Bitcoin’s positive price movement continued over the weekend, and it surpassed the coveted $10,000. Today, however, the largest cryptocurrency recorded a notable drop of over $500 in a few hours, which also filled the CME closing gap from Friday.

Bitcoin Drops With $500

Bitcoin has been on quite the run lately. For the first time since October last year, it went above $10,000. However, the price of the largest digital asset took a serious dive of over $500 in just a few hours.

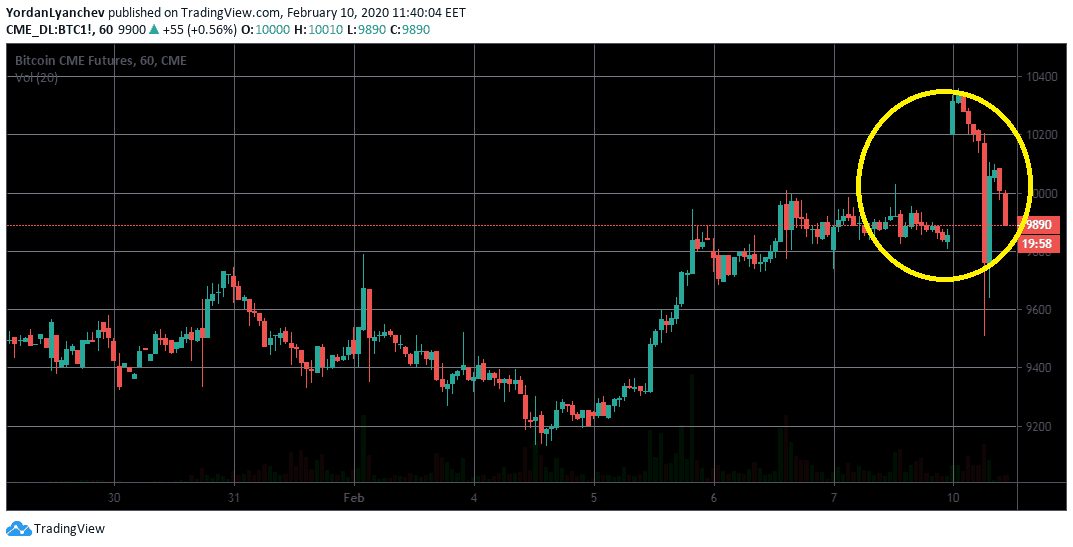

The dip aligned with a price gap on the Chicago Mercantile Exchange Bitcoin Futures chart. CME closed on Friday at approximately $9,850. However, it opened at above $10,000 since the largest cryptocurrency continued increasing over the weekend.

As it has happened numerous times before, Bitcoin’s price noted a negative spike taking it to $9,500 on CME’s chart, thus closing the gap.

CME Bitcoin Futures Price Gap. Source: TradingView

A price gap occurs when the asset has either risen or fallen from the previous trading day’s close, without any trading happening in between.

It’s worth noting that Bitcoin price gaps started after the launch of the CME Bitcoin Futures platform in late 2017. As the latter is a regulated establishment, it operates between certain hours within the weekdays and is closed during the weekend and official holidays.

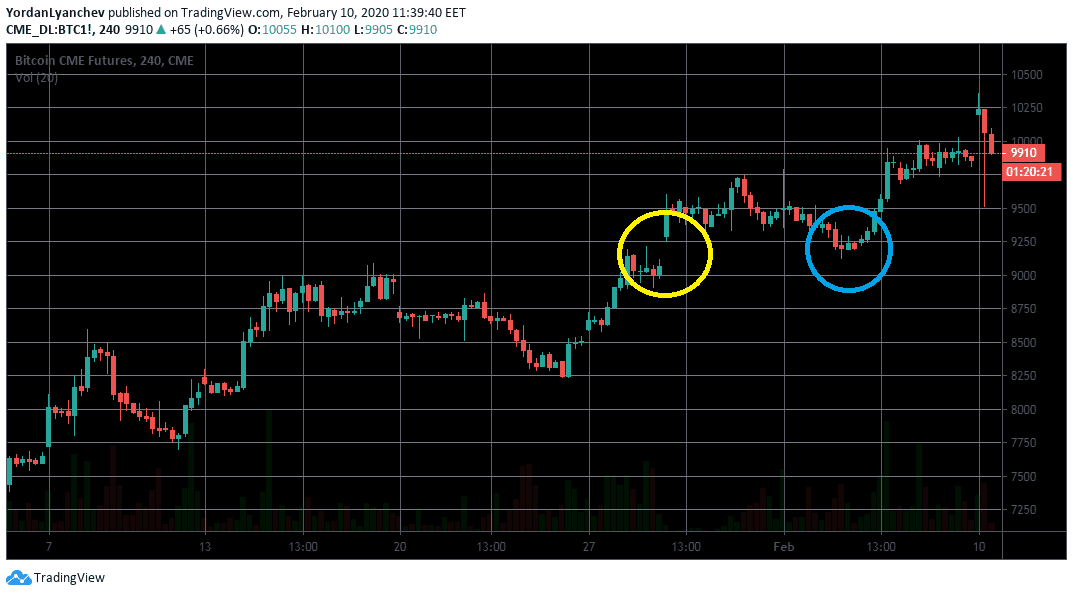

Price Gaps Examples

As Cryptopotato reported before, Bitcoin price gaps get closed around 95% of the time. Moreover, 50% are filled on the opening day of trading as it occurred today.

If one takes a look at a broader chart, he can notice such examples happening almost weekly. While some are smaller and get filled in the first few days, others deliver a significant gap that needs more time to close.

CMEBitcoinFutures Price Gap. Source: TradingView

For instance, on January 17th, 2020, CME closed at $8,950, and it opened at $8,720. This $230 dip was not filled in the first week, and it took ten days to close on January 27th.

Some traders are purposefully looking at these gaps as legitimate opportunities to make profits. Seemingly, since such a high percentage gets filled in a short time, it’s rather tempting. Yet, in such a volatile market, one should be aware of the risks.

The post appeared first on CryptoPotato