A recent report by Bloomberg says it might be time for a 2017-like bull run for Bitcoin. According to the document, interest in BTC is increasing while the market is maturing in time for the 2020 Halving, winking at the previous event of the kind that took place in 2016.

Becoming The Digital Gold, After a High-Five With The Precious Metal

It might be the digital currency’s ready-get set-go for a bullish run, the report predicts. It emphasizes that BTC probably has what it takes to become “the digital gold.” The paper points out that Bitcoin and gold exist in a time-tested convergence. The price for the digital currency pairs with that of gold and moves further away from the days of high volatility that it used to see.

Along with this, it is expected that the declining Bitcoin volatility, combined with the rising readings of the precious metal, could be a signal for a stronger correlation between them in the near future. More precisely, the report states that Bitcoin’s price might be supported by its declining volatility against the rising gold.

Apparently, the worldwide COVID-19 pandemic predicament has supported the digital currency’s on-chain indicators. They remain price supportive and the coronavirus might serve as a lever to accelerating its outperformance compared to the broader crypto market. Bloomberg’s paper also indicates that certain metrics such as active and existing addresses and adjusted transactions also show the increasing maturity and stability of Bitcoin’s network.

“Increasing addresses support Bitcoin’s transition toward a digital version of gold, and we believe margin-call-related selling should be a temporary headwind to both quasicurrencies” – Reads the report.

Along with this, the publication states that the upcoming halving in May might be the wind in the sails for Bitcoin’s price.

Countdown to 2020 Halving Pushes BTC Interest to 100%

Although a lot of things might happen in the following weeks, as the clock’s ticking, the upcoming Bitcoin halving shows a massive influence in the interest in the digital currency.

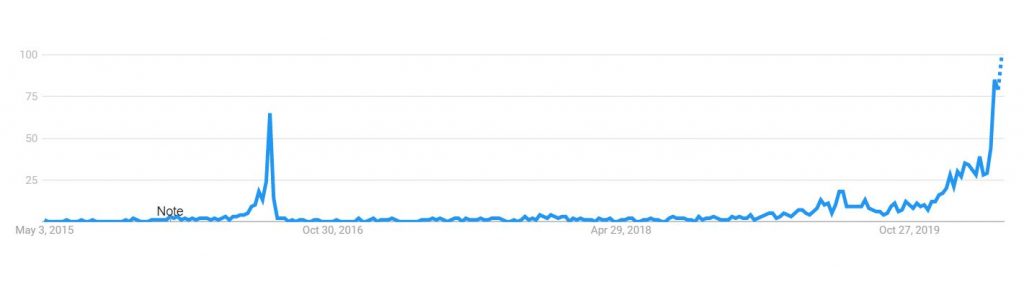

As seen in the above chart, the searches for the “Bitcoin halving” key term throughout the entire world are at their all-time high level. This is quite supportive of Bloomberg’s report because the same search term back in 2016 had performed a lot less impressive. In fact, the increase in interest compared to then is more than 50%.

The post Correlation Between Bitcoin and Gold Sets The Stage For Another 2017-Like Parabolic Price Surge, Bloomberg Reports appeared first on CryptoPotato.

The post appeared first on CryptoPotato