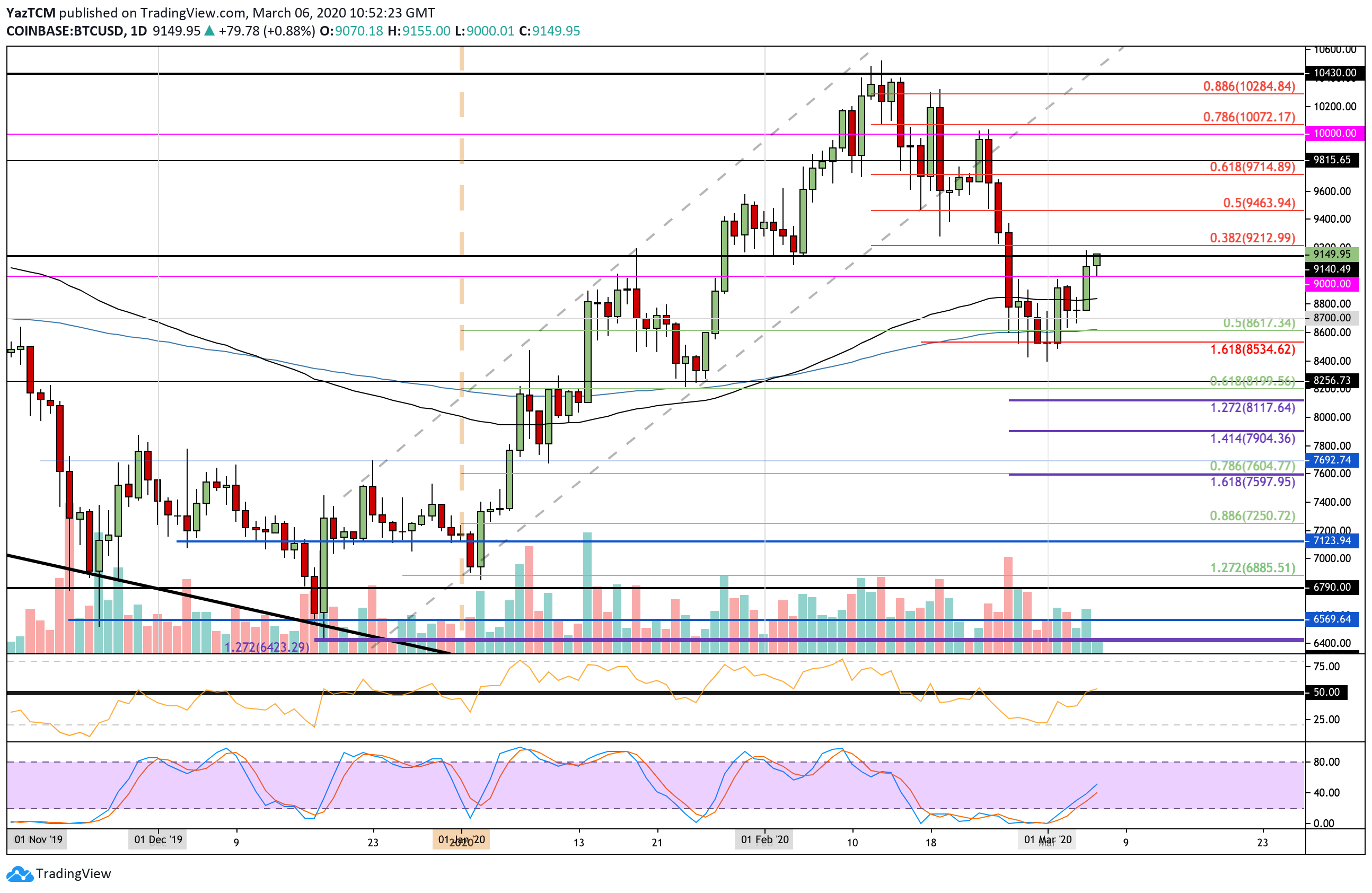

Bitcoin (BTC)

Bitcoin price managed to increase by a total of 5.58% over the past 7-days of trading after rebounding from the support at $8,550 provided by the downside 1.618 Fibonacci Extension level. After bouncing, the cryptocurrency managed to travel higher as it broke the $9,000 level in yesterday’s session to reach $9,150 today.

From above, the first level of resistance lies at $9,200 (bearish .382 Fib Retracement). This is followed by resistance at $9,400, $9,450 (bearish .5 Fib Retracement), $9,600, and $9,700.

From below, if the sellers push lower, the first level of support can be found at $9,000. Beneath this, support lies at $8,800 (100-days EMA), $8,600 (200-days EMA) and $8,550.

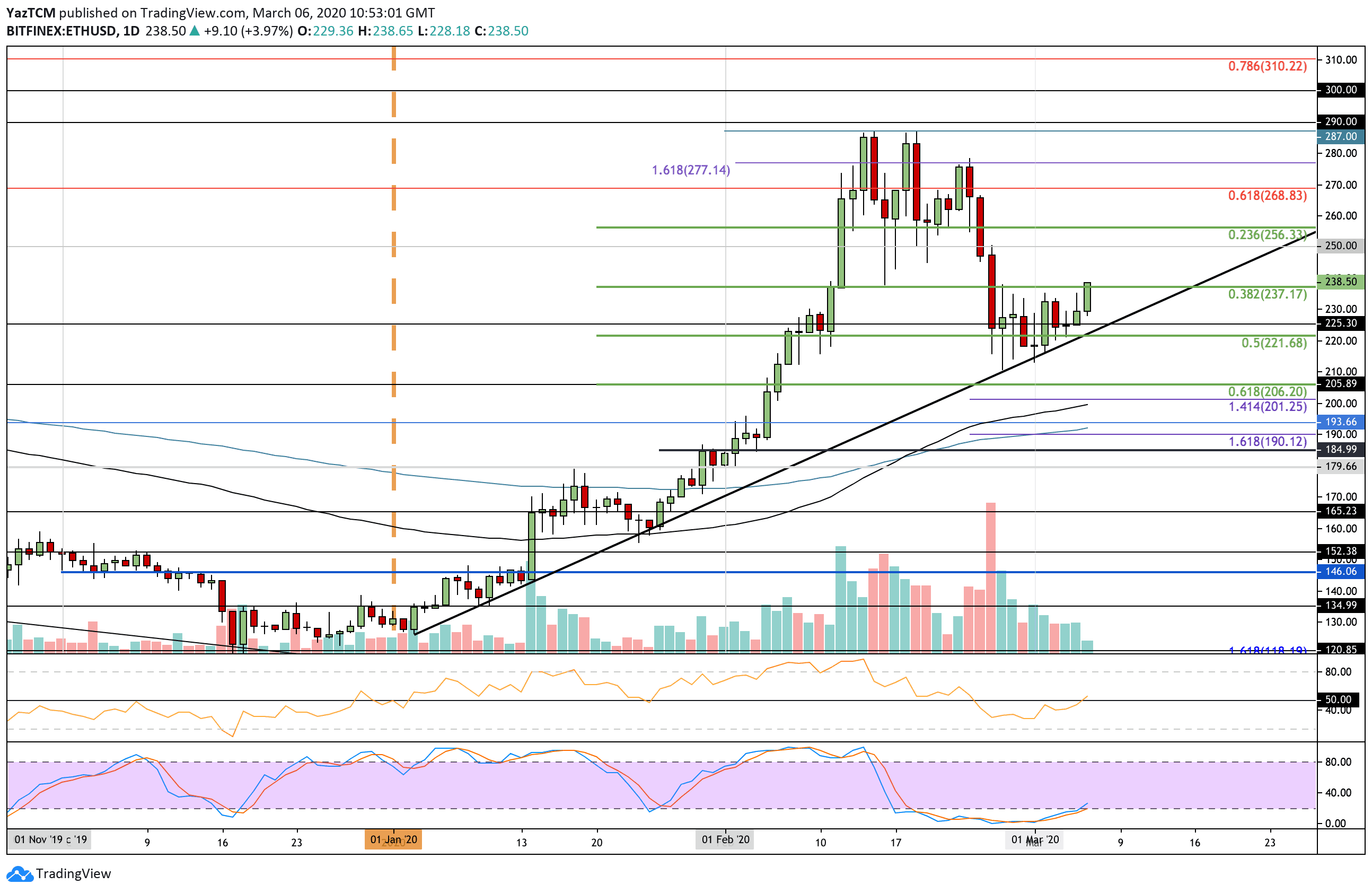

Ethereum (ETH)

This week, Ethereum saw a 7% increase; however, it did break further beneath $220 and managed to find support at the rising trend line where ETH bounced. It allowed ETH to climb back above $230 and reach $238 today.

From above, the first level of resistance is located at $250. This is followed by resistance at $255, $260, and $270.

From below, support can be found at $225. This is followed by support at $220, $215, and $205.

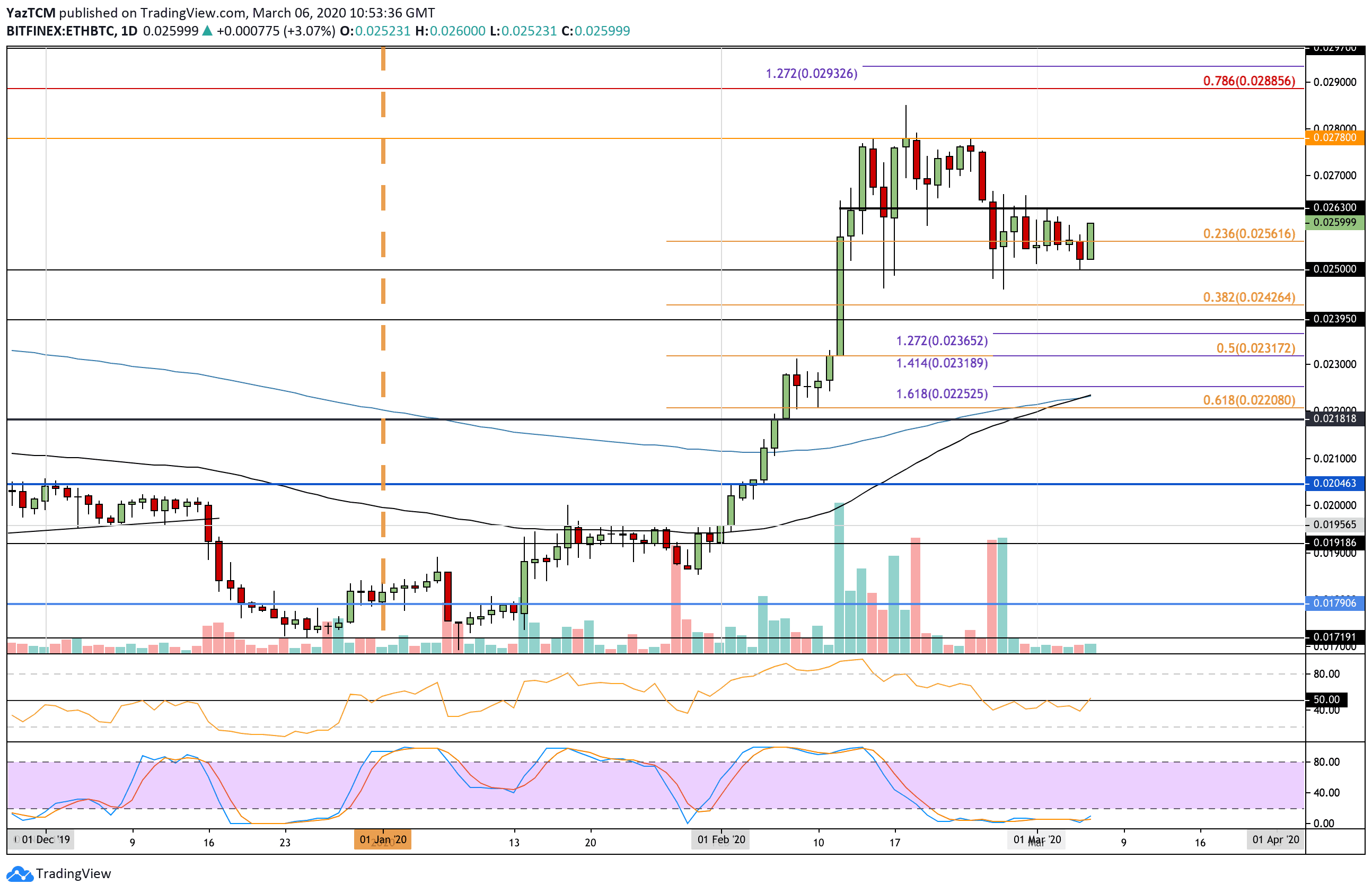

Against Bitcoin, ETH slowly ground lower until finding the support at 0.025 BTC level. Since bouncing, ETH is struggling to overcome the 0.026 BTC resistance.

ETH/BTC has been trading within a range between 0.0263 BTC and 0.025 BTC throughout the past week and will need to break above the range in order to continue further higher.

From above, the nearest resistance lies at the upper boundary around 0.0263 BTC. Beyond this, resistance lies at 0.027 BTC, 0.0278 BTC, and 0.0288 BTC.

On the other hand, support can be found at 0.0256 BTC, 0.025 BTC, and 0.0242 BTC.

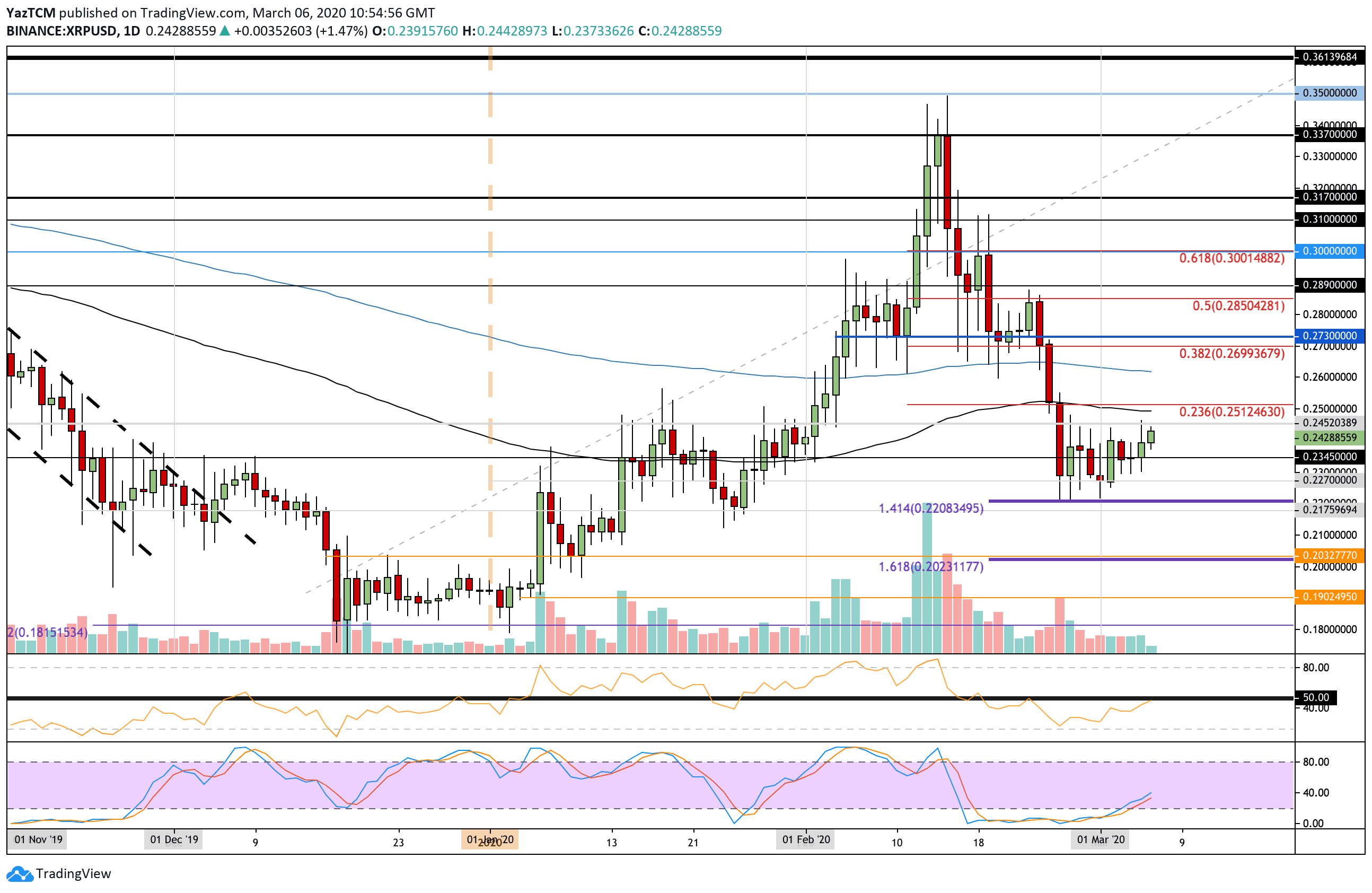

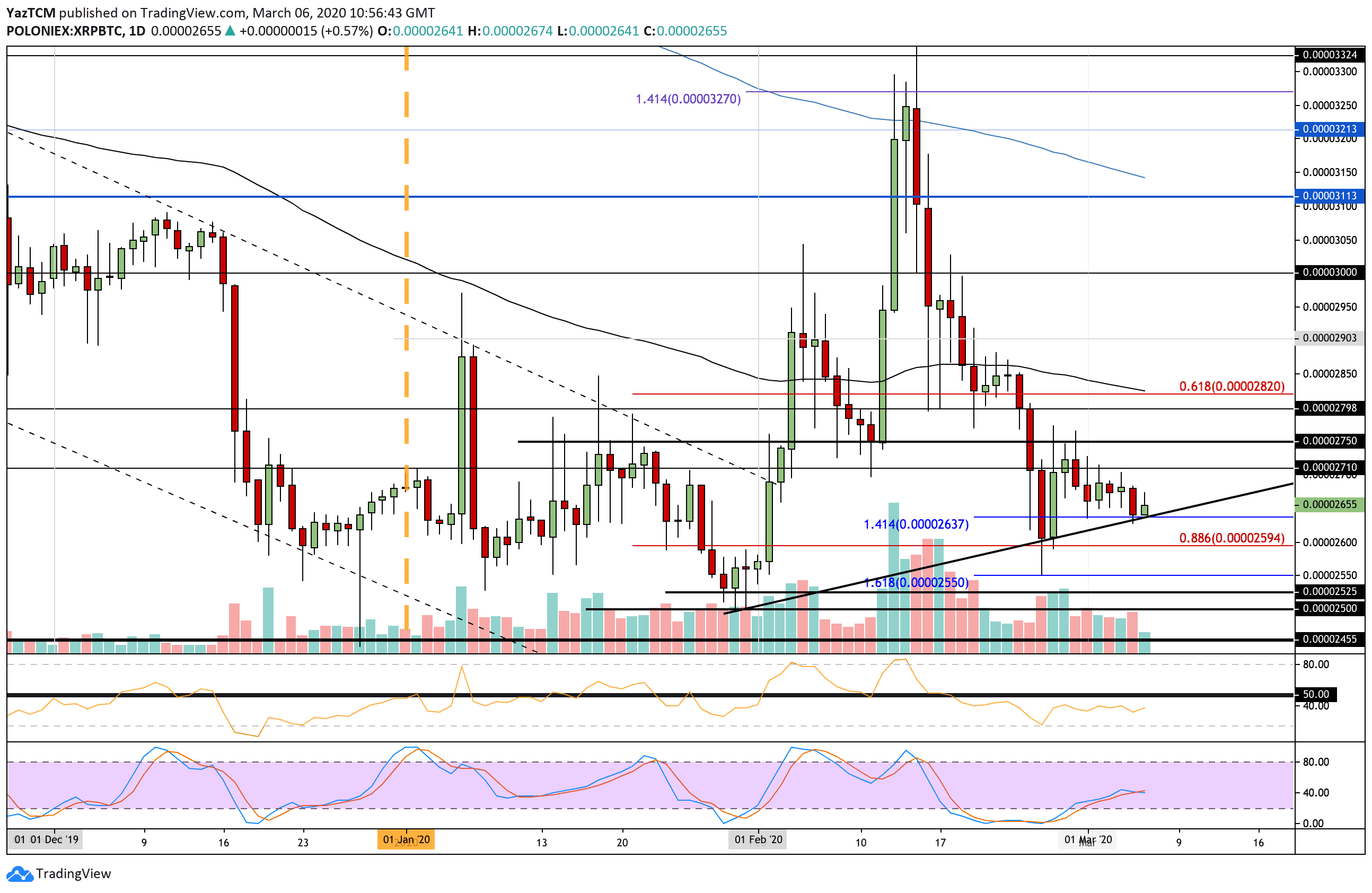

Ripple (XRP)

XRP witnessed a 4.2% price increase over the previous week as it managed to maintain support at the $0.22 level. More specifically, the $0.227 support had been kept. However, it was trapped by $0.24 and only managed to break above this level today.

If the bulls can close above $0.24, resistance lies at $0.025 (100-days EMA), $0.26 (200-days EMA), and $0.27 (bearish .382 Fib Retracement). Alternatively, support can be found at $0.235, $0.227, and $0.20.

Against BTC, XRP climbed above 2710 SAT but failed to break 2750 SAT. This caused the coin to roll over and return to the support at 2640 SAT, provided by the downside 1.414 Fib Extension. It also remains supported by a ascending trend line and a break beneath this could see the market heading beneath 2600 SAT.

If the buyers can rebound from 2640 SAT, resistance lies at 2710 SAT and 2750 SAT. Following this, resistance is located at 2800 SAT and 2820 SAT (100-days EMA).

Alternatively, if the sellers break 2640 SAT, support lies at 2600 SAT (.886 Fib Retracement), 2550 SAT (downside 1.618 Fib Extension), and 2525 SAT.

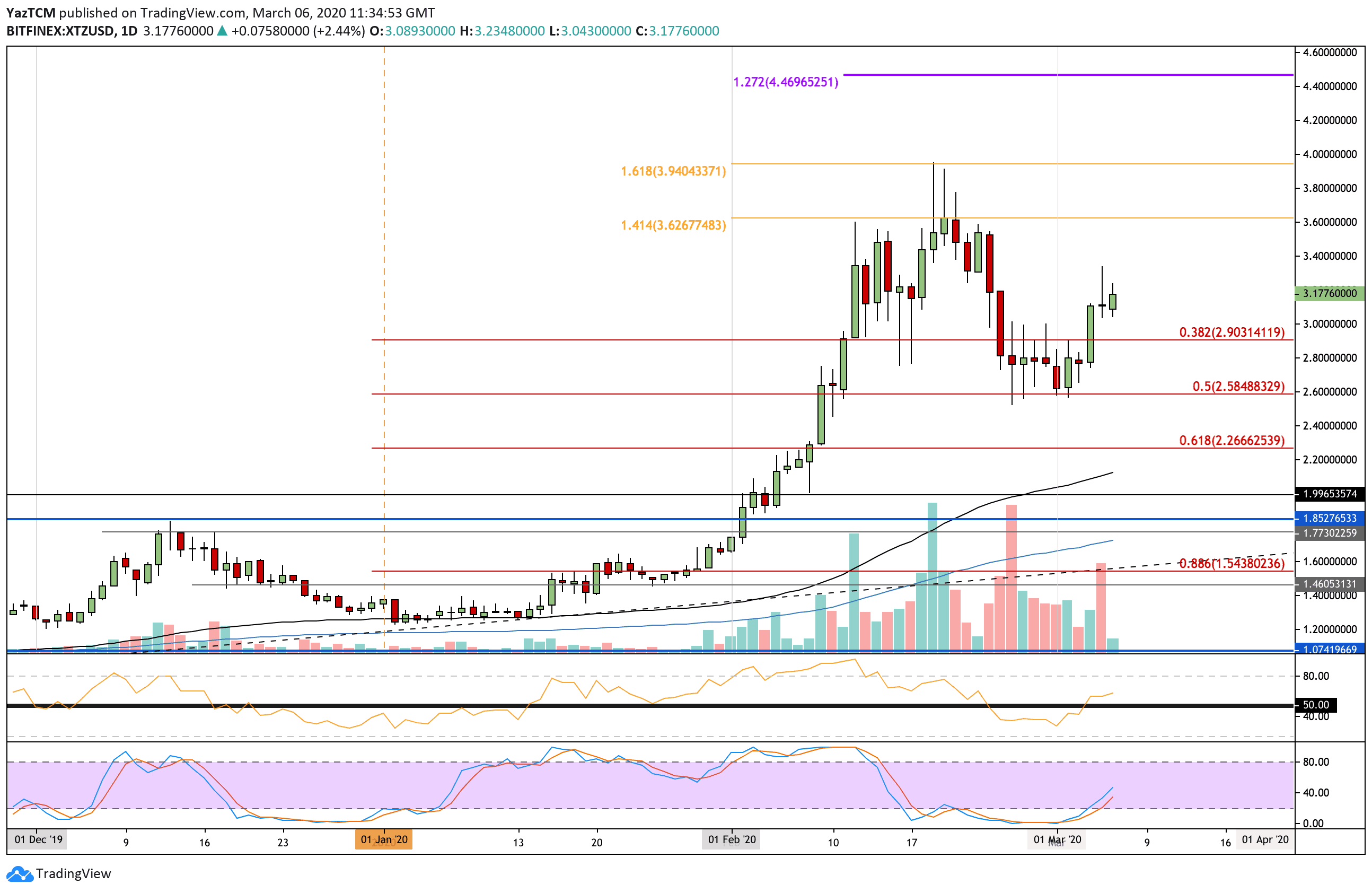

Tezos (XTZ)

Tezos witnessed a 16.3% price surge over the past 7-days of trading after it managed to rebound at support around $2.58, provided by the .5 Fib Retracement. XTZ broke above $3.00 as it trades at around $3.17.

Looking ahead, once and if the $3.30 resistance is breached, resistance lies at $3.63 (1.414 Fib Extension) and $3.84 (1.618 Fib Extension). If the buyers continue above $4.00, resistance lies at $4.20 and $4.46 (1.272 Fib Extension, new 2020 high).

If the sellers push back beneath $3.00, support can be found at $2.90 (.382 Fib Retracement), $2.58 (.5 Fib Retracement), and $2.26 (.618 Fib Retreacement).

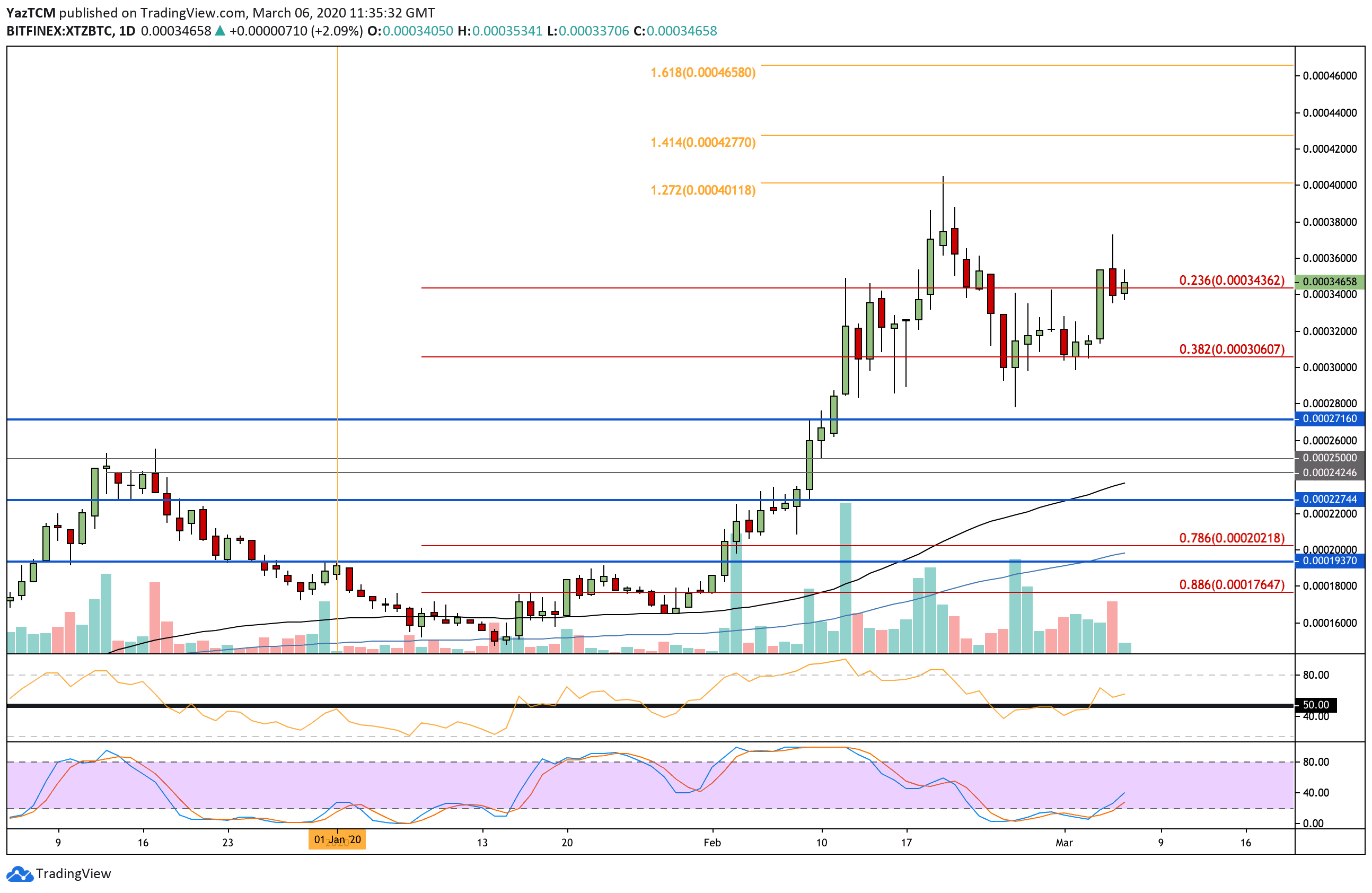

Tezos has also been on the rise against Bitcoin after finding support at 0.0003 BTC (.382 Fib Retracement). It successfully broke above 0.00032 BTC and 0.00034 BTC till reaching 0.00036 BTC yesterday.

Beyond 0.00036 BTC, resistance lies at 0.00038 BTC and 0.0004 BTC. This is followed by resistance at 0.000427 BTC (1.414 Fib Extension) and 0.00045 BTC.

From below, the nearest support can be found at 0.00032 BTC and 0.0003 BTC. Beneath this, additional support lies at 0.00028 BTC and 0.000271 BTC.

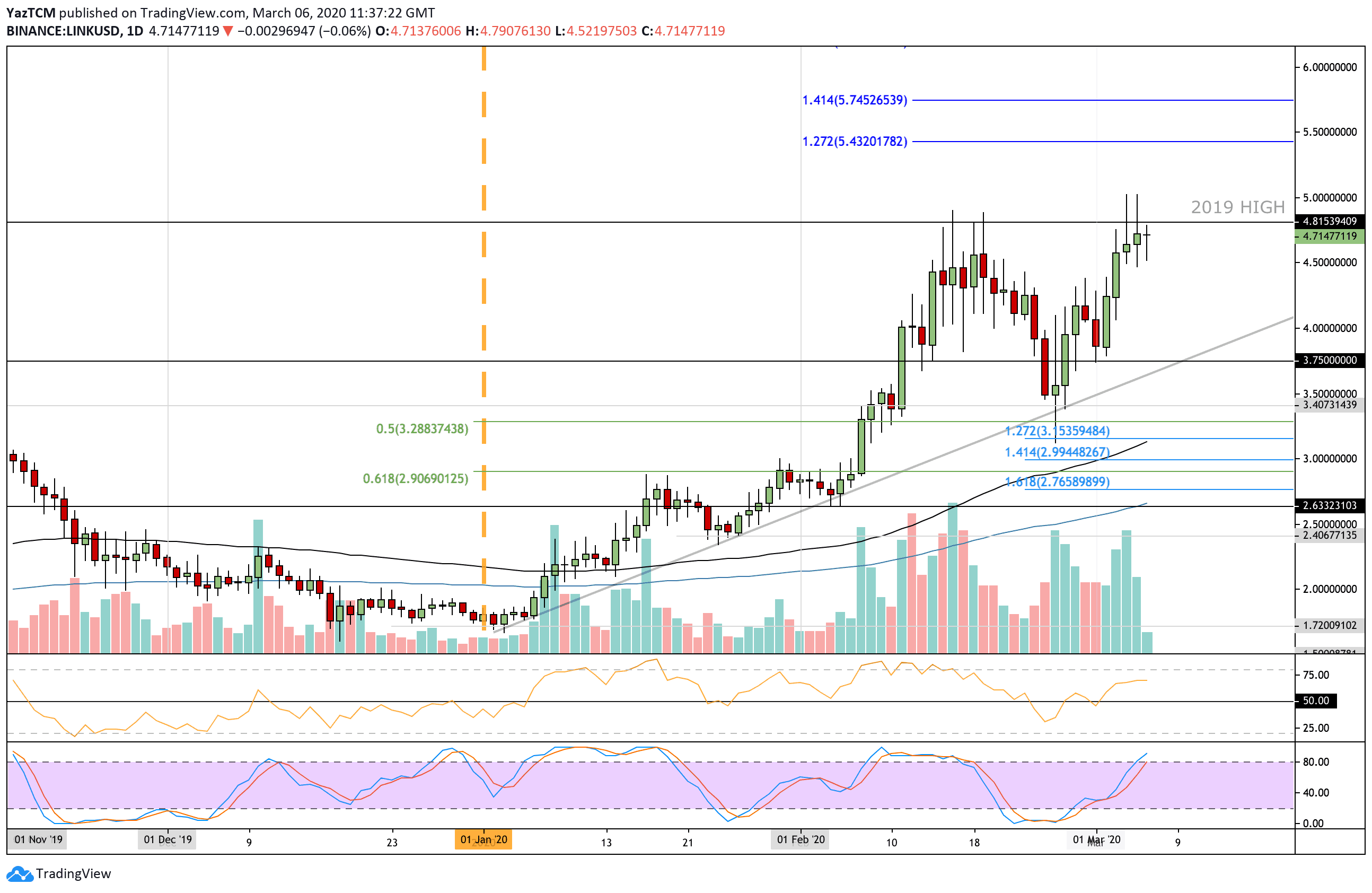

Chainlink (LINK)

Chainlink continues to be the strongest performer, of the largest cryptos, following a 20% weekly increase. It went on to find support at $3.75 before rebound higher to reach the resistance at the 2019/2020 price around $4.80. It is still facing this resistance.

Once the bulls can clear $4.80, resistance lies at $5.00. This is followed by resistance at $5.20, $5.43 (1.272 Fib Extension), and $5.74 (1.414 Fib Extension). Alternatively, if the sellers push beneath $4.50, support can be found at $4.00, $3.75, $3.50, and $3.400.

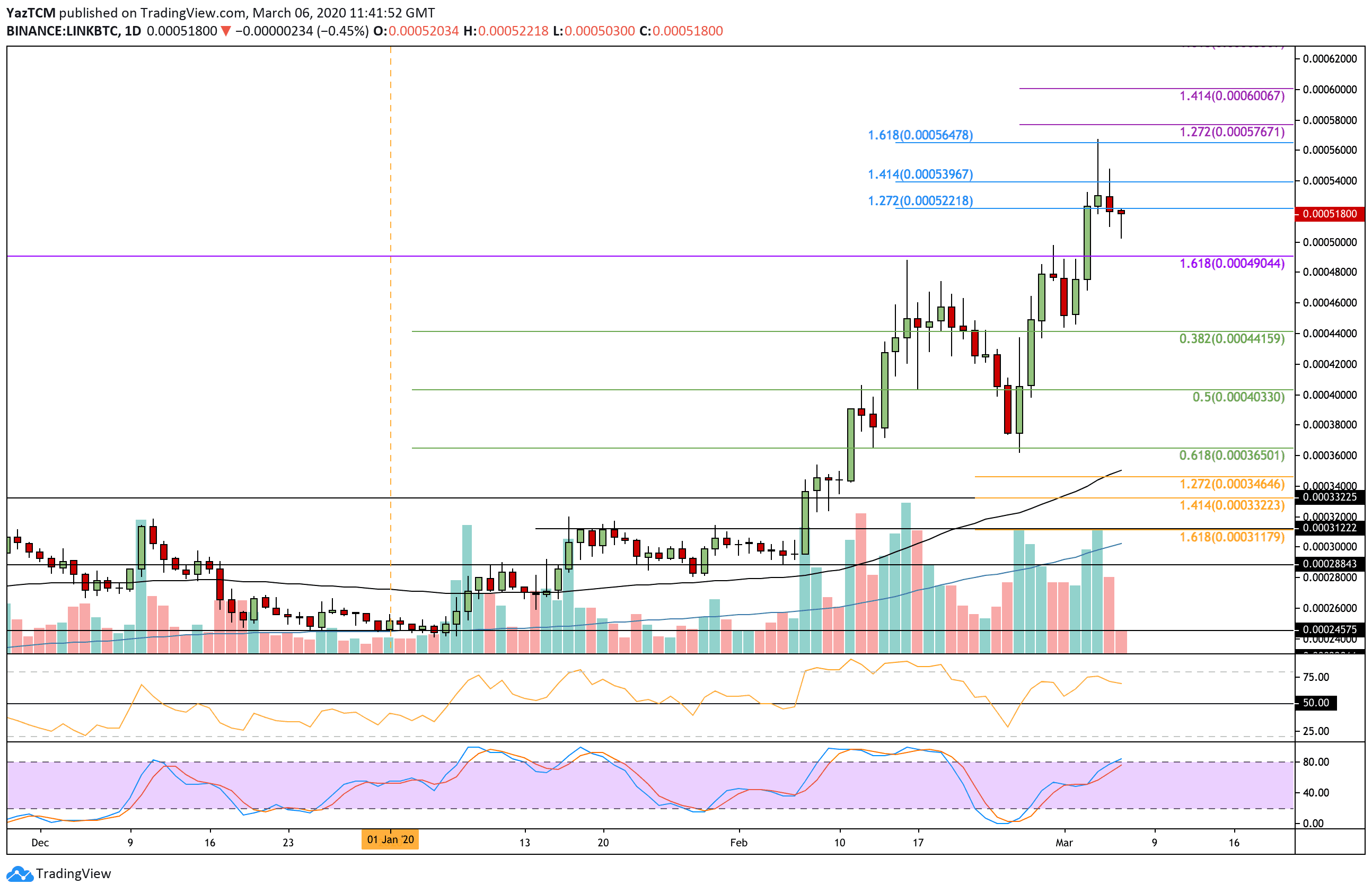

Chainlink managed to go on to create a fresh 2020 high against Bitcoin this week. It broke above the previous high at 0.00049 BTC and went on to soar above 0.0005 BTC. It continued to rise further and even spiked as high as 0.00056 BTC (1.618 Fib Extension). It currently trades at 0.000518 BTC.

Looking ahead, if the sellers push lower, the first 2 level of support lies at 0.0005 BTC and 0.00049 BTC. This is followed by support at 0.00046 BTC and 0.000441 BTC.

From above, if the bulls break 0.000522 BTC, resistance lies at 0.00054 BTC and 0.000564 BTC. This is followed by resistance at 0.000576 BTC and 0.0006 BTC.

The post Crypto Price Analysis & Overview March 6: Bitcoin, Ethereum, Ripple, Tezos, and Chainlink. appeared first on CryptoPotato.

The post appeared first on CryptoPotato