Bitcoin accumulation is on the rise in the past few weeks, according to new information. BTC hodlers are stashing more coins daily now than they did at any time in the last year.

The question remains if the upcoming Halving scheduled to take place in May is the primary reason behind this, or is it something more.

BTC Hodlers Increase Their Positions

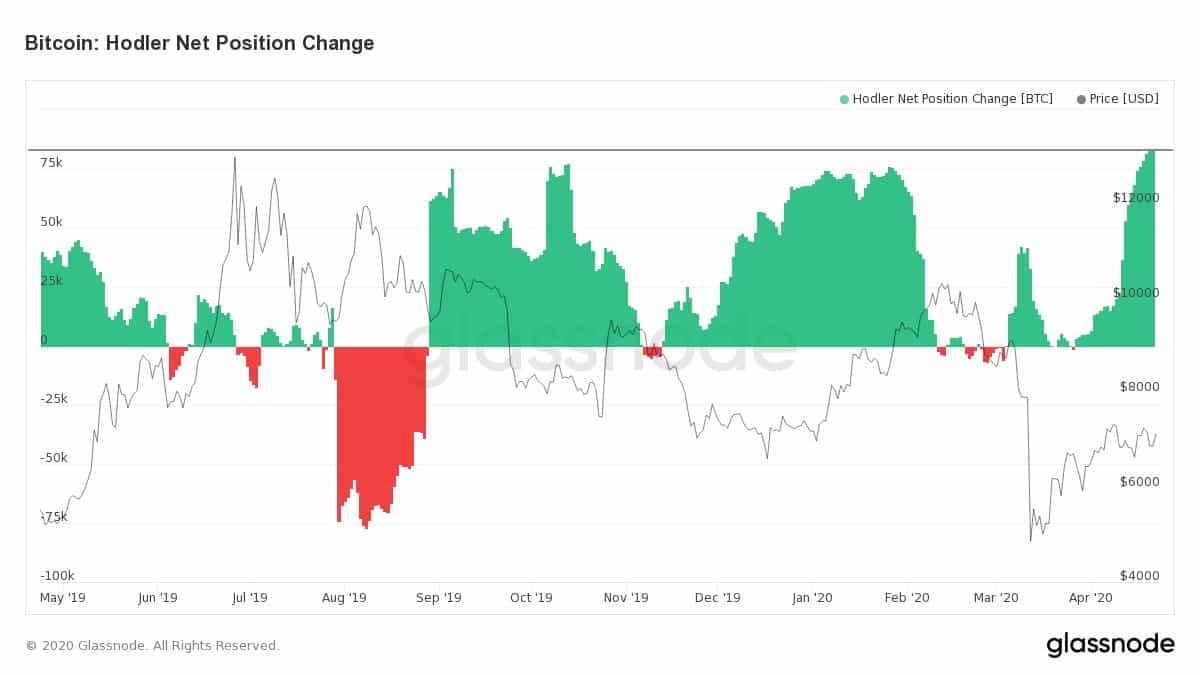

Per data provided from the monitoring resource, Glassnode Insights, the primary cryptocurrency has seen lots of accumulation phases in the past year. Yet, none looks more impressive than the current stage. Hodlers are adding about 75,000 BTC to their positions each day.

As the graph above demonstrates, the past year has been quite “green” in matters of BTC accumulation. For starters, when the price of the asset was trading below $6,000 in May 2019, hodlers purchased over 25k per day.

After the price exploded to above $12,000, the market saw a serious sell-off. However, ever since September of 2019, BTC hodlers have been accumulating significant portions regularly.

It’s worth noting, though, that the data might also include exchange wallets.

Is It The Halving?

The current rate of accumulation comes as a support to a previous similar paper. As Cryptopotato reported earlier this month, Bitcoin whales purchased record amounts of the largest cryptocurrency by market cap. The number of entities with at least 1,000 BTC was at a 2-year high.

What’s more, the last time a similar rise in BTC whales was at the beginning of 2016. And in July of that same year occurred the second-ever Bitcoin Halving.

Fast-forward to the present day, the third-ever Halving is just around the corner, and the accumulation rates are at substantially high levels. Naturally, this begs the question if the event scheduled to take place in less than 20 days is the main reason.

Historically, the price of the asset has surged in the years following the two previous Halvings. However, the situation now may be somewhat different.

Not only is history not a valid price indicator, but lots of community members believe that Bitcoin has been priced in already. Others are even more pessimistic, claiming that the COVID-19 crisis could lead to massive competition among miners with devastating effects on BTC’s price.

Or Maybe Something Else?

That same coronavirus crisis, however, could present another theory on why people are accumulating Bitcoin now. This one, much more speculative, relates the current reality of central banks and governments printing tons of fiat currencies. Per some experts, this could decrease their value and even bring hyperinflation to the scene. Therefore, people should look into alternatives.

As Bitcoin has a max cap of 21 million, it certainly presents such an alternative. No central authority can decide to print more.

To support this speculative theory, recent data from Coinbase implied that the number of deposits worth exactly $1,200 skyrocketed. Interestingly, this coincided with the first stimulus checks sent to U.S. citizens containing exactly, wait for it, $1,200.

Nevertheless, perhaps both these theories are far away from the truth. Yet, this combined data revealed that more and more people are accumulating the primary cryptocurrency, for now. It would be interesting to follow what happens in the next several months.

The post BTC Accumulation At Record Levels: Are HODLers Expecting Bitcon Halving Price Surge? appeared first on CryptoPotato.

The post appeared first on CryptoPotato