- The Tezos train has started to move once again after a noticeable 17% increase over the past week of trading, bringing the price of the coin up to $1.55.

- Against Bitcoin, the cryptocurrency found strong support at the 200-days EMA, which allowed it to rebound higher.

- Tezos is now the 14th largest cryptocurrency by market capitalization.

Key Support & Resistance Levels

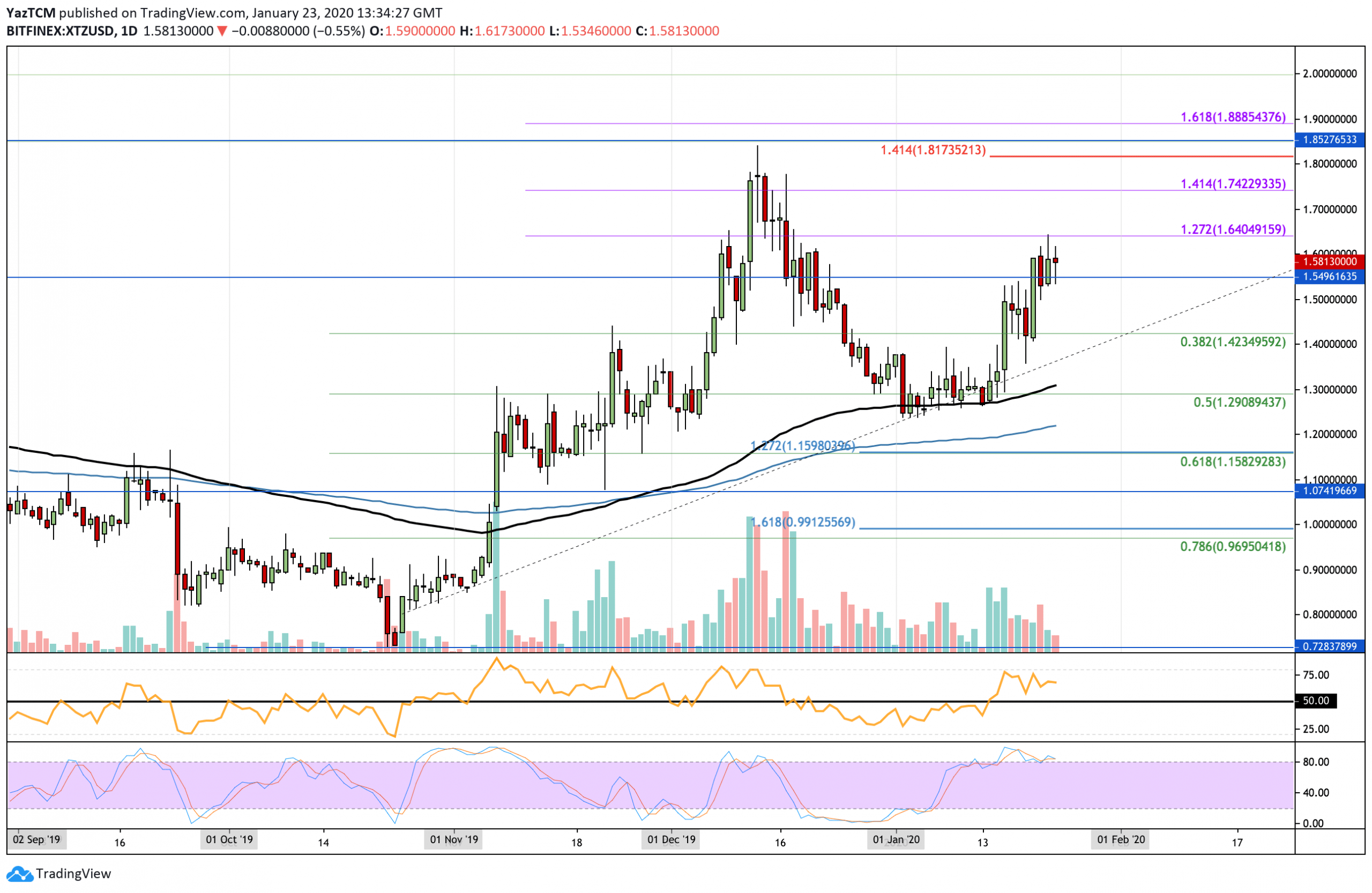

XTZ/USD

Support: $1.50, $1.42, $1.30.

Resistance: $1.64, $1.74, $1.88.

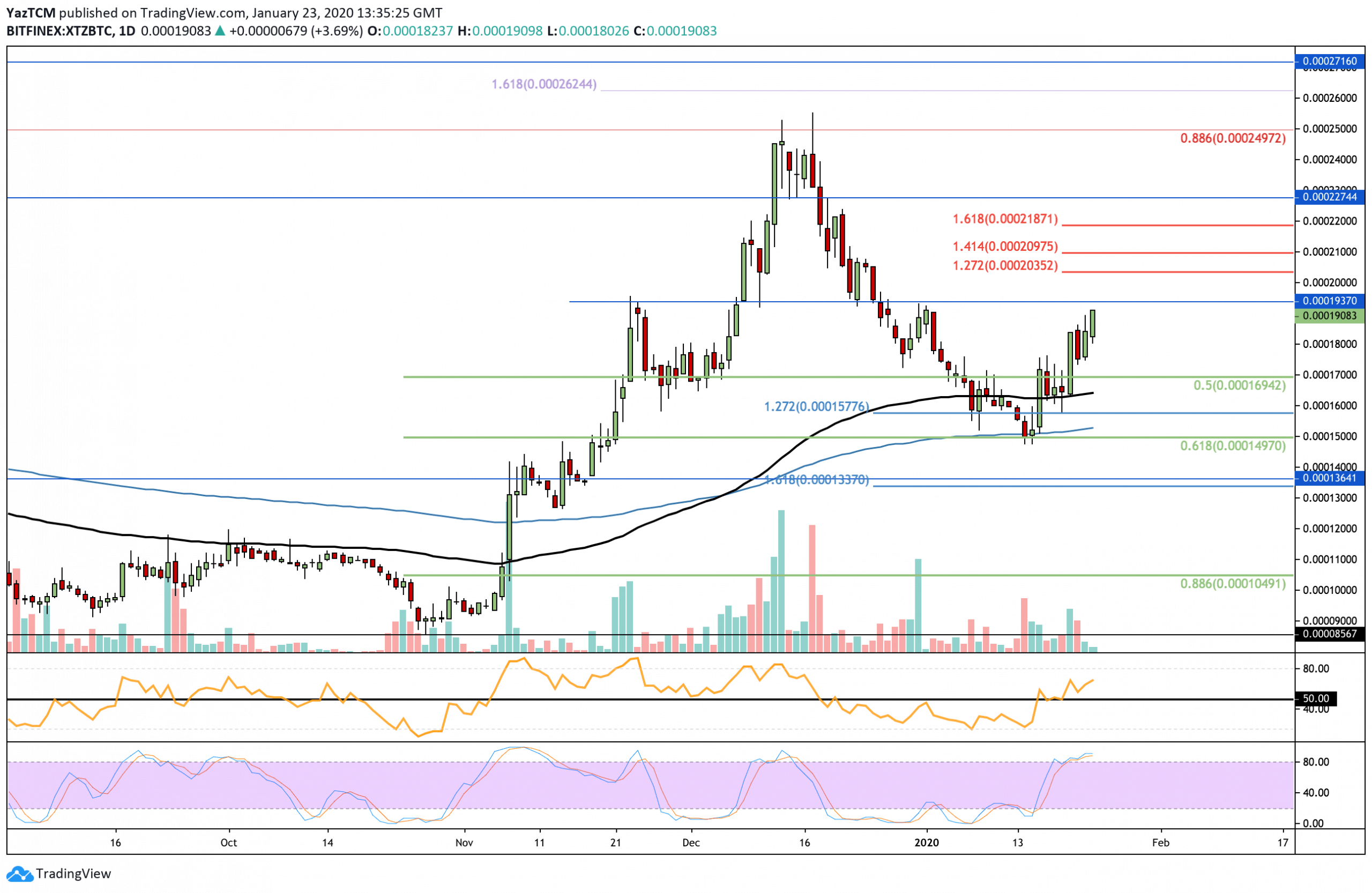

XTZ/BTC:

Support: 0.00017 BTC, 0.00016 BTC, 0.000149 BTC.

Resistance: 0.00019 BTC, 0.000209 BTC, 0.00025 BTC.

XTZ/USD: Bulls Defend 100-days EMA and Rebound Higher

Since our last analysis, Tezos continued to trade along with the support provided by the 100-days EMA. It eventually rebounded higher to break above the $1.40 level but stalled at $1.50 for a few days. XTZ went on to break above the $1.50 resistance this week as it surged into resistance at $1.64 (1.272 Fib Extension).

Tezos is currently in the process of turning bullish once again after a break above the $1.50 level. However, it must continue above the December highs at $1.80 to develop a strong bullish run. If it were to drop beneath the support at $1.30 (100-days EMA), the market would turn bearish.

Tezos Short Term Price Prediction

If the buyers continue to drive Tezos higher, an initial resistance is located at $1.64. Above this, resistance can be found at $1.74 (1.414 Fib Extension), $1.81, and $1.88 (1.618 Fib Extension). Beyond $1.88, resistance lies at $2.00. Alternatively, if the sellers regroup and push Tezos lower, strong support is located at $1.50. Beneath this, support lies at $1.42 and $1.30 (100-days EMA).

The RSI is still above the 50 level, which shows that the bulls still have control over the market momentum at this time. If it starts to drop toward 50, this would be a sign that the bullish pressure is starting to fade. Additionally, the Stochastic RSI is shaping up for a bearish crossover signal in overbought conditions, which would send the market lower.

Against BTC, Tezos continued to drop further beneath the 100-days EMA but managed to find strong support at the 200-days EMA. This was further bolstered by the .618 Fibonacci Retracement level, which allowed XTZ to rebound higher against BTC. After bouncing, Tezos went on to climb above the 100-days EMA and continued to surge toward the 0.00019 BTC level.

Tezos can now be considered as a neutral market after the rebound from the 200-days EMA. For this market to turn bullish, Tezos must rise and break above 0.00025 BTC.

Tezos Short Term Price Prediction

If the bulls push XTZ above 0.000193 BTC, resistance is expected at 0.000203 BTC (1.272 Fib Extension), 0.000209 BTC (1.414 Fib Extension), and 0.000218 BTC (1.618 Fibonacci Retracement). Beyond this, resistance lies at 0.000227 BTC and 0.00025 BTC. On the other hand, if the sellers regroup, immediate support is found at 0.00017 BTC (.5 Fib Retracement). Beneath 0.00017 BTC, additional support lies at 0.00015 BTC (200-days EMA) and 0.000133 BTC.

The RSI has climbed back above the 50 level to show that the buyers have taken control over the market momentum. If it stays above 50, Tezos should continue to rise.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

The post appeared first on CryptoPotato