If you were into Bitcoin and crypto for at least five years, the name Chris Dunn would probably sound familiar to you.

The 35 years old Texas boy was one of the first crypto YouTubers. As of writing these lines, his popular channel has more than 200,000 subscribers since its first uploaded video, somewhere in 2013.

Personally, I learned a lot about crypto and trading from Chris; that’s why I was eager to interview him for CryptoPotato.

In the following interview, Chris Dunn shares his attitude towards crypto investments (“there were so many people that were just looking to get rich quickly”), the crypto ‘noobs’ of our days compared to 2015, and why he is quite a fan of investing in the stock markets, especially as a crypto trader.

Oh, yeah, and we can’t release him without his Bitcoin post-halving prediction.

Halving 2020: Do you think there will be a price effect similar to the halving event of 2016 that initiated the 2017 bull run?

After the first having the price went up by about 10,000% and then after the second having it went up about 4,000%. If we just extrapolate that and assume that the third having price is going to go up by 40% of the prior having, that would get us to somewhere around $150,000 per coin.

I don’t know about the timeframe necessarily. The market cycles are taking longer to play out. So timing is kind of hard but based on the way that the global economic situation is looking and the way that Bitcoin’s kind of growing in the mass public, I think there’s a real possibility that it could play out.

COVID19: Waking Up People About Their Money

In your article from a year ago, you wrote that “all we need for increased Bitcoin use is one major economy to experience a deep recession.” One year after, and there came the COVID19 crisis. Are we here yet?

In my opinion, this feels like a tipping point where more mass mainstream adoption is starting. This is really Bitcoin’s time to show what it can do. It’s kind of the perfect storm, where we’ve got the Fed printing trillions of dollars, and there’s a global crisis.

We saw JP Morgan go from calling Bitcoin fraud to now – they’re supporting crypto exchanges with banking services. We’re also seeing famous iconic investors like Paul Tudor Jones just publicly announcing that he’s investing in Bitcoin, and it’s potentially the best hedge against inflation that we’ve seen in our lifetime.

I think that with the shock that we’re having right now in the global economy, it’s waking people up. A lot of them have never questioned what money is before they are starting to think about it now. This could also lead to more mass mainstream adoption.

Somewhere in 2018, you and Rocky (Chris Dunn’s partner) shifted your focus to the global markets. Was it temporary because of the bear market of 2018? Or do you think investors should diversify themselves to both crypto and equities?

I’ve always been investing in the stock market, but my focus as a trader and an investor is continuously evolving. I put my time, energy, and capital into markets and areas that I think have the best potential to grow well.

Over the past couple of years, I have become more opportunistic about stocks again. I’ve started to more actively trading stocks, but this time I’m not looking for short-term moves, my time horizon has gotten a lot longer – I’m looking for stocks that can double or triple over the next couple of years.

Last year we brought a successful hedge fund investor on our team. This guy grew a hedge fund from $100 million to over a billion in assets. He’s got one of the best public track records out there.

“I know stocks are pretty unpopular in the crypto community. But the reality is that the stock market has given the best gains and the best place to really build wealth. And I don’t think crypto is going to change that.”

I think crypto is great, and it’s challenging people’s belief in what money is. But when you think about what the stock market is, it’s real ownership in companies. And I don’t think crypto is going to make companies go away.

Maybe we’re going to tokenize stocks, and we’re going to tokenize equity in companies. But I’m still a huge proponent in owning stocks in profitable companies.

I’m also a huge proponent of diversifying. I pull hard profits out of the crypto market all the time and invest in gold, invest in real estate, and invest in stocks.

I think it’s very dangerous if you don’t diversify. Even if you believe in Bitcoin and crypto, it’s just very risky to put all of your wealth in one asset.

As an early adopter of crypto trading, what is the difference between the noobs (inexperienced crypto traders) of 2014 – 2015 to the noobs of 2020?

I think all noobs start from the same place. The most important thing that people need to learn is how to approach investing with the right mental models.

Today’s noobs might know more about the tech behind crypto than in the early days when a lot of people just didn’t even know what it was.

There’s more information out there now. People have been going to sites like CryptoPotato to learn some of the basics – like blockchain and how it works.

I Don’t Think We Will Ever See Ethereum At $1,000

5-6 years ago, crypto was mostly a Wild Wild West with lots of pumps and dumps. Whoever joins today, did miss the train? Do you believe that there are still investment opportunities in Bitcoin and altcoins?

I think the whole ICO boom was unsustainable and probably negative for the crypto space. There were so many scams, there were so many people that were just looking to get rich quickly, and we saw the result of that, which wasn’t good.

It brought a lot of regulatory scrutinies. A lot of people lost a lot of money. I don’t think we’ll see anything like that again because it wasn’t real.

“Now, however, I’m more bullish than ever on the crypto space because we’re kind of in that plateau productivity where I think we’re going to see more sustainable growth.”

There may be less hype and fewer projects, but the ones that survive are going to do very well. It’s similar to the Dot-com bubble of the 2000s. Many people lost a lot of money during the 2000 tech bubble, but some companies came out of that position and are still wildly successful today, like Amazon.

So I think there are projects, companies, and crypto assets today that are going to be like Amazon in 20 years from now. I think people have to be more patient and selective and make sure they’re getting in the right projects.

I’m really excited about the security token movement, even though that’s a lot slower of moving space. When you tokenize real assets to be like a company that actually has profits or a tangible asset like real estate or art, to me, that’s even more exciting than the ICO boom because they’re tied to real things.

There’s already a framework in the US at least for raising capital, and the security tokens fit in that framework. But there’s a need for vast improvements.

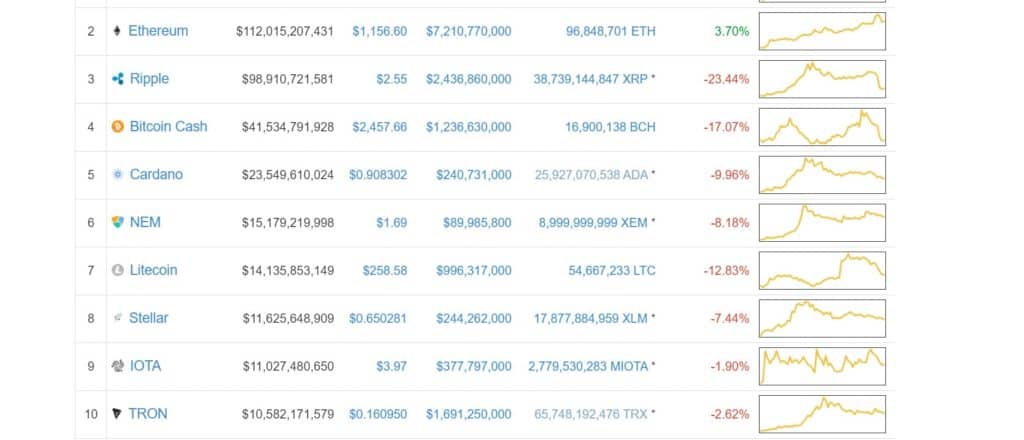

Following the last question, will altcoins ever reach their all-time high? Like Ethereum and Ripple against Bitcoin?

I think Bitcoin has the best risk-reward profile right now of any accessible market out there. When it comes to altcoins, I think, well over 95% of them are going to fail and go to zero eventually. It’s also hard to say if any of the current altcoins will exceed their all-time highs.

“I kind of differentiate between coins that went through the 2017 bubble and coins that were born after that. Such coins like Ethereum and Ripple have a lot of bag holders from people that bought the highs. This creates a lot of selling pressure.”

So it’s harder for old coins to exceed their prior highs where new coins that don’t have a lot of bag holders could have more upside because they don’t have those who add to the selling pressure.

For Ethereum reaching $1,000 – there was a very specific set of circumstances that created that price, and I don’t know if we’ll ever see anything like that again.

It’s All About The 4 Buckets

What’s the best tip you can give crypto traders in regards to today’s market conditions?

The best tip that I would give any crypto trader, regardless of what’s happening today, is just – if you’re going to invest in crypto, think about risk management first.

That’s the most important thing. A lot of people get caught up, and most of them lose money because they don’t think about the risk. They just think about how they can get rich quickly.

A couple of things that you could consider are your capital buckets: Where do you put your capital into? What strategies are you applying – are you a HODLer? Are you looking to make short term swing trades? Or are you going in early on new projects? Then, just think about how you want to break that capital into different ‘buckets.’

I have four primary buckets: My first one is my cold storage, where I store Bitcoin. After a bubble pops in Bitcoin and prices are depressed, I accumulate as many bitcoins as I can for cold storage. I tuck it away, and I don’t really think about the price.

My second capital bucket is my multi-year position trading one, where I try to trade for longer times of one to three years and trade the bigger market cycles. Capital bucket number three is shorter-term swing trades where I can go in and make money on the volatility.

The fourth capital bucket is like the highest risk capital bucket, which is investing in higher-risk altcoins or new projects where the risk of it going to zero is very high. But, that’s also where you can get the biggest percentage gains.

The second thing outside of capital buckets is for somebody that comes into crypto and has never bought Bitcoin before.

They’re looking at the price and say $10,000, and they’re asking, “should I buy Bitcoin now?”

“I always say that if you want to buy Bitcoin, buy such an amount today that if the price goes down by 90%, you’re not going to be hurt financially, and you’re not going to panic-sell the lows. That’s what a lot of people do.”

The other piece of advice when it comes to risk management is don’t use the shotgun-approach, which worked well during the ICO boom, where you can just throw money at random projects. If you do that today, you’re going to lose most of your money. So be very selective and do your due diligence.

Also, a lot of people come in, and they buy something because they watched a YouTube video or listened to some guy on CNBC, and then they blame other people when they lose money. If you want to be a real investor, you have to take 100% responsibility for all the decisions that you make.

Crypto Is Here To Stay

For the sake of the times when Poloniex and Bittrex were the two leading exchanges (years 2015 – 2016), can you share a juicy/unique/odd investing experience you had in the young emerging altcoins markets, that will probably never happen again?

In the early experiences that I remember, Bitcoin would crash by 50% in the span of one to three days. Every time that would happen, we would buy. Sometimes we would have the biggest gainers – at least the fastest wins.

It’s funny because we even see that today. Like in March (2020), we saw Bitcoin that had a 50% panic drop. What did we do? We bought the lows.

“Rocky was literally buying at $4,100. I didn’t get quite that good of a price, but it was exciting nonetheless. I think that’s a story that worked back then and it’s still working today.”

In terms of adoption, how do you see the crypto space by the year 2030?

I think it’s hard to put a timeline on this. The global financial system is going to start changing more rapidly now. Governments and central banks know that crypto is here to stay. We see everybody rushing to create their own country coin.

Like the average person that isn’t a crypto nerd. They’ve never questioned the US Dollar, the Euro or the yen before.

“But for the first time now, people are starting to think if these dollars are really worth anything.”

Why is Bitcoin so valuable, why is gold going up, and what is money? The more people that start to question that, the faster things will start to change.

Money is just a social construct. It’s something that is an illusion. It’s whatever we decided it is. As people start thinking about this decentralized, borderless money called Bitcoin, the more valuable it inherently becomes.

Over the next ten years, I think things will change, and the rate of that change will also increase. It could be a few years from now that we see a big shakeup in the global financial system.

But – is Bitcoin going to become the world reserve currency? I have no idea. All I know is that within ten years, things are going to look different from how they do today.

I definitely see a scenario where one government or multiple governments try to ban Bitcoin or fight it. However, I don’t think that it necessarily means the end of Bitcoin. If anything, it would make people say – “why is this government so afraid of Bitcoin? Why are they trying to get rid of it?”

Governments want control. And the best way to control people is to control the money supply. We are kind of starting this fight for what money is and who controls it. I don’t think a government is going to go down without a fight. But it’s inevitable, the momentum is rolling, and I don’t think any government can stop it at this point.

The post Chris Dunn Trader’s Digest: Bitcoin To $150K Post-Halving, Crypto Investing Methodology, Tips, And More appeared first on CryptoPotato.

The post appeared first on CryptoPotato