Stablecoins now have a larger share of value transferred on the Ethereum network than its native cryptocurrency – ETH.

Even though the continuously increasing interest towards stablecoins appears as a concern to some, Changpeng Zhao believes that they are still needed for mass adoption.

Stablecoins’ Flip On The Ethereum Network

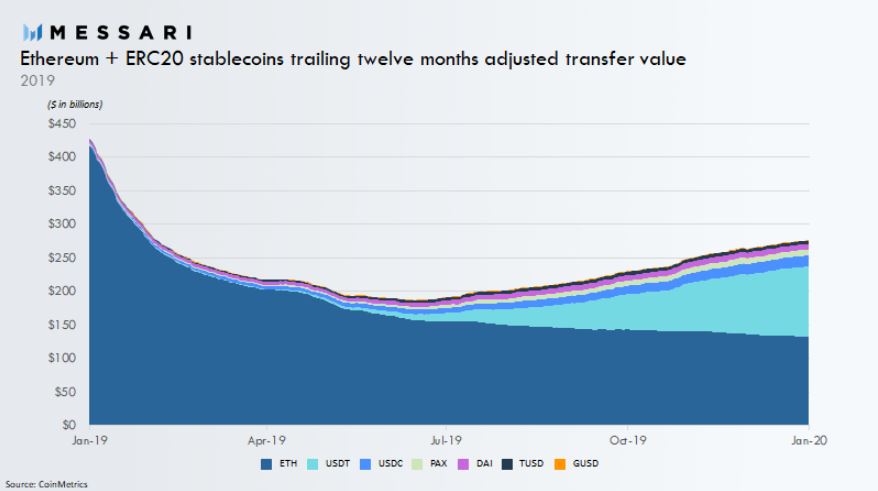

Yesterday, new research by Messari, found out that ETH is no longer carrying the most substantial transfer value on the Ethereum network as stablecoins have surpassed it.

Stablecoins On Ethereum’s Network. Source: Messari.io

“This is largely the story of USDT transitioning to Ethereum,” said Ryan Watkins from Messari.

As shown above, Tether (USDT) is dominating over the other stablecoins. USDC also has a continuously rising transfer value, and PAX, DAI, TUSD, and GUSD are left behind.

Tether’s flippening brings a concern to some members of the Ethereum community. They believe that USDT’s long history of controversy might not be a step in the right direction since its influence keeps increasing. As a reminder, just a few months ago, Tether became the 4th largest currency by market capitalization. This lasted not for long; however, it just proves how during Bearish market conditions, Tether gains momentum.

The Ethereum network allows for numerous tokens to operate simultaneously. Despite that, the flip raises a valid question – will it have a positive or negative effect on the Ether?

CZ Binance: We Live On Earth

Despite the negative notion, the “flippening” supports the current need in the cryptocurrency space for stablecoins.

Those play a significant role, which is emphasized explicitly during times of high volatility, as traders can use them to “store” their funds’ FIAT value.

The fact that most of them are pegged to fiat currencies (U.S. dollar) or commodities (Gold), raises the trust levels and utilization.

The CEO of Binance, Changpeng Zhao (CZ), also brings another plausible positive feature of stablecoins.

“Many of us (early adopters) don’t like stable coins, but the fact is, that’s what’s needed to help us cross the chasm, as most new crypto people will still think in fiat base for a while to come. I wish that’s not the case, but we live on earth, not utopia.” according to CZ.

In his opinion, stablecoins are (still) the pathway to mass adoption since most people “still think in fiat base.” For instance, as long as most users accept that one bitcoin has a specific value in dollars (or in any other fiat currency), stablecoins will have a vital role.

The post appeared first on CryptoPotato