt’s volume to be sufficient enough at the moment, calling it “rather small.” The researchers believe that since CME has been more dominant in the Futures market, its options on Bitcoin will have a more significant impact.

Another Bitcoin options product came from the large cryptocurrency derivatives platform FTX. According to the company’s CEO, it was launched on January 11th and the volume quickly reached $1 million in just two hours.

Bitcoin Price Reaction To Come?

The largest cryptocurrency has been on a volatile ride since the start of 2020. Historically, it has previously shown reactions whenever similar products were launched. For instance, just a day after Bakkt’s Bitcoin futures trading platform saw the light of day, BTC’s price plunged by more than $1,500 in a matter of hours.

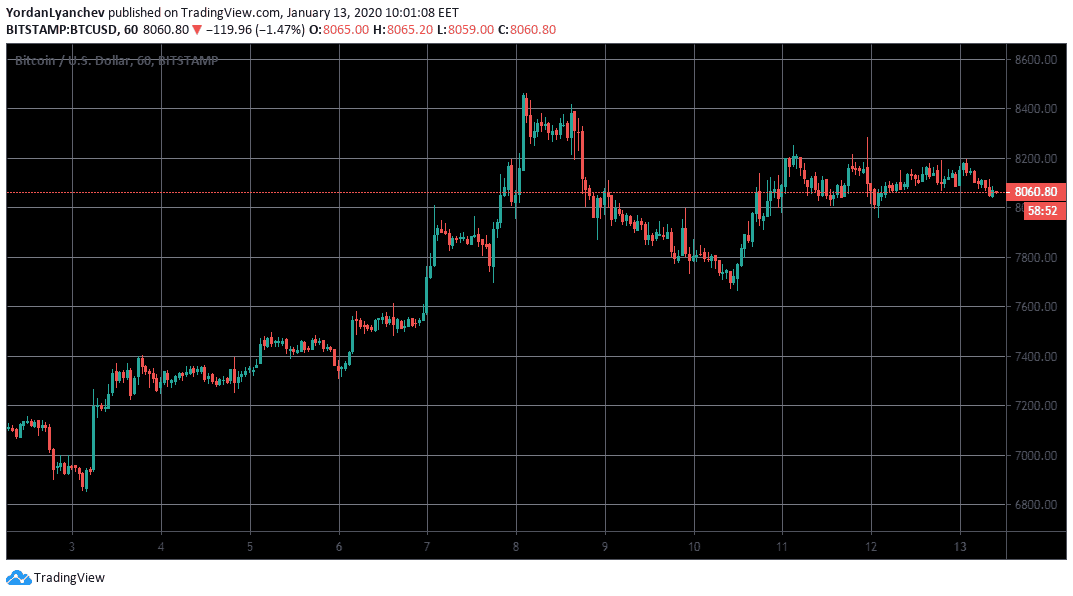

At the time of this writing, Bitcoin trades at $8,060, which is slightly above the first support line of $8,000. If this level fails to hold, lower support can be expected at $7,700 and $7,400. However, if BTC continues to increase, the first line of resistance it would have to overcome stands at $8,300 and then at $8,600.

BTCUSD 1h Bitstamp. Source: TradingView

You might also like:

The post appeared first on CryptoPotato