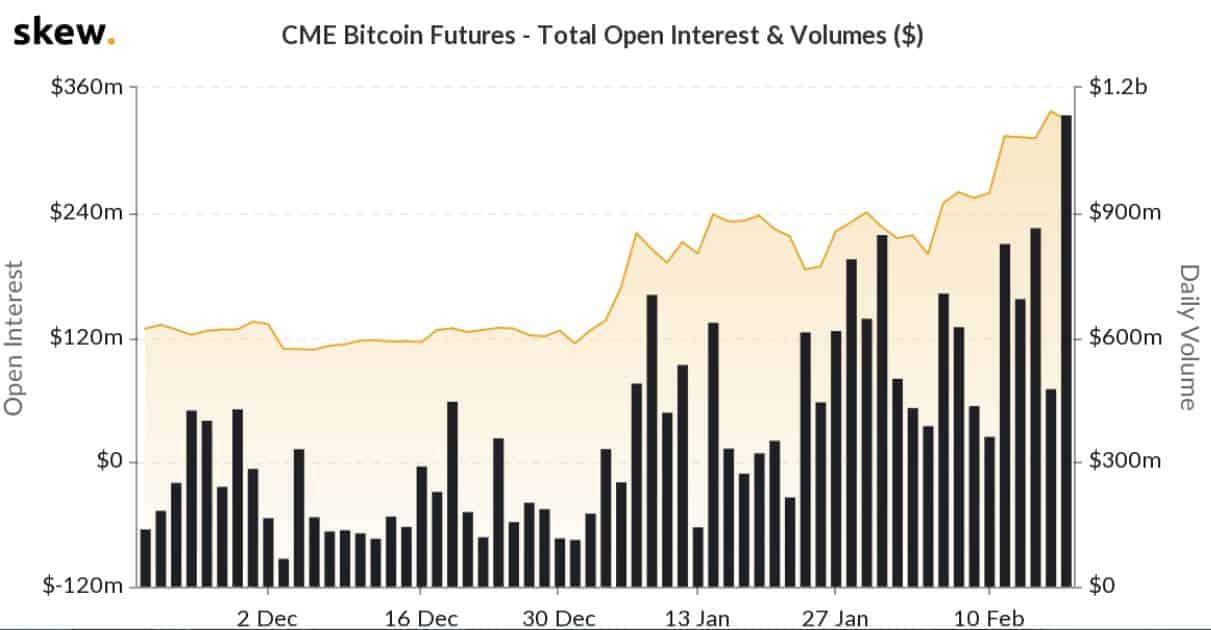

With Bitcoin’s price increase in 2020, so does the interest in futures trading. A few days ago, for instance, CME recorded one of its best trading days with over $1 billion in daily volume.

Other significant names in Bitcoin Futures trading, including BitMEX and Binance, are also noting impressive volumes lately.

CME Bitcoin Futures Volume Spikes

The Chicago Mercantile Exchange (CME) opened its Bitcoin Futures platform in late 2017. It’s a regulated establishment that allows contracts to be settled against the USD.

Since 2017, it has enjoyed steady volume flows. With the start of this year, though, following Bitcoin’s price surge, the volume has been continuously increasing.

Earlier this week, CME Bitcoin Futures recorded approximately $1.1 billion daily volume, according to data from the popular monitoring resource – skew. This is only the third time in its history when the volume has exceeded the coveted $1B mark.

Data from CME’s website notes that the total amount of traded contracts is above 23,000. It’s worth mentioning that each of them contains five bitcoins.

Some members of the community argue that the price increase of the largest digital asset is not the only reason. They bring out other fundamentals, such as the upcoming Bitcoin Halving, as potential game-changers.

Scheduled to take place in less than three months, the Halving is one of the most important events of the year for the cryptocurrency space. As such, it brings serious attention to Bitcoin and the whole market.

Bitcoin Futures Volume On The Rise Across The Map

Most Bitcoin margin trading platforms also see a serious increase in their volumes. For example, the leading futures exchange by volume, BitMEX, continues to boast a daily trading volume upwards of $4 billion.

Additionally, Bitcoin Futures Open Interest has risen with over 60% since the start of the year, and it surpassed $4 billion. As Cryptopotato recently reported, BitMEX leads in this category as well, with almost $1.5 billion.

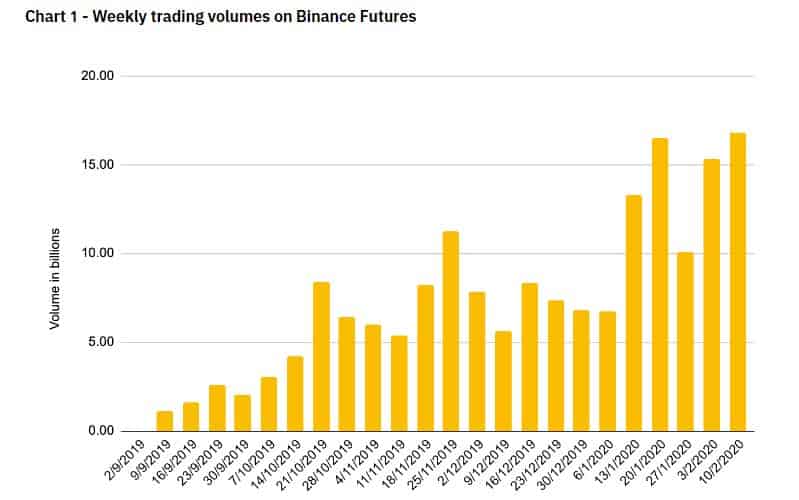

Binance futures platform launched back in September 2019. Even though it’s relatively young and trails to most of its competitors, it also sees a serious increase in its volumes. According to a recent blog post, the weekly trading volume has more than doubled since the start of the year.

However, it’s worth noting that Binance Futures offers over twenty different perpetual contract pairs.

The post CME Bitcoin Futures Records Over $1B In Daily Volume As The Interest Surges appeared first on CryptoPotato.

The post appeared first on CryptoPotato