By Mike Co

In recent days, stablecoins have grown by nearly $3 billion.

As a brief primer, a stablecoin is “a digital currency designed to maintain price parity to some ‘stable’ asset. A stablecoin can have its value ‘pegged’ to fiat money, to gold, to other digital currencies, to exchange-traded commodities, etc.” There are currently at least nine major stablecoins operating globally such as USDC, USDT, and BUSD.

The USDC stablecoin for example, is fully backed and redeemable for the U.S. dollar on a one to one ratio through platforms such as Coinbase and Circle. Coinbase currently supports one fiat-backed stablecoin, USDC. Like many other stablecoins, USDC currently operates on the Ethereum blockchain.

Stablecoins such as USDC are not hindered by the volatility of non-pegged cryptocurrencies such as Bitcoin and Ethereum, while inheriting some of their most powerful properties:

- Open, global, and accessible to anyone on the internet, 24/7

- Fast, cheap and secure to transmit

- Digitally native to the Internet and programmable

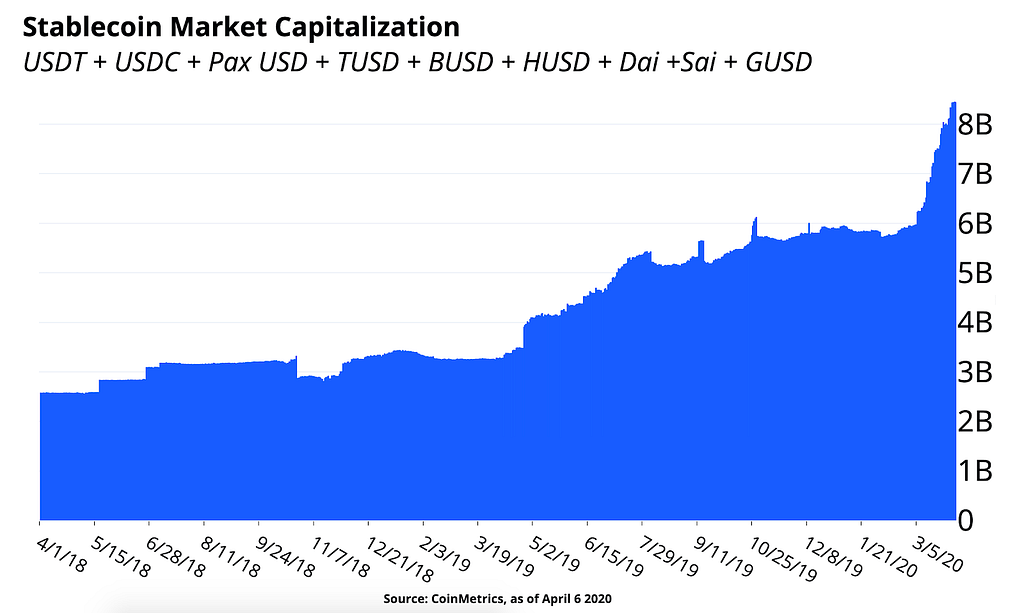

Today, the primary uses for stablecoins are as a haven from cryptocurrency volatility and as a bridge for value transfer between exchanges. In addition, evidence of stablecoins’ use in global commerce, traditional financial settlement, and as collateral for decentralized finance is emerging. So as Bitcoin and Ether prices have experienced historic volatility in recent days, the larger stablecoin ecosystem has grown significantly. As of April 20th, the total stablecoin market capitalization has risen to an all-time-high of over $9 billion according to CoinMetrics, of which USDC is ~$730 million.

While being driven by the typical hedge against BTC volatility that stablecoins benefit from, there may also be a macroeconomic force driving demand. According to a Wall Street Journal article “The World’s Desperate for Dollars” in March, global investors were dumping assets and paying dearly to swap local currencies into US dollars. USD demand has historically increased during financial crises amid a “flight to safety.” As a representation of USD demand, the DXY Dollar Index has recently surged to multi-year highs. The DXY measures USD against a basket of currencies such as the Euro, Yen, and Pound.

Stablecoins are innovative mechanisms for global investors seeking U.S. dollar exposure. As an example, USDC can be transferred within minutes, 24/7, for minimal fees, to a myriad of personal crypto wallets or global exchanges. USDC doesn’t have any concept of borders, and anyone in the global crypto ecosystem can obtain and hold USDC. Since the beginning of March, USDC market capitalization has soared from $457 million to an all-time-high of over $700 million.

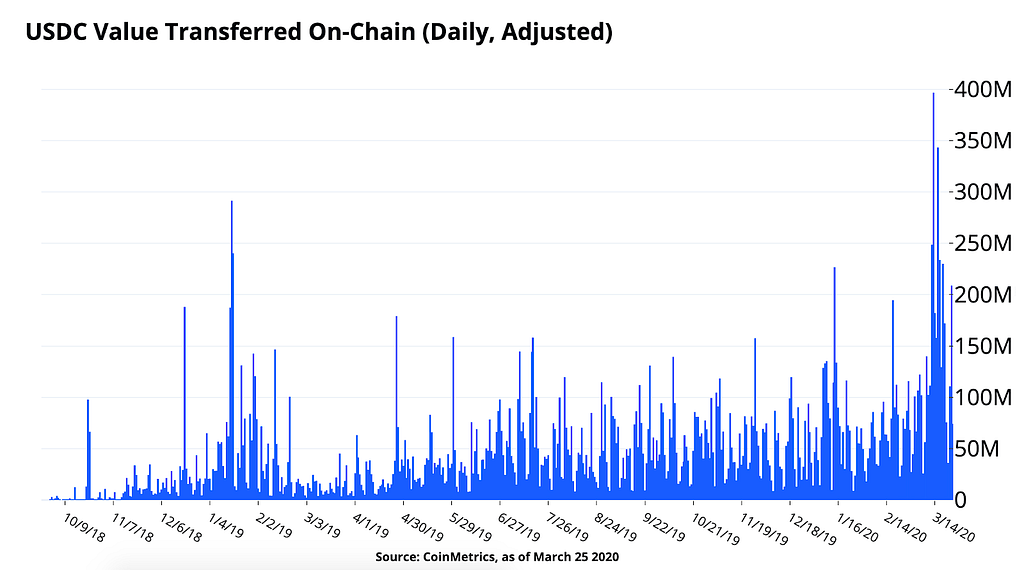

Similarly, on-chain value transfers of USDC have recently reached all-time-highs of nearly $400 million per day. USDC has also transferred over $26 billion on-chain since creation. As a likely explanation, USDC usage as a bridge for value transfer between global exchanges is surging. For context, USDC currently trades across many centralized and decentralized exchanges globally.

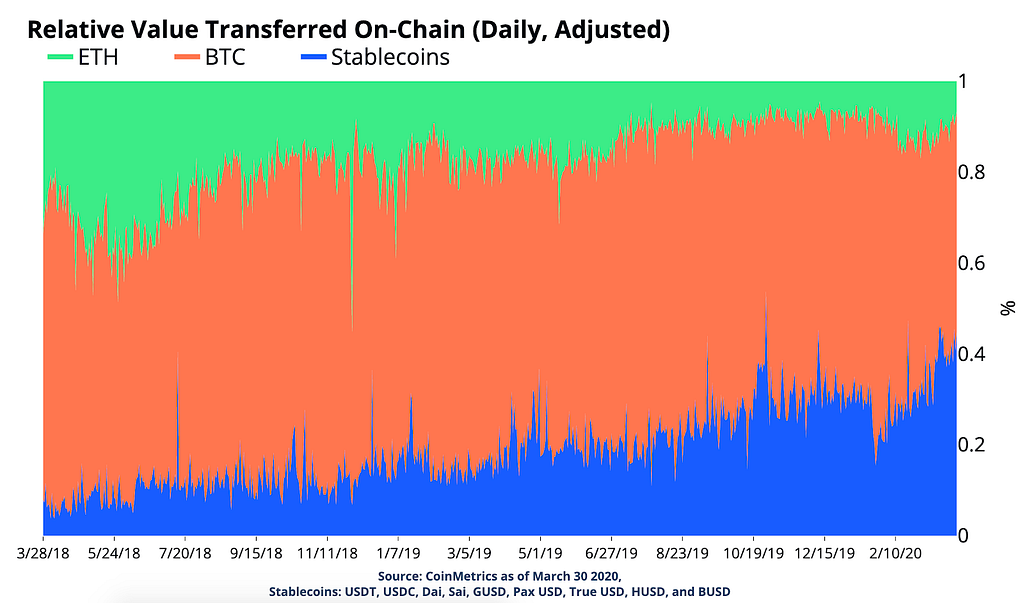

In terms of relative value transferred across the larger cryptocurrency ecosystem, stablecoins have gained significant ground in the past two years. In March, stablecoins have altogether reached ~40% of relative daily value transferred compared to Bitcoin and Ethereum, the two largest non-pegged cryptocurrencies. Notably, while Ethereum’s native value transferred has dropped significantly compared to Bitcoin, many stablecoins currently operate on Ethereum’s blockchain.

Stablecoins maintain a variety of advantages over traditional banking. Setting up a crypto wallet to transfer stablecoins (for example via the self-custodial Coinbase Wallet) is much more accessible than setting up a bank account, especially for people outside the U.S. The accessibility of crypto software and proliferation of stablecoins in the future may prove valuable for “banking the unbanked” of the world. Or according to the Bank of International Settlements:

“In principle, retail stablecoins could enable a wide range of payments and serve as a gateway to other financial services. In doing so, they could replicate the role of transaction accounts, which are a stepping stone to broader financial inclusion.”

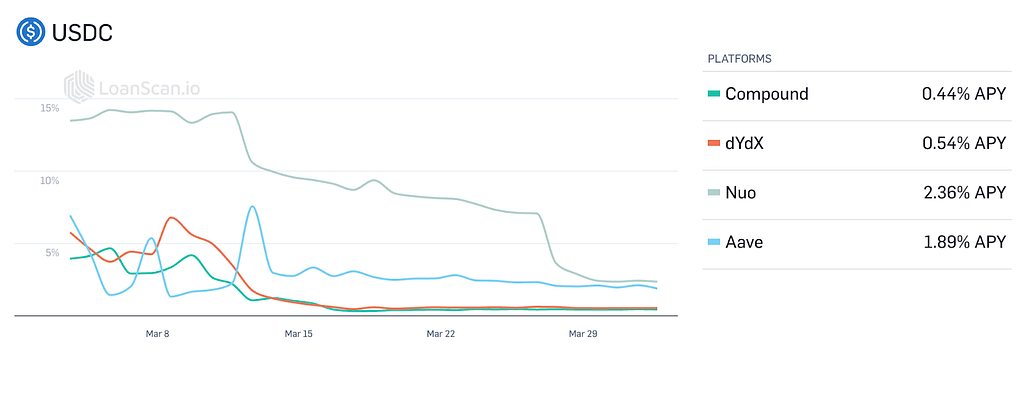

Further, a new class of financial services called “DeFi” or decentralized finance has been created so that stablecoins can be programmatically borrowed, lent, and used as collateral. Smart contract lending protocols like Compound, dYdX, Nuo, and Aave currently offer an APY range of 0.44–2.36% for USDC (as of April 1st) and have historically been much higher:

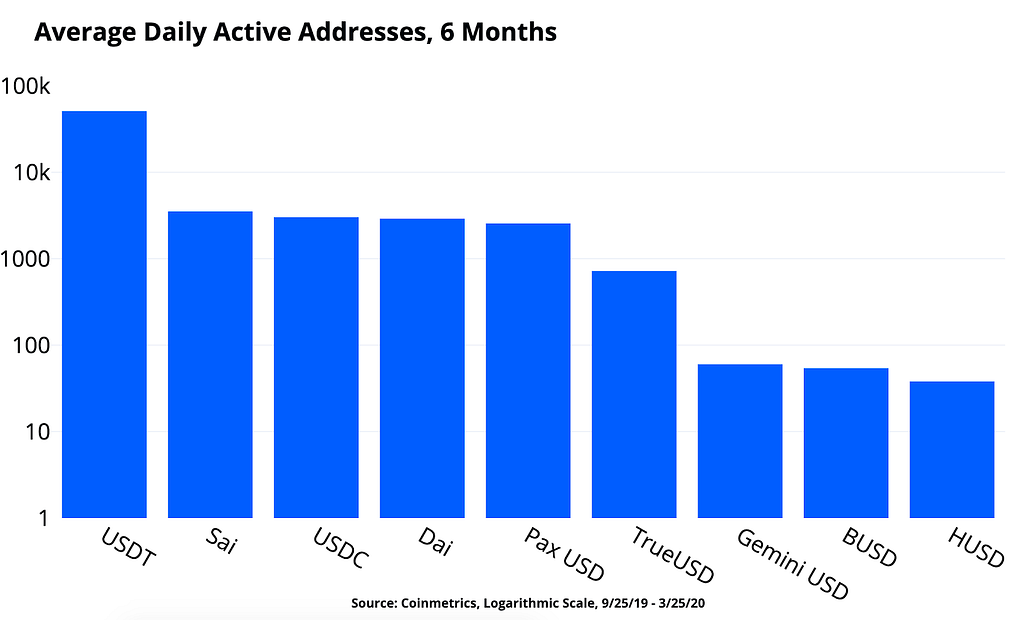

As evidence of on-chain stablecoin use for these various uses, we can compare daily active addresses. By measuring daily active addresses, USDT is the leader of stablecoins. Sai, USDC, Dai, and Pax USD active addresses have been hovering around ~3K per day while USDT leads significantly with 50K and GUSD (Gemini), HUSD (Huobi), BUSD (Binance) trail with <100.

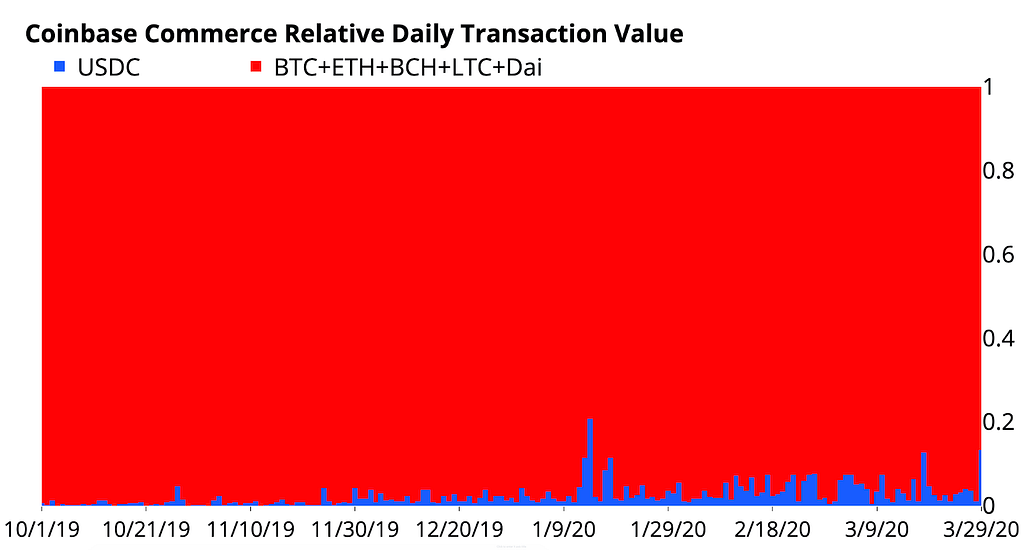

Further, as evidence of stablecoin use in global commerce, we can analyze USDC on the Coinbase Commerce platform. For context, Coinbase Commerce has processed over $200 million worth of transactions, allowing thousands of global merchants to accept cryptocurrency in a fully decentralized way. Via Commerce, USDC has been slowly but surely gaining traction against other accepted cryptocurrencies in the last six months, reaching up to 20% of daily transaction value on January 14th, 2020.

Due to fundamental advantages over traditional payment systems, stablecoins may become increasingly viable for global commerce. And as another emerging use-case, stablecoin prototypes like the JPM Coin by J.P. Morgan may prove stablecoins’ viability for traditional financial settlement by “enabling the instantaneous transfer of payments between institutional clients”.

In the meantime however, surging market caps and on-chain value transfers indicate stablecoins’ established use-cases: as a hedge against cryptocurrency volatility and as a bridge between exchanges.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, Inc., or its affiliates (“Coinbase”), and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators. The opinions expressed on this website are those of the authors who are associated persons of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products.

Unless otherwise noted, all images provided herein are the property of Coinbase.

Flight to stablecoins in 2020 was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

The post appeared first on The Coinbase Blog