Bitcoin’s network went through one of its biggest difficulty adjustments just recently. While this had a quick and expected impact on the network, everything is back on track with blocks being produced on schedule.

However, interesting performance data reveals that the price tends to increase following extreme difficulty adjustments, such as the one that was witnessed on March 26th. According to some analysts, this might be quite favorable for Bitcoin’s price in the medium term.

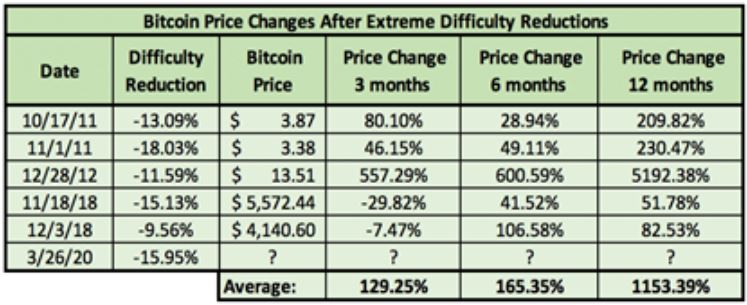

Bitcoin Price Historic Performance Following Extreme Adjustments

On March 26th, Bitcoin’s network went through a planned difficulty adjustment, which lines up as one of the biggest. The difficulty dropped with about 15%, hence making it so much profitable to mine Bitcoin.

Interestingly enough, it appears that following extreme difficulty adjustments of the kind, the price tends to perform comparatively well over a certain period. This was brought up by Matt D’Souza, a hedge fund manager and CEO at Blockware Solutions.

In a Twitter thread, he explained that the recent adjustment was one of the biggest in Bitcoin’s history. He also pointed out that this has historically been a favorable signal for long-term capital deployment.

As seen on the chart, D’Souza shared, Bitcoin’s price has increased by 129.25% on average following the previous extreme difficulty adjustments.

More interestingly, it has increased by a total of 165.35% on average in 6 months following events of the kind. In theory, if this trend keeps up, Bitcoin’s price should be around $17,800 in September 2020.

The most impressive performance comes in 12 months, where Bitcoin’s price increases by a total of 1153.39% on average. Of course, it’s also worth noting that this percentage is rather high because of how BTC’s price performed back in December 2012 and the following year, where it increased by a staggering 5192%, hence bringing the total number up quite a bit.

There’s a Twist For Bitcoin’s Price

While all of the above seems favorable and preferable for Bitcoin bulls, it’s essential to understand that previous behavior is not an indicator of future performance.

Moreover, in none of the previous years of extreme difficulty, adjustments was the world economy in a state of a massive financial crisis like the one that’s unwinding at the time of this writing.

It’s still unclear how Bitcoin will perform during times of tremendous economic uncertainty as the coronavirus continues to spread and to suppress global economies.

The post Bitcoin Price Could Reach $17,800 In 6 Months Following Extreme Difficulty Adjustment, Historical Data Suggests appeared first on CryptoPotato.

The post appeared first on CryptoPotato