One of the world’s leading cryptocurrency asset management companies, Grayscale Investments, has registered its strongest quarter to date. Despite the violent price developments in the market, the firm has raised over $500m, and its 12-month product inflow crossed the $1b mark for the first time.

Grayscale On The Rise

According to the quarterly report published earlier this week, the company saw inflows of $503.7 million over the past three months. The number is nearly twice as much compared to the previous quarterly high of $254.8 million in Q3 2019. New investors accounted for approximately $160m.

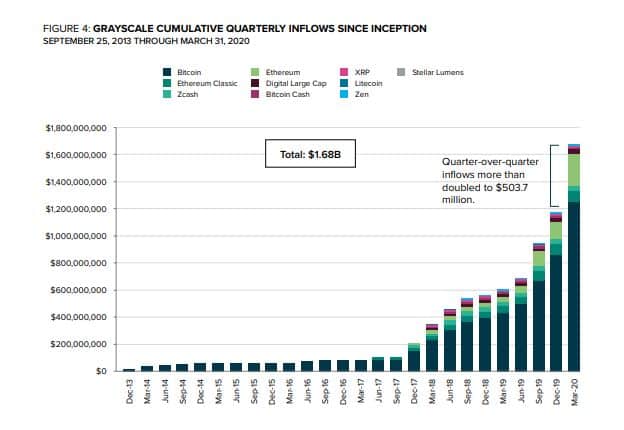

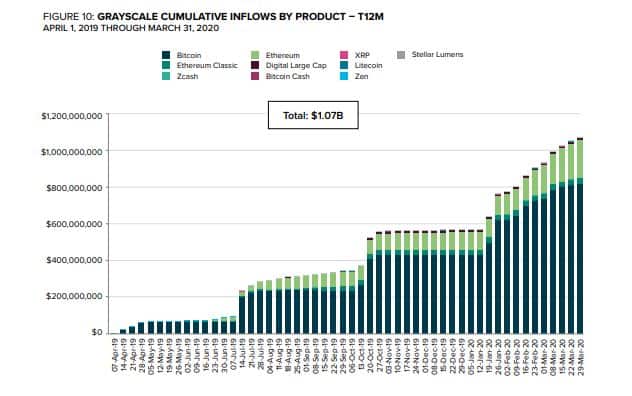

Thus, inflows to Grayscale products over 12 months have exceeded the coveted $1 billion mark ($1.07B). And, the total cumulative investment amount since the inception of the company has reached $1.68b.

Interestingly enough, Grayscale’s record quarter comes amid the sharp price developments in the cryptocurrency market. The pressure from the COVID-19 pandemic rushed investors to massive sell-offs, and most assets lost vast chunks of their value in mid-March.

However, Ray Sharif-Askary, Director of Investor Relations and Business Development at Grayscale Investments, told CryptoPotato that Bitcoin’s potential keeps attracting investors, despite the short-term price tendencies:

“Through this period of increased volatility in global markets, our investors’ conviction in the long-term prospects of Bitcoin and other digital currencies has not wavered. Many see digital currencies as an important part of their diversification strategies, and appreciate the superior risk-adjusted returns that digital currencies may provide.”

Bitcoin Dominates

Somewhat unsurprisingly, the most widely-adopted digital asset offered by Grayscale continues to be Bitcoin. The primary cryptocurrency is responsible for approximately 80% of the yearly inflows.

It’s also worth noting, though, that Ethereum’s share has also increased in the last several months. Other favorable digital assets include Ethereum Classic, Zcash, Bitcoin Cash, and Ripple.

Institutional Investors

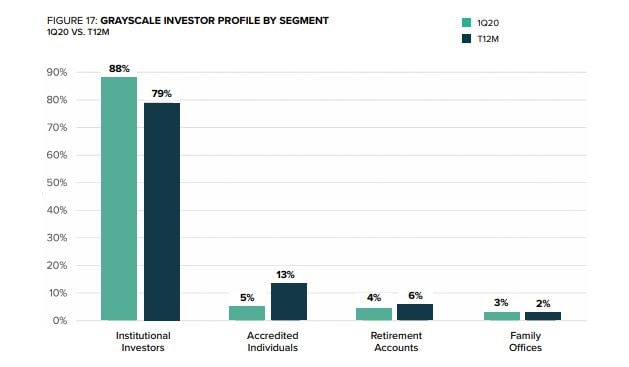

The document also provided information on investment sources. 5% of the total Q1 inflow came from accredited individuals, 4% from retirement accounts, and 3% from family offices.

Institutional investors, proving once again their significant role, accounted for the remaining 88%. “The overwhelming majority of which were hedge funds,” the report reads.

The CIO of Arca Jeff Dorman commented on the data but expressed doubts regarding the perception of institutional investors:

“This terminology is so misleading. Hedge funds are not institutional investors. They are professional money managers. Institutional Investors are pensions, family offices, sov wealth funds, endowments. A bunch of hedge funds buying Grayscale products shows that there is an arb, not interest.” – he Tweeted.

The post Despite COVID-19 Pressured Sell-Offs Grayscale Records Its Best Quarter appeared first on CryptoPotato.

The post appeared first on CryptoPotato