By Mike Co and Shawn Dejbakhsh

Bitcoin and gold are fundamentally similar as scarce and globally accessible units of value. But gold’s recent market supply squeeze highlights important distinctions between the two assets. The recent challenges of the gold market reveals Bitcoin’s distinct advantage over gold: Bitcoin does not rely on fragile physical supply chains and is truly globally accessible.

According to the LA Times on March 24, “The gold market in New York is facing a historic squeeze as the global pandemic chokes off physical trading routes at the same time that investors are piling into the metal as a safe haven.” As airlines, refineries, and distribution hubs buckle under the weight of coronavirus, gold markets have been greatly hindered. Further, according to the WSJ, “As the coronavirus pandemic takes hold, investors and bankers are encountering severe shortages of gold bars and coins. Dealers are sold out or closed for the duration.”

In recent days, global gold prices have been continuously disconnected as a result of broken supply chains. According to Reuters, “The premium on CME’s Comex [New York] exchange over spot gold traded in London rose sharply again on Tuesday [April 7th] as supply routes remained partially closed and banks and brokers wary of the price gap reduced trading.” While heightened market uncertainty is hopefully only temporary as global coronavirus curves are flattened, gold and Bitcoin’s distinctions have been brought to the fore.

More recently, gold’s price dislocation has dampened slightly as “Gold Bars Are Flying 11,000 Miles to New York to Ease Supply Squeeze.” Yet as gold refineries, miners, and supply chains have been disrupted, Bitcoin’s core protocol continues to function as designed. Miners continue to mint 12.5 new Bitcoins every ten minutes on average, verifying Bitcoin’s network while edging towards its 21 million limit. In May 2020, after its third programmatic supply “Halving”, Bitcoin will be approximately as scarce as gold while also being teleportable.

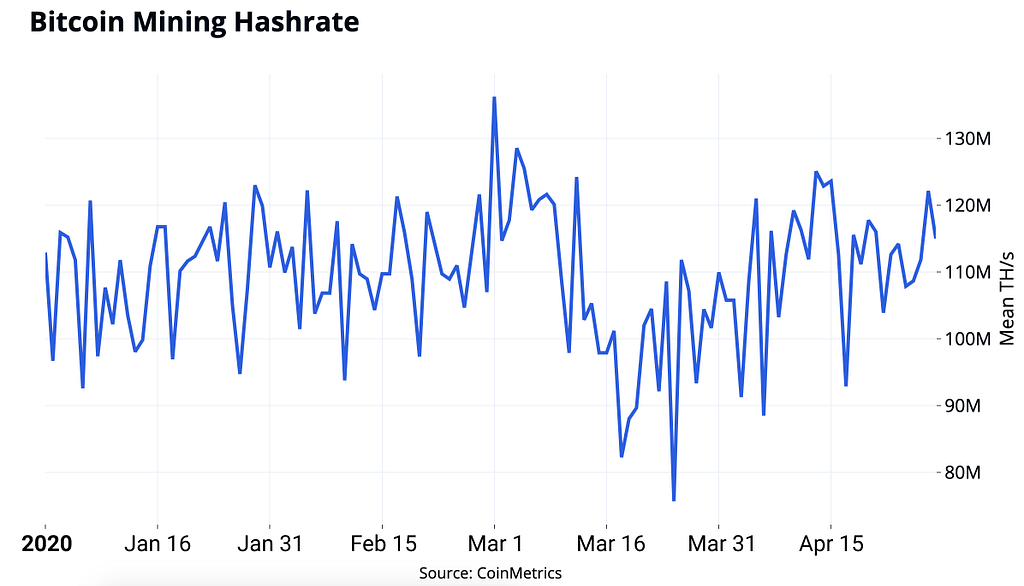

Today, Bitcoin’s rate of new supply is ~3.6% per year and will soon drop to ~1.7% on May 12th, setting it on par with gold’s historic scarcity. As gold miners and refineries have gone offline, Bitcoin’s global mining ecosystem seems resilient according to hash rate measurements in recent days. According to CoinMetrics, on April 30th, Bitcoin’s mean hash rate reached ~115 million TH/s (the measurement of mining power backing the network), which is well in the range of historical all-time-highs.

Bitcoin’s hash rate may drop as the mining reward halves in May 2020 however, as mining power is reallocated to the most efficient miners. Yet if the past two Halving events are any reliable indication, mining power will continue its upward trajectory soon thereafter. And regardless of price and hash rate volatility in the past, Bitcoin has continued to successfully process transactions with 99.98% uptime since its creation on January 3, 2009.

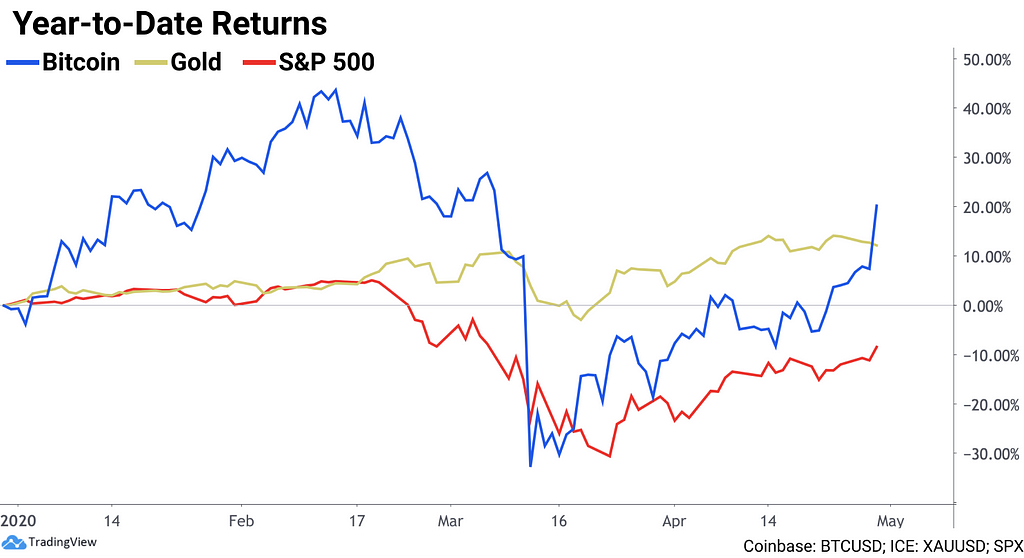

Bitcoin’s price has also been relatively resilient amid recent market volatility. In terms of 2020 returns, Bitcoin is currently outperforming both gold and the S&P 500 (although Bitcoin is significantly more volatile). Bitcoin, gold, and the S&P 500’s year-to-date returns are +20%, +12%, and -8% respectively as of April 29th.

On Coinbase and other exchanges, Bitcoin can be deposited, traded, or withdrawn in minutes for a current median network fee of ~$0.30 (as of April 25th). In September 2019, a Bitcoin network transaction valued over one billion dollars was sent for a fee of only ~$700. The cost to internationally send an equal amount of gold during normal market conditions would be exorbitant, requiring armored transport and insurance. Today, it would be exceptionally difficult.

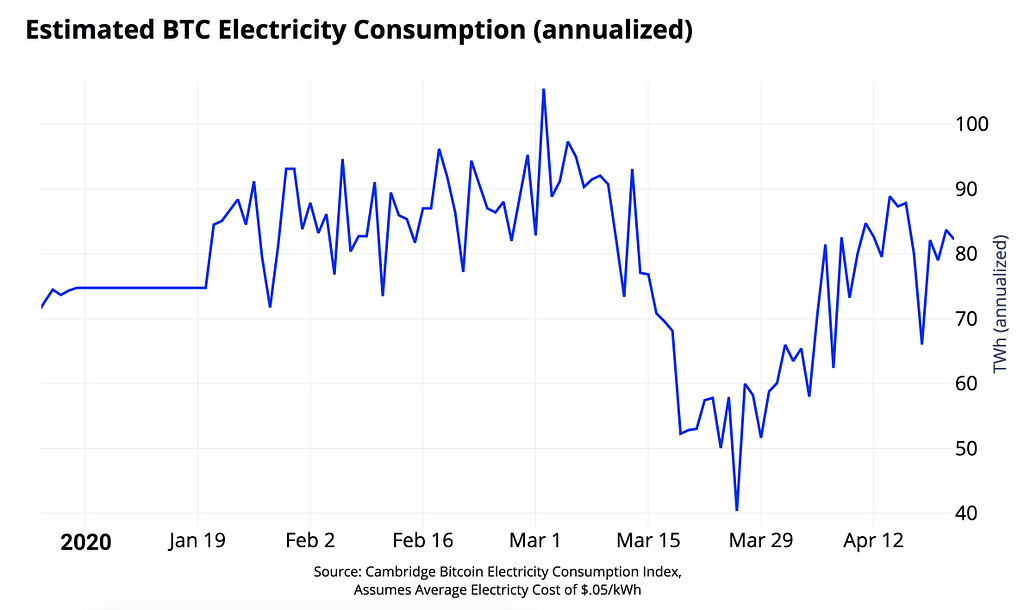

Bitcoin and gold production are also different when it comes to energy cost transparency. While the energy costs for gold mining and refining are opaque and difficult to measure on a macroeconomic scale (while also being exorbitant), the energy cost for Bitcoin mining is relatively transparent and easy to measure. The University of Cambridge puts this into perspective with an index estimating Bitcoin energy consumption, measuring factors such as mining hashrate, mining equipment efficiency, and average electricity cost

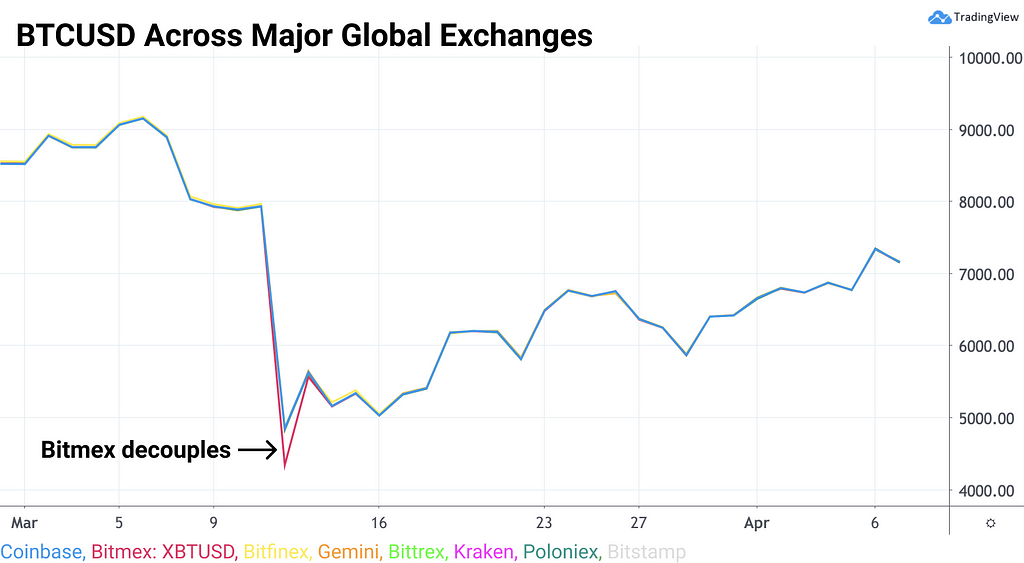

Further, in terms of Bitcoin’s global marketplace and as evidence of seamless global transfer, BTC has been moving in near-perfect unison across seven global exchanges offering U.S. dollar trading pairs. The only anomaly has been Bitmex, which temporarily dipped ~$500 below the rest of the exchanges (which are barely distinguishable on the chart below) then quickly returned to parity.

By and large, measuring closing prices across major global exchanges, Bitcoin markets have been relatively efficient amid recent macroeconomic turmoil. Contrasted with global gold markets that have been dislocated for the duration of a few weeks, Bitcoin’s major exchanges have largely maintained parity.

Compared to transporting, depositing, or withdrawing gold to exchange globally, Bitcoin is at a technological advantage. And if current market conditions continue, Bitcoin may yet distinguish itself further.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, Inc., or its affiliates (“Coinbase”), and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators. The opinions expressed on this website are those of the authors who are associated persons of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products.

Unless otherwise noted, all images provided herein are the property of Coinbase.

Market efficiency of gold and Bitcoin was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

The post appeared first on The Coinbase Blog