By Mike Co and Shawn Dejbakhsh

TLDR: Although Bitcoin has recently sold off alongside the S&P 500, based on historical data, recent positive correlation may be temporary.

From an Economist article dated Nov. 18th, 2007, just prior to the Financial Crisis:

“INSTITUTIONAL investors have been looking for ‘uncorrelated’ assets ever since the equity bear market of 2000–2002. They realised that they made too big a bet on the stockmarket and wanted to diversify. But neither government bonds nor cash offered the level of returns they desired.”

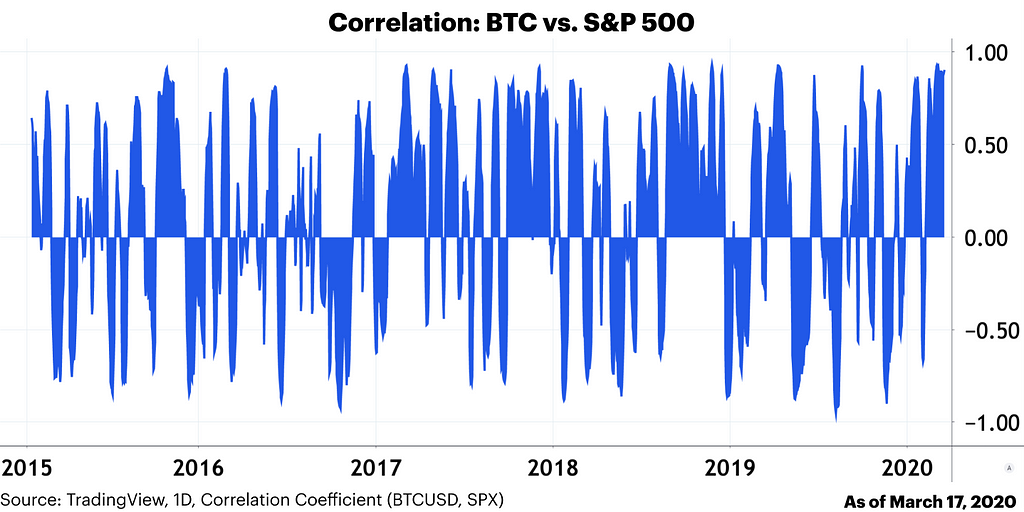

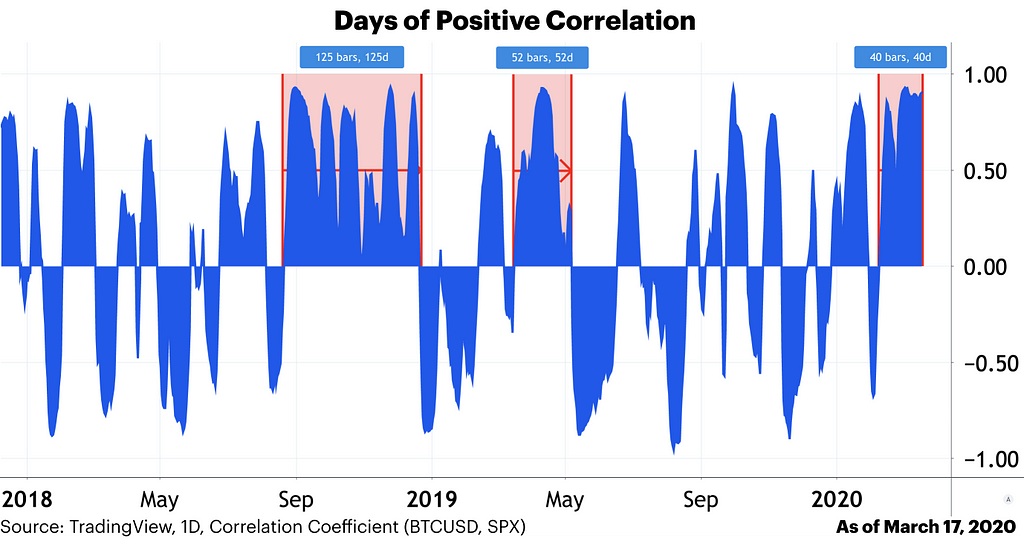

Uncorrelated assets move independently of major stock market indices, potentially giving opportunity for savvy investors to “beat the market.” For years, Bitcoin has widely been considered an “uncorrelated” asset. By and large this has been statistically true. As evidence, by using a statistical method called a Correlation Coefficient, Bitcoin’s price has moved independently of the U.S. S&P 500 for much of its history. However, more recently Bitcoin has sold off alongside the S&P 500 in positive correlation.

As a quick primer, a correlation of 1.00 means that two asset prices move in concert, or are positively correlated. A correlation of -1.00 indicates that two asset prices move in opposition, or are negatively correlated (i.e. BTC sells off while the S&P rises or vice versa). Bitcoin’s historical correlation with the S&P 500 swings wildly between 1.00 and -1.00, seemingly positively correlated at times then negatively correlated during others. That means BTC has been largely uncorrelated with major stock market indices throughout its history.

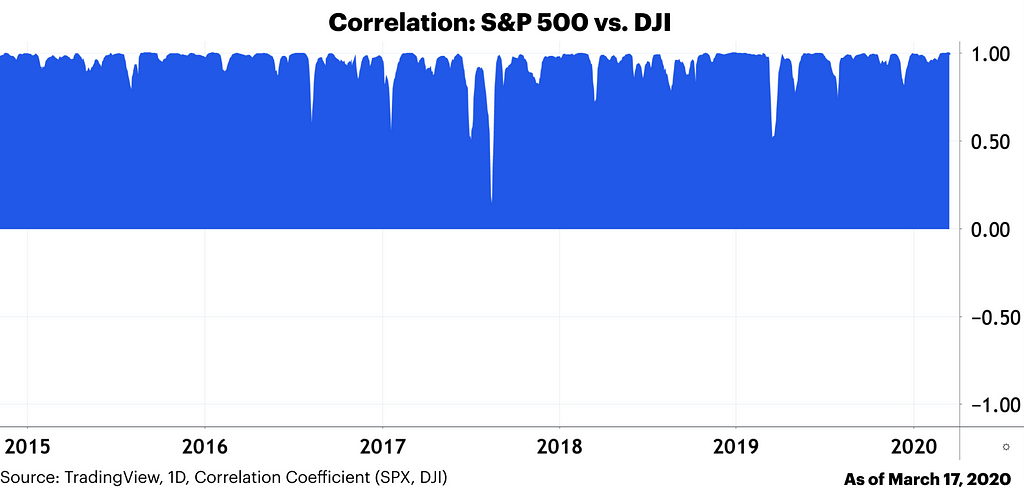

As an example of two positively correlated assets in traditional markets, look to the S&P 500 versus the Dow Jones Industrial Average:

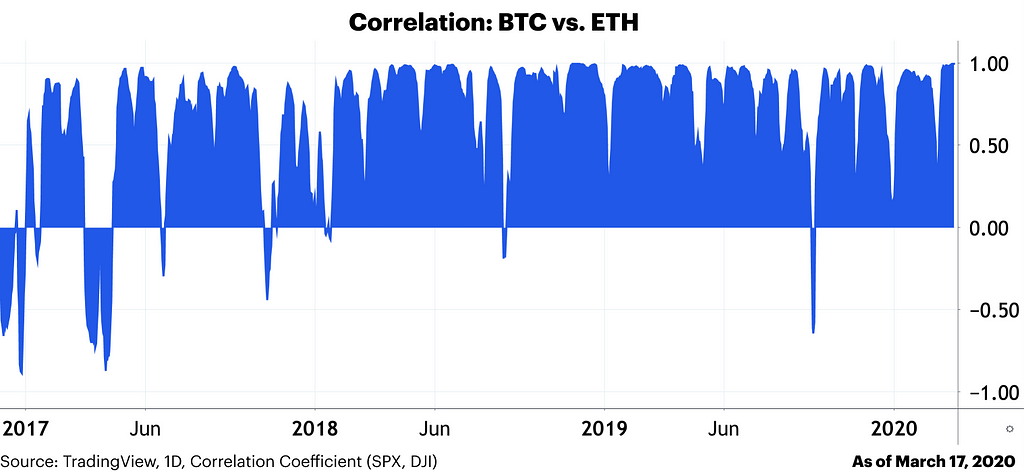

As an example of two positively correlated assets in cryptocurrency markets, look to Bitcoin versus Ethereum:

While there have been brief periods of negative correlation, Ethereum’s price generally moves in concert with Bitcoin.

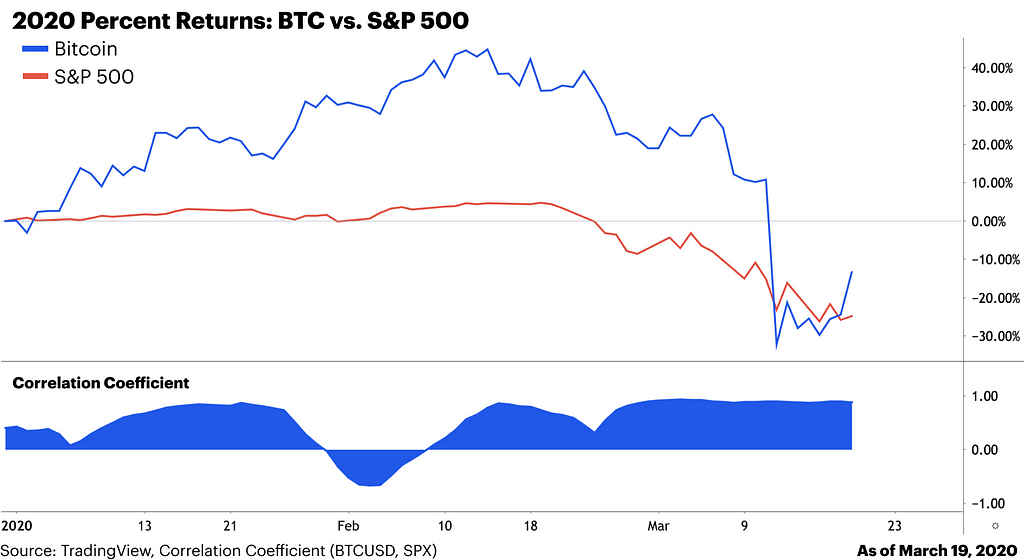

Last week, global markets buckled and Bitcoin sold off aggressively alongside the S&P 500. Across traditional markets, exchanges around the world halted trading to stem selling. Whereas Bitcoin’s peer-to-peer protocol has operated at 99.98% uptime since its creation on January 3, 2009. Further, Bitcoin’s spot market liquidity is global, decentralized, and runs 24/7.

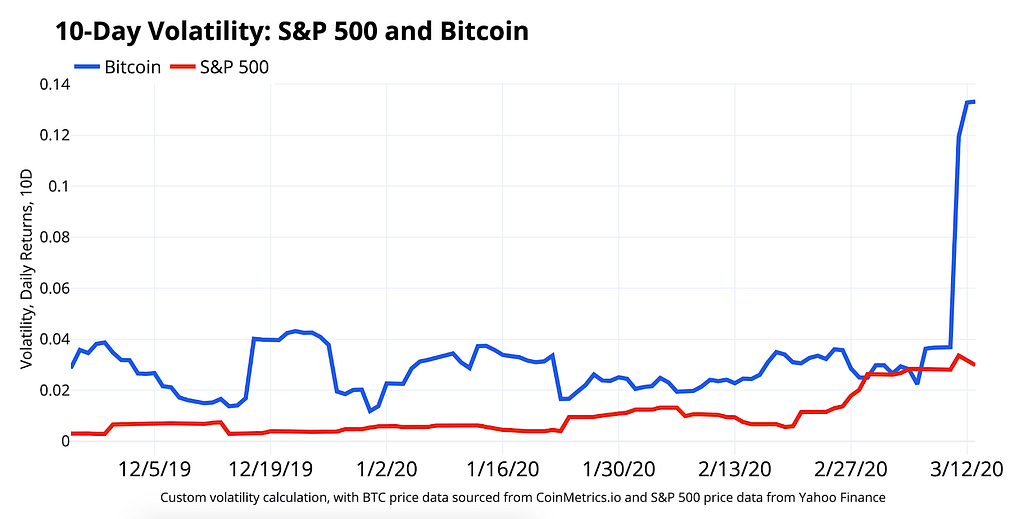

This year has proven tumultuous for global markets, and BTC’s year-to-date returns are currently -13.2% while the S&P 500 is -25.1%. Notably, Bitcoin is significantly more volatile than the S&P 500. However, by measuring 10-day volatility, the S&P 500 has recently spiked to levels that rival Bitcoin’s typical range. S&P 500 volatility has increased substantially in recent days, and so has BTC.

Despite its volatility, Bitcoin’s virtues may become more apparent as the world enters uncharted economic, monetary, and fiscal territory. Bitcoin as a globally accessible, permissionless, and scarce asset may yet prove its worth.

If Bitcoin’s historical chart is a reliable indication, recent bouts of positive correlation with the S&P 500 are likely temporary. On the other hand, if S&P 500 correlation sustains for an extended period hereafter… Bitcoin will enter uncharted territory.

Endnotes

- The Economist: “The New Small Thing” (November 18, 2007)

- Investopedia: “Correlation Coefficient” (February 19, 2020)

- Bitcoin Uptime (Accessed March 19, 2020)

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, Inc., or its affiliates (“Coinbase”), and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators. The opinions expressed on this website are those of the authors who are associated persons of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products.

Unless otherwise noted, all images provided herein are the property of Coinbase.

Bitcoin’s Uncoupling from “Uncorrelated” was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

The post appeared first on The Coinbase Blog