- While Chainlink holds support at $3.3, a break down could lead to a massive drop in price.

- Against Bitcoin, Link is beginning to flag a bearish trend after dropping off a 4-day wedge.

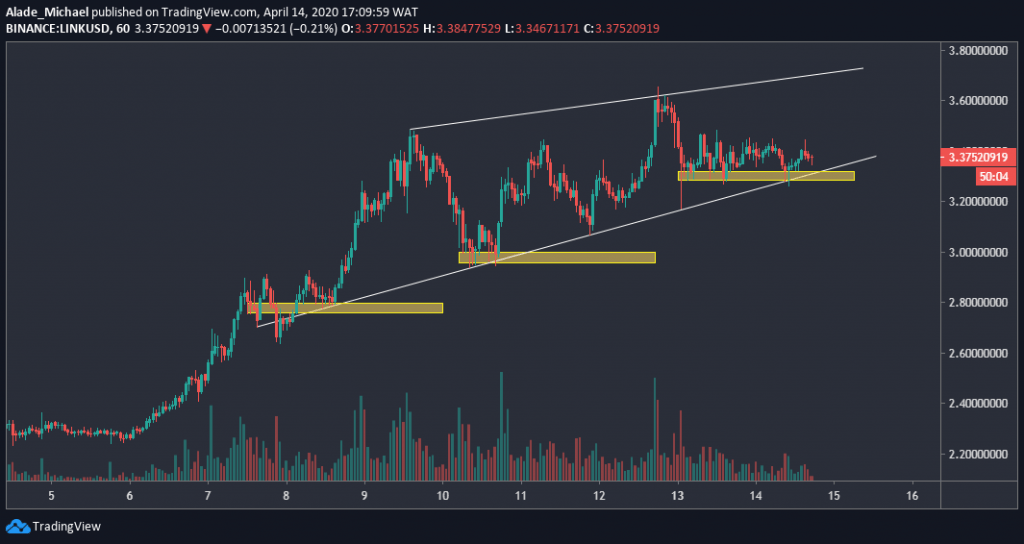

LINK/USD: Chainlink Holding Support At $3.3

Key Resistance Levels: $3.48, $3.6.2, $3.8

Key Support Levels: $3.3, $3, $2.8

The price of Chainlink saw a massive 60% increase over the past two weeks of trading, making it the top gainer amongst the major altcoins so far this month. This notable gain was followed by quick recovery from March’s low – $0.05 (Binance).

At the moment, Chainlink is still looking bullish on the hourly chart as the price remains trapped in an ascending wedge. The latest bounce from the wedge’s support at $3.3 indicates a potential price increase, but it could be the end of the bullish if price collapse.

Chainlink is priced at $3.37 at the time of writing. If the bulls fail to reiterate actions, however; a steep drop below this wedge could lead to serious selling pressure in the market.

Chainlink Price Analysis

As it appeared now, the bulls are plotting more actions. The first level of resistance is $3.48 (yesterday’s high), followed by $3.62 – where Link initiated the sell last weekend.

A break above these resistances may trigger a fresh increase to $3.8, around the wedge’s resistance.

Meanwhile, Chainlink is holding weekly support at $3.3, where the first yellow area lies. If a breakdown occurs, the next support to watch is $3 and $2.8 in the yellow spot.

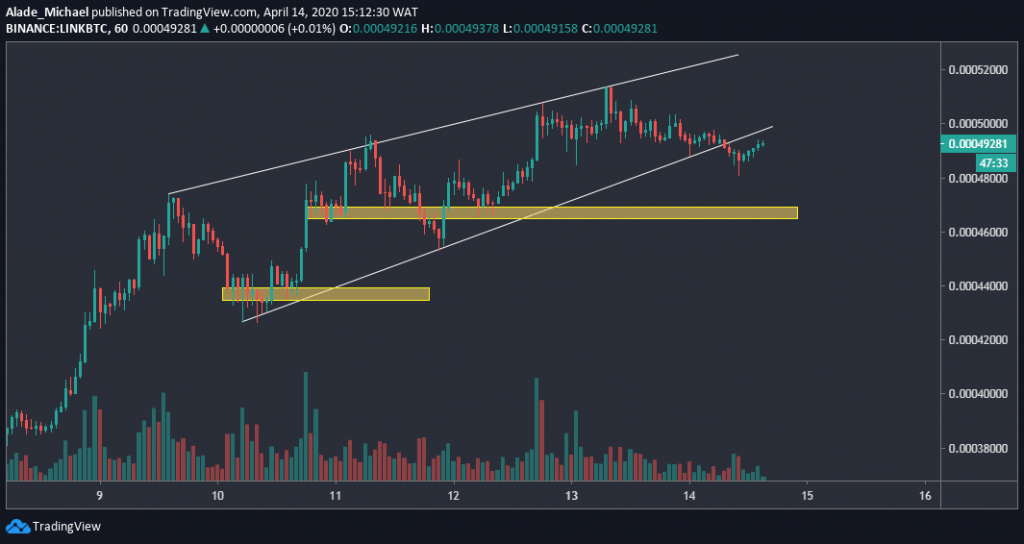

LINK/BTC: Chainlink Breaks Down From A Wedge

Key Resistance Levels: 49600 SAT, 51300 SAT

Key Support Levels: 46800 SAT, 43800 SAT

Against Bitcoin, Chainlink starts to show a bearish sign following a slow decline from 51300 SAT yesterday. After breaking down from an ascending wedge today, Chainlink pulled back and resumed the selling action.

The price is trading around the 48680 SAT level with a 2% loss at the time of writing. Although, the selling pressure is still weak for now.

At the same time, the trading volume is decreasing as volatility remains low. Huge volatility should be expected as soon as sellers start to show a strong interest in the market.

Chainlink Price Analysis

In case of a surge, Chainlink is expected to drop quickly into the initial yellow support area of 46800 SAT. Below this support lies at 45400 SAT but the key support to keep in mind here is the second yellow area at 43800 SAT.

From above, Chainlink is holding resistance at 49600 SAT (April 11 high) and 51300 SAT, which is yesterday’s high. Though, reclaiming 50000 SAT could charge the bulls back in the market

But as it stands now, Link is currently following a bearish sentiment on the short-term trend.

The post Chainlink Price Analysis: LINK Holds Above $3.3 But Bearish Sentiment Surfaces Against Bitcoin appeared first on CryptoPotato.

The post appeared first on CryptoPotato