- Binance Coin saw a sharp increase of 9.8% over the past 24 hours as the coin rises to $21.50.

- Against Bitcoin, BNB has also increased to create a fresh 2 month high at 0.00219 BTC.

- Binance Coin has now climbed back into the top 10 ranked projects as it sits in the 9th position with a $3.33 billion market cap.

Key Support & Resistance Levels

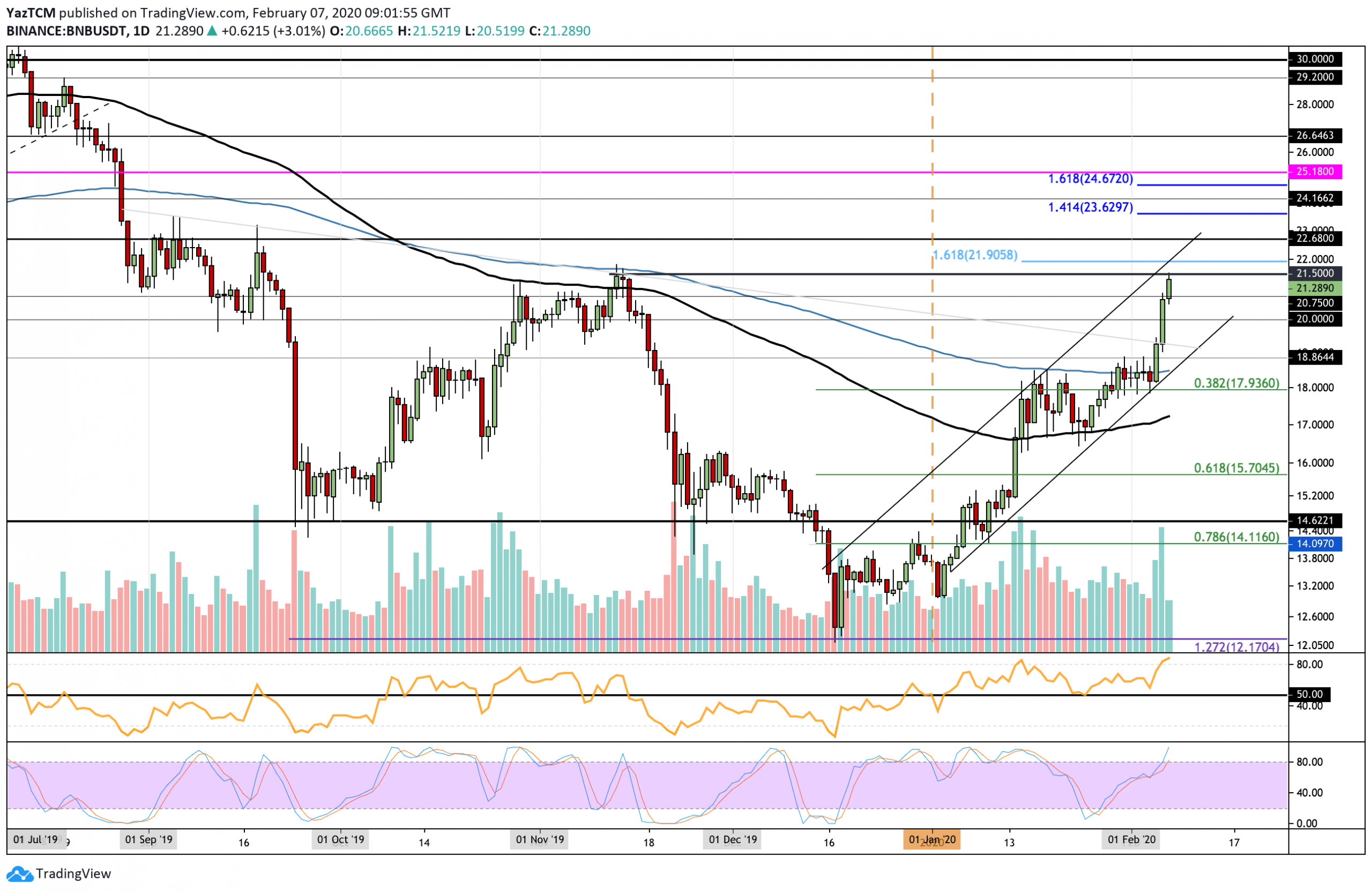

BNB/USD

Support: $20.75, $20, $18.50.

Resistance: $22.70, $23.60, $25.

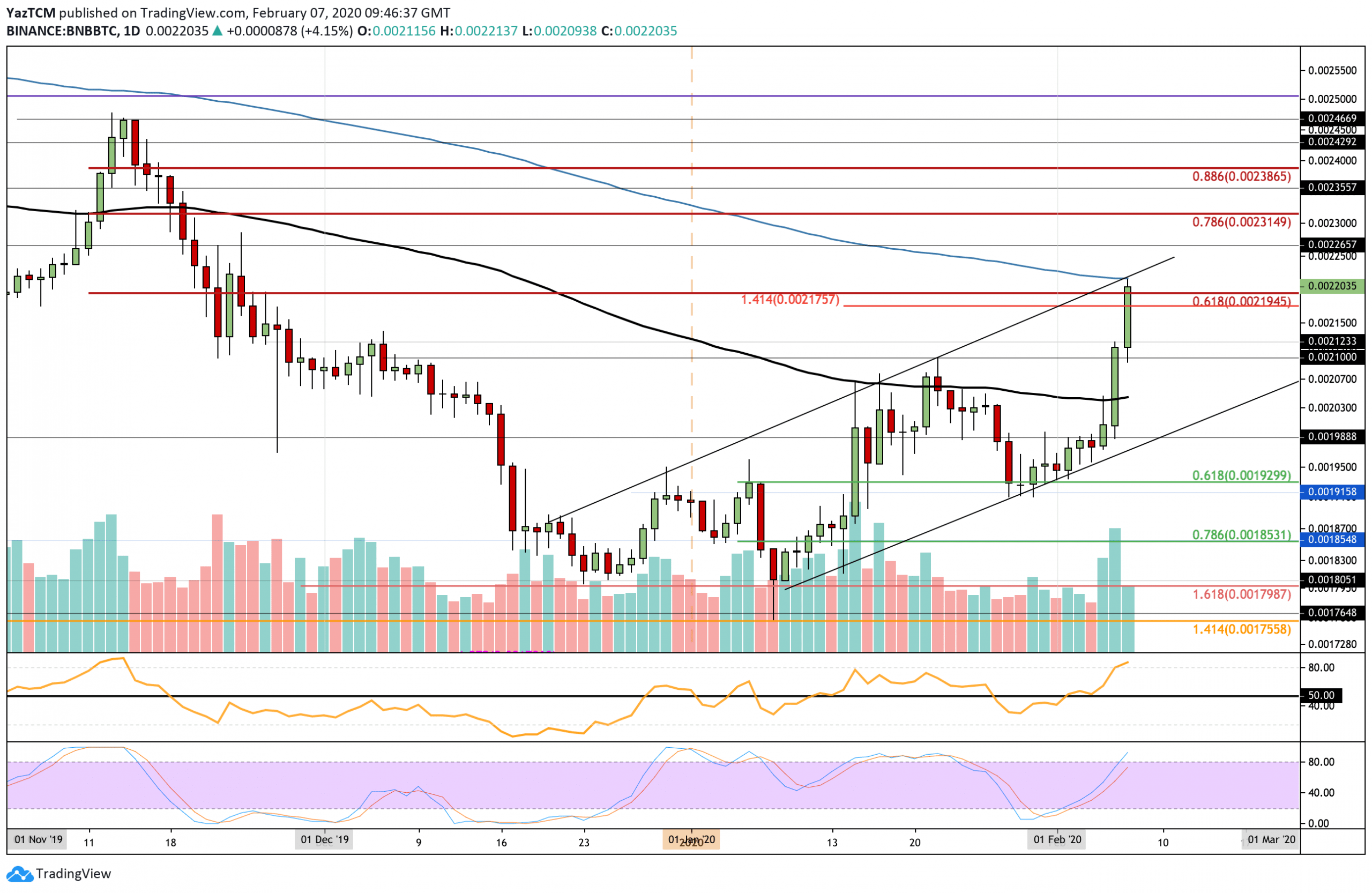

BNB/BTC:

Support:0.0022 BTC, 0.00215 BTC, 0.00212 BTC.

Resistance: 0.00225 BTC, 0.00231 BTC, 0.00238 BTC .

BNB/USD: Binance Coin Reaches November 2019 Highs

Over the past month, Binance Coin has risen by a total of 42% as the cryptocurrency rises back into resistance provided by the November 2019 highs.

The cryptocurrency started the year at a price of around $13 and started to surge much higher to break above the 100-days EMA at $17 and reach the 200-days EMA at $18.50.

It is important to highlight the clear ascending price channel that BNB has been trading within over the past 6-weeks of trading.

BNB struggled at the $200-days EMA during the rest of January, however, as February started to trade it quickly penetrated above as it broke above a 5-month old descending trend line to climb higher into the current resistance at $21.50.

BNB/USD. Source: TradingView

Binance Coin Short Term Price Prediction

If the bulls manage to break $21.50, the next level of resistance lies at $21.90 (1.618 Fib Extension). Above this, resistance lies at $22.70 (September high-day closing price), $23.60, and $25.

Alternatively, if the sellers push BNB lower, support can be found at $20.75 and $20. Beneath this, additional support lies at $18.50 (200-days EMA), $17.90 (.382 Fib Retracement), and $17.00 (100-days EMA).

The RSI has reached extremely overbought conditions which could suggest that the bulls might be overextended. If the RSI starts to point downward, this could be the first sign of a brief retracement toward $20.

BNB/BTC: BNB Reaches 200-Days EMA against BTC

Against Bitcoin, Binance Coin has also been surging quite significantly as it breaks resistance at 0.00219 BTC, provided by a long term bearish .618 Fib Retracement level, and reaches the 200-days EMA at 0.0221 BTC.

The cryptocurrency is also trading within a much wider ascending price channel as it approaches the upper boundary of the range.

BNB will remain bullish against BTC so long as it can remain above the 100-days EMA at around 0.00205 BTC.

BNB/BTC. Source: TradingView

Binance Coin Short Term Price Prediction

Moving forward, if the bullish pressure continues to drive Binance Coin above the 200-days EMA and the resistance at the upper boundary of the price channel, the next level of strong resistance lies at 0.00226 BTC. Above this, resistance lies at 0.00231 BTC (bearish .786 Fib Retracement) and 0.00238 BTC (bearish .886 Fib Retracement).

On the other hand, if BNB drops from here, the first level of support lies at 0.022 BTC. Beneath this, additional support lies at 0.00215 BTC, 0.00212 BTC, and 0.0021 BTC.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato