Coinbase Around the Block, sheds light on key issues in the crypto space. In this edition, we analyze recent market activity and Bitcoin’s Value Proposition.

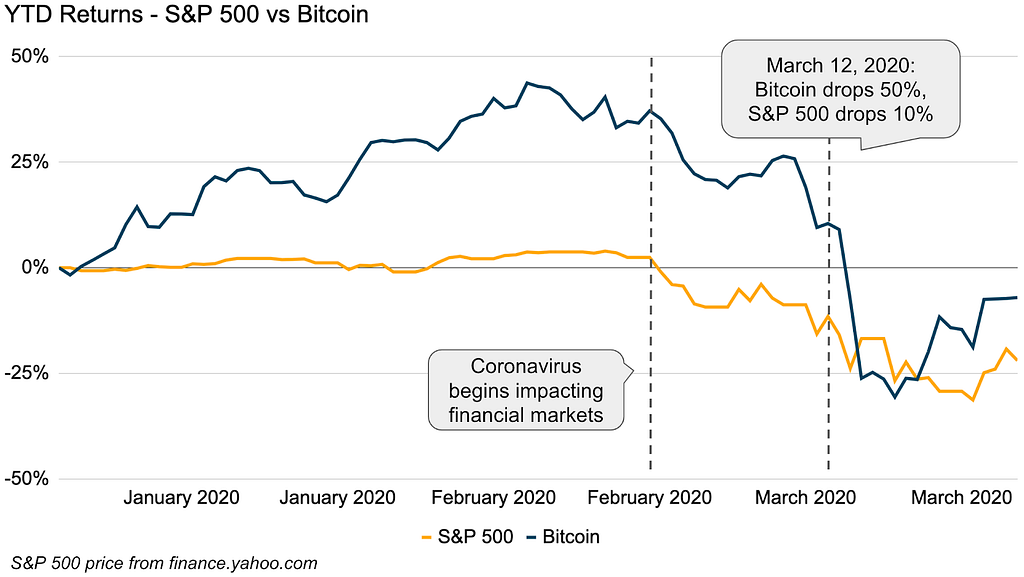

BTC and other crypto assets saw a ~50% price decline earlier this month on March 12, marking the single largest one-day drop in Bitcoin’s price since 2013.

These moves coincided with broader financial market disruption amidst worries around the economic impact of COVID-19, with the S&P 500 and DOW Jones dropping nearly 10% in the biggest one-day slide since the Black Monday crash of 1987.

There is a growing belief in Bitcoin as a potential safe-haven amidst broader economic turmoil. But in this moment of validation and despite a widely held belief in Bitcoin as an uncorrelated asset, the Bitcoin market still crashed 50%. What’s going on?

Putting context on the broader markets

We should first look at traditional financial markets for context. Just before March 12th, WHO declared the Coronavirus to be a pandemic, President Trump announced a 30-day travel ban between the United States and Europe, and Italy’s Prime Minister placed the whole country on lockdown. As this growing recognition of the magnitude of COVID-19 sunk in, it became clear our global economy was not in a place to adequately handle the shock, and the markets suddenly reeled downward.

The psychology of this moment is important to understand. When investments sharply fall, investors naturally seek out “safe haven” assets — things that will not lose their value (usually USD). But everyone rushing to the exit at once produces a liquidity crisis, where the number of sellers far surpasses the number of buyers, which further drives prices lower and lower.

To add insult to injury, many large asset allocators held leveraged positions, where only $1 of real value was backing ~$2-$3 of borrowed value. When markets crashed, these leveraged positions were in jeopardy of becoming insolvent and being forced closed, further placing a premium on USD.

The general sell-off combined with a massive deleveraging event resulted in an intense rush for cash. In these moments, investors do not sell what they want to sell, they sell whatever they can. This includes Bitcoin and other cryptocurrencies, but every liquid market saw deep losses on March 12th.

Let’s talk Bitcoin. So what happened here?

The reasons behind the Bitcoin crash were similar. Some short term speculators sold, some institutions required cash for margin calls elsewhere, and some leveraged positions were forced to close. But it dropped harder and faster for Bitcoin than traditional markets for one central reason: the size and scope of leverage in the Bitcoin industry.

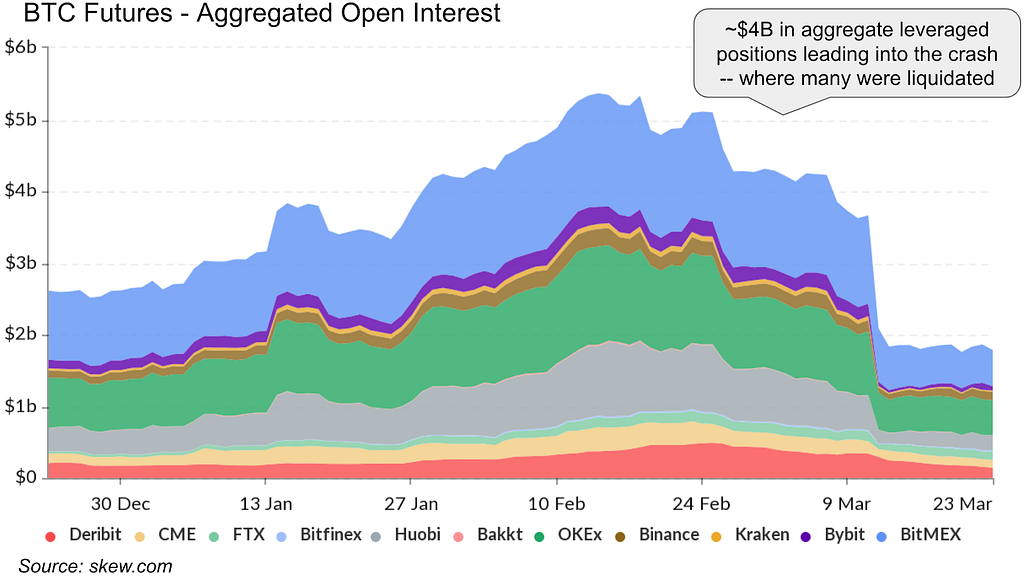

Traditional equities markets limit the amount of leverage to ~2–3x. In contrast, Bitcoin has some offshore exchanges that offer 100x+ leverage, where $1 of Bitcoin could be used as collateral to back $100 in purchasing power. To be fair, this is very risky — a position leveraged to 100x would get force-closed if the market moved just ~1% against you. So most traders hold positions at a more sensible 5–30x leverage, but still notably higher than 2–3x.

Leverage also exists in several other products: miners often collateralize loans with Bitcoin, lenders offer cash loans for BTC deposits, and more advanced traders use leverage for futures contracts.

Prior to the crash, the aggregate size of all leveraged contracts on exchange-based products hovered around $4B. Significant enough that any appreciable drop could induce additional shocks to the price. Normally these drops coincide with willing buyers, but the March 12th panic flipped buyers into sellers. As prices drove lower, more leveraged positions were forced to close. Each new sell was met with tepid buying, dragging the price again lower, resulting in more liquidations. A cascading effect.

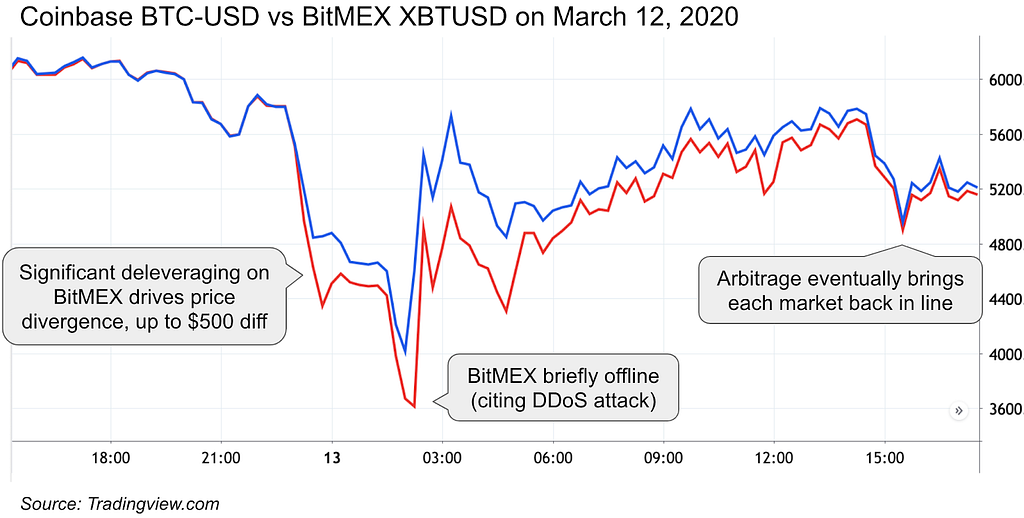

Cascading liquidations were most prominent on BitMEX, which offers highly leveraged products. Amidst the selloff, a Bitcoin on BitMEX was trading well below that of other exchanges. It wasn’t until BitMEX went down for maintenance at peak volatility (citing a DDoS attack) that the cascading liquidations were paused, and the price promptly rebounded.

When the dust settled, Bitcoin had briefly spiked below $4000 and was trading around the mid $5000s.

Some have argued that exorbitant leverage made accessible to retail investors in unregulated environments may be risky to the crypto asset class if left unabated. While it appears leverage played a role in crypto markets on March 12th, we should expect improvements to these dynamics as crypto matures, both externally from regulators increasing controls and internally from industry led initiatives.

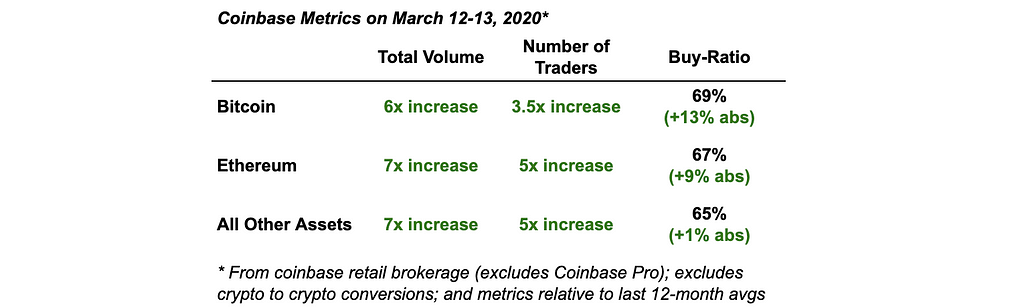

If this was driven by a broad liquidity crisis, exacerbated by extreme leverage in crypto, then how did Coinbase customers react?

In the 48 hours during and immediately following the drop, we saw record-breaking numbers compared to our last 12-month averages:

- 5x increase in cash and crypto deposits, totalling $1.3B

- 2x increase in new-user signups

- 3x increase in trading users

- 6x increase in total traded volume

But beyond just a rush, two things are clear: customers of our retail brokerage were buyers during the drop, and Bitcoin was the clear favorite. Our customers typically buy 60% more than they sell but during the crash this jumped to 67%, taking advantage of market troughs and representing strong demand for crypto assets even during extreme volatility.

Bitcoin was most popular with over half of both total deposits and trades. Other cryptocurrencies also saw increased traction too, with ETH and XRP as #2 and #3 favored assets. Other popular assets included newer cryptocurrencies like Tezos and Chainlink, and older more established cryptocurrencies like Litecoin and Bitcoin Cash.

Closing thoughts

For crypto enthusiasts, it’s harrowing to watch the price ripple downward and shake through the industry. In these moments, it’s only human to second guess our convictions. Perhaps you felt the same.

But with some context, we can recognize there are broader mechanisms at play. Fear drove many investors to cash and induced a deep liquidity crunch (cash became “expensive”), decoupling price from fundamental value and leading to broad deleveraging in nearly all asset classes. Bitcoin was not spared, and in fact was hit hardest due to the size and scope of deployed leverage, leading to a fierce cascade of liquidations.

Since the drop, Bitcoin and the broad cryptocurrency ecosystem has rallied while equities have continued to drop (S&P -6% vs Bitcoin +23% as of March 27th). Coinbase customers in particular exemplified this buy behavior during the drop and thereafter.

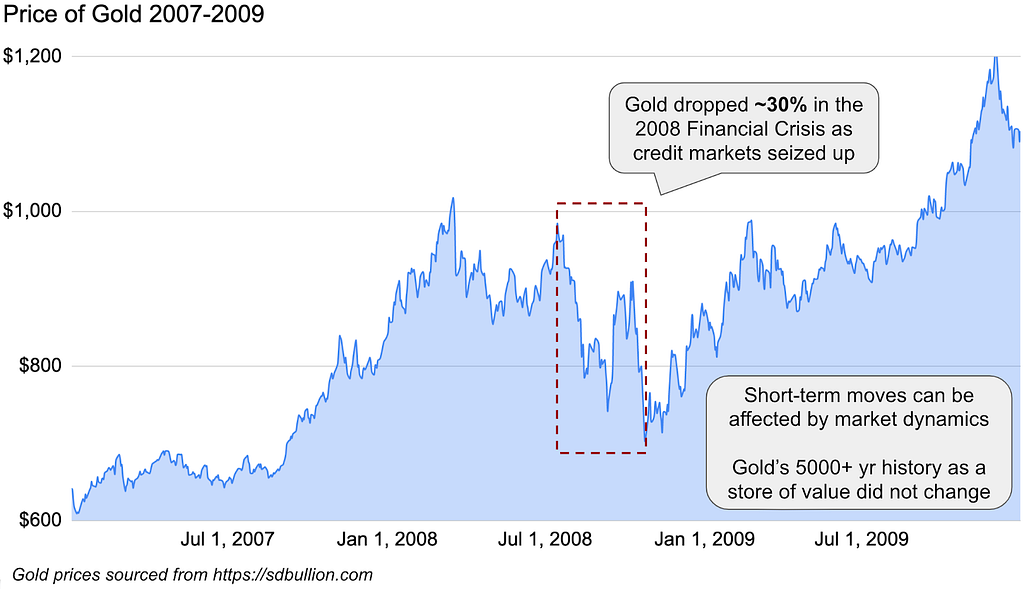

This has happened before. In the 2008 financial crisis, gold initially dropped more than 30%. Not because it’s a bad store of value, but because a similar liquidity crisis affected gold just as well. Gold went on to rally 3x over the next three years as it’s value stood out amidst the broader financial turmoil.

Bitcoin was created for a moment like this. Inscribed into its Genesis Block is the phrase “Chancellor on brink of second bailout for banks,” an homage to the government bailouts of 2008 and the last great financial crisis. The call out is a subtle nod to the need for a sovereign form of money without any central intermediary. And as the US government turns to slashing interest rates, passing large stimulus packages, and infinite quantitative easing, Bitcoin will soon do the opposite in the next Bitcoin halving. The contrast could not be more stark.

For many, Bitcoin is the hardest form of currency that exists. Only 21 million will be issued, and the network is collectively owned and controlled by its participants with no central authorities who can affect the supply schedule or adjust interest rates. Ultimately, Bitcoin’s value prop should not be defined by extraneous market dynamics, but rather by its unique properties that make it a potentially attractive store of value.

For more reading:

- Fred Wilson muses about correlation and market meltdowns, with a section on crypto

- Multicoin’s technical analysis of what drove the dip

- Anthony Pompliano of Morgan Creek Digital posts a salient commentary

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, Inc., or its affiliates (“Coinbase”), and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators. The opinions expressed on this website are those of the authors who are associated persons of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products.

Unless otherwise noted, all images provided herein are the property of Coinbase.

On Crypto Markets and Bitcoin’s Value Proposition was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

The post appeared first on The Coinbase Blog