The novel COVID-19 pandemic disrupted gold distribution in Q1 2020, while the demand saw a serious increase, primarily in the west.

At the same time, most central banks continued amassing large quantities of the precious metal.

Gold Demand During The COVID-19 Crisis

With the unexpected outbreak of the COVID-19 pandemic at the start of the new decade, traditionally perceived as riskier assets such as equities and cryptocurrencies plunged as investors were looking for liquidity in fears of the potential aftermath of the crisis.

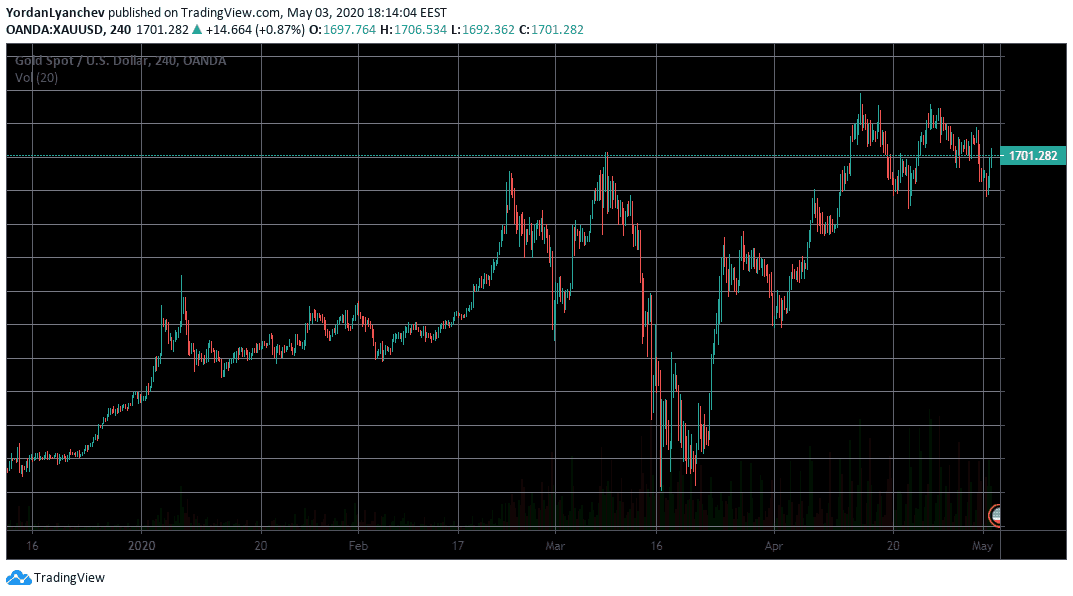

Gold, generally utilized for its safe-haven status, also suffered from price declines in mid-March during the most emphatic days of uncertainty. Since then, however, its price has recovered, and it’s even trading at 12% in the green so far in 2020.

When world governments were initiating stimulus packages, also known as printing excessive amounts of money and debts in short periods, investors turned to the precious metal’s safe-haven feature.

Consequently, gold demand increased significantly. Gold-backed ETFs attracted massive inflows (about +300t), which resulted in global holdings of Gold-based ETFs, reaching a new record high of 3,185t. The interest for gold was up by 36% to roughly 77t, particularly desired in the Western world.

Contrary, and somewhat unsurprisingly, jewelry and technology gold utilization fell by 39% and 8%, respectively.

The worldwide lockdowns disrupted the overall gold supply, as gold-mine production fell to a five year low of less than 800t.

The first quarter of 2020 also continued the central banks’ initiatives to amass the bullion as gold reserves grew by 145t. One exception came from the Central Bank of Russia: After years of purchasing substantial quantities, the largest country by landmass decided to stop, and sell it internationally instead.

Pandemic Easing Leads To Gold Price Drops

Fortunately, recent reports suggest that the effects of the COVID-19 pandemic may be easing. The general belief is that most countries have passed the peak of infected people.

As such, the European Central Bank (ECB) didn’t announce earlier this week an increase to its pandemic emergency purchase program.

The positive news regarding the pandemic, however, harmed gold futures as they fell for several consecutive sessions.

“The market was somewhat disappointed by today’s ECB policy signals, which weren’t aggressive enough when measured against further signs of economic deterioration,” said Bart Melek, a TD Securities analyst.

Despite the most recent decreases, though, April was gold’s best month since last August – the bullion rose by over 6%.

The post Gold Demand Rises While Supply Is Disrupted In Q1 2020 Amid The COVID-19 Pandemic appeared first on CryptoPotato.

The post appeared first on CryptoPotato