The latest price developments helped Bitcoin’s price to recover following the massive sell-offs in mid-March. However, while most features of the cryptocurrency market have reclaimed previous positions, a few are still showing weak charts.

Bitcoin Price Recovered Since Black Thursday

The year started quite positively for Bitcoin and the entire cryptocurrency market. Interest, trading volumes, and ultimately prices were soaring.

BTC reached its yearly high in February at around $10,500. And when it all seemed optimistic on the surface, the COVID-19 pandemic thread became real to people outside of China. Then came the notorious Black Thursday in mid-March when it all went south.

In less than two days, Bitcoin’s price dropped to about $3,600, marking one of the most vicious declines in its history. As to what propelled it – analysts explained that investors were liquidating risk-on assets to meet margin calls as the legacy markets also tumbled.

Aside from the price effects, though, those eventful hours impacted numerous aspects of the cryptocurrency market. A recent thread compiled by the popular monitoring resource, Skew, examined the recovery processes of various areas since then.

The price of the primary cryptocurrency has fully recovered since then. Moreover, BTC is in the positive for the year, up 23% since January 1st, 2020.

Bitcoin Futures Volumes Recover

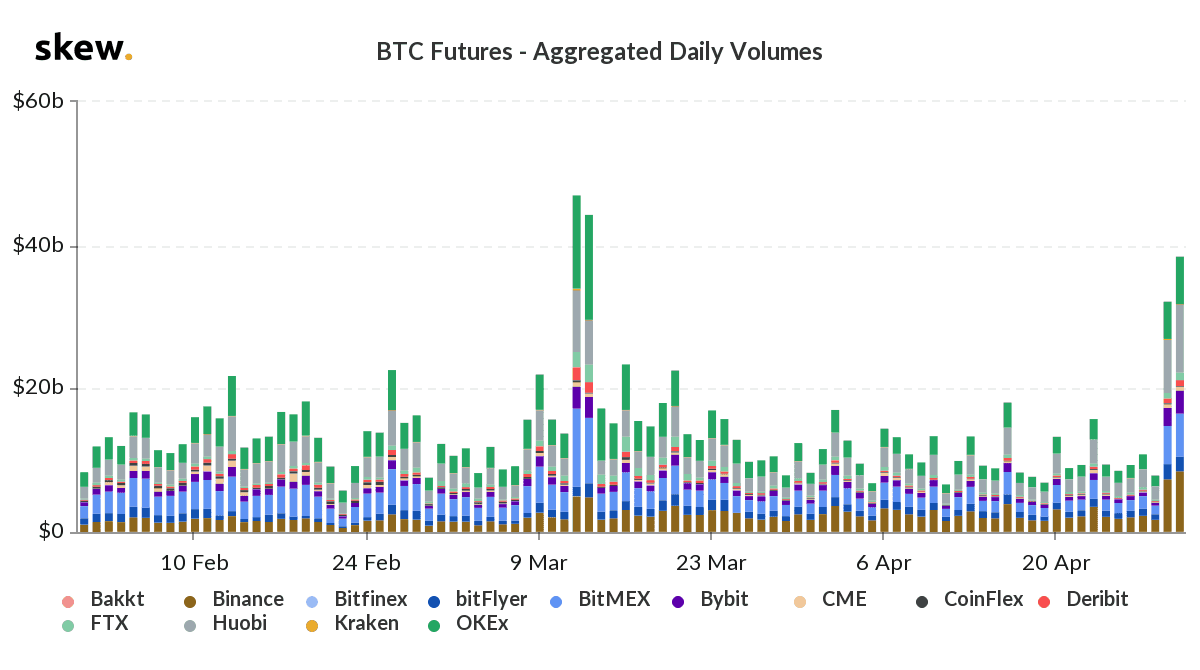

Naturally, as the price of Bitcoin saw excessive levels of volatility in mid-March, this resulted in unusually high trading volumes and liquidations. BitMEX and OKEx were the leaders at the time in terms of trading volumes.

As some investors were afraid of repetition, the trading volumes decreased in the following weeks after the March 12 crash. Skew, however, indicated that in the past few days, the high volumes are back. This time, though, Huobi and Binance Futures have the most substantial share.

BitMEX lost some of their reputations during the March 12 crash. Some would say the veteran margin exchange’s liquidation system is responsible for the severe collapse of Bitcoin to as low as $3600.

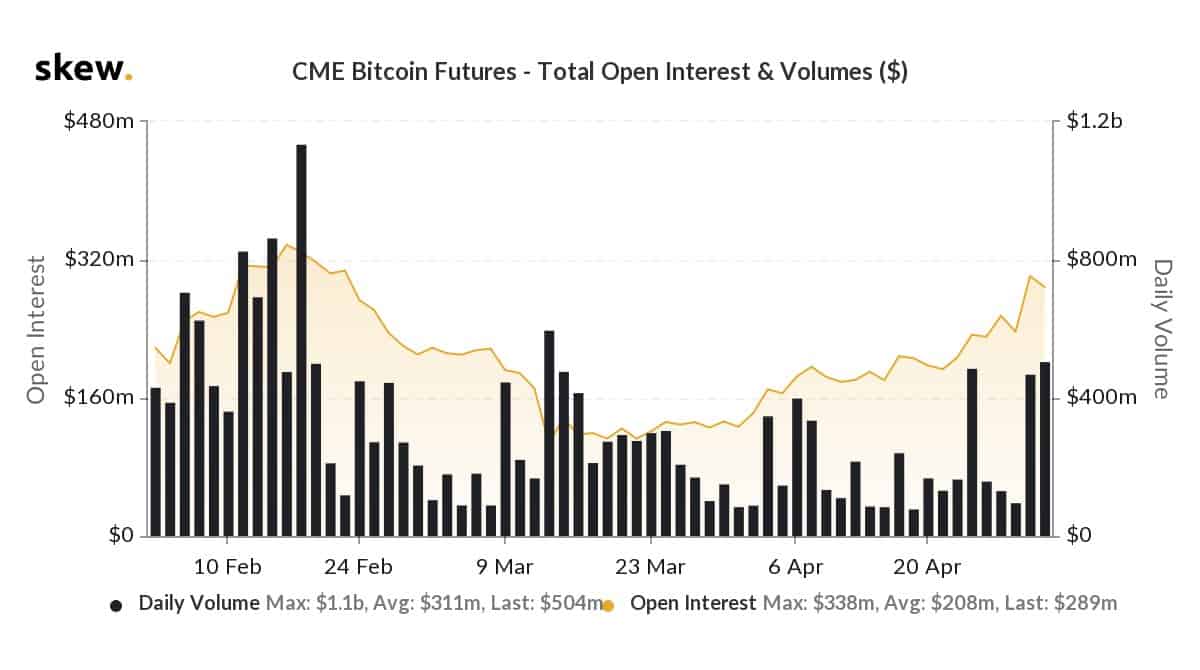

Shortly after the price dumps, Bitcoin futures trading volumes on the Chicago Mercantile Exchange (CME) decreased. Lately, the volumes and the open interest on the platform are slowly returning to their average levels.

Open Interest On The Low

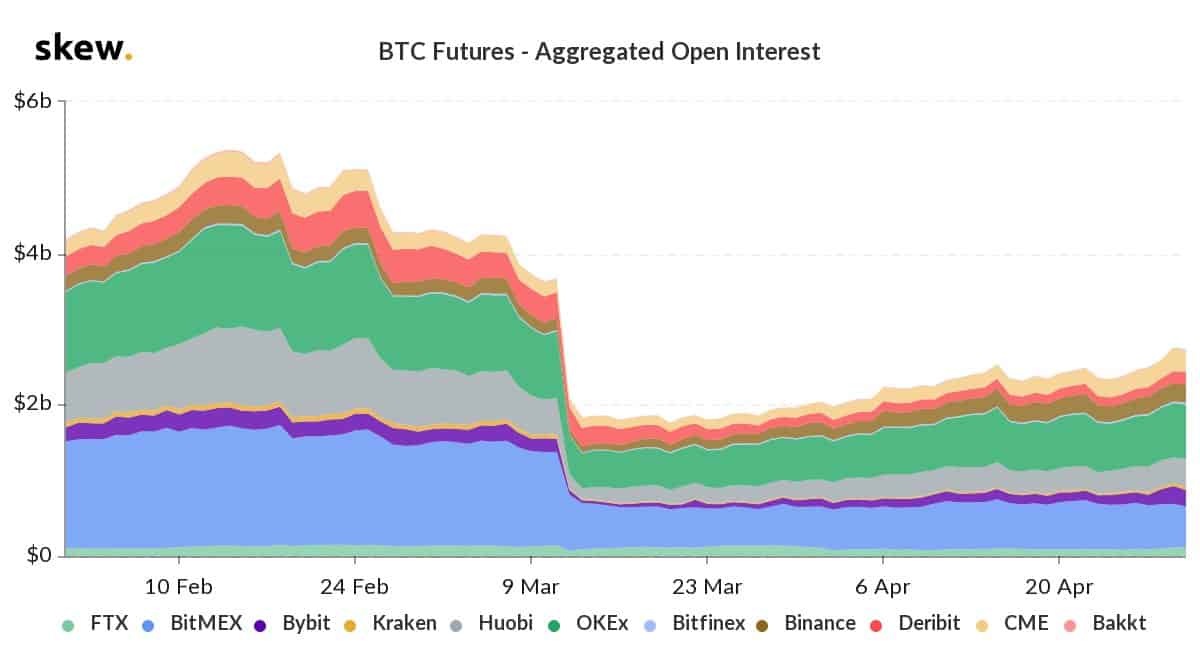

While Bitcoin futures volume is regaining its power from before, the aggregated open interest is not yet. It went from the highs of approximately $5B a day in February to about $2B after the Black Thursday.

Now, the aggregated open interest in at about $3B, which is still considerably lower than the mid-February data. Open interest alone, however, is not indicative of market sentiment, and it’s not to be considered as a bad sign.

The post Research: While Bitcoin Price and Volume Fully Recovered, Open Interest Is Still Lower Than March 12 Levels appeared first on CryptoPotato.

The post appeared first on CryptoPotato