Popular Bitcoin proponent and educator Andreas Antonopoulos believes that the current drops in oil prices will benefit some BTC miners. In a video on his YouTube channel, he outlined that miners in the recently opened Bitmain facility in Texas could be the biggest beneficiaries.

Oil Prices To Affect BTC Mining

The sudden outbreak of the COVID-19 pandemic started a domino effect on world economies. Nationwide lockdowns – meaning less traveling and movement – prompted less oil consumption. At the same time, though, oil production continued with high levels.

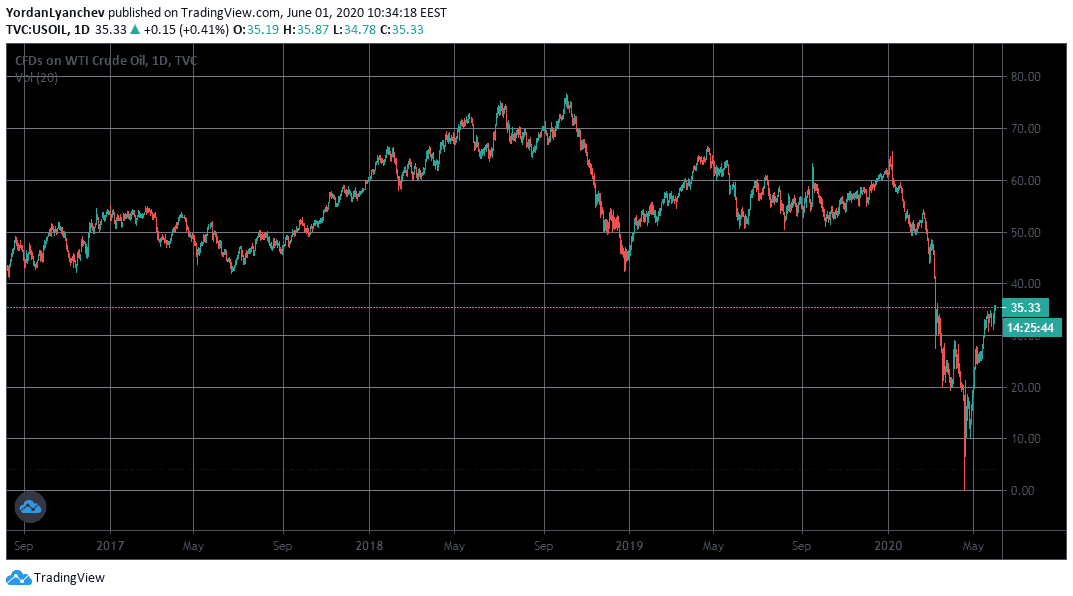

Ultimately, the decreased demand and the large production caused price plunges not seen before as some futures, including WTI, were trading in the negative at one point.

Although WTI’s price has recovered to some extent since those historical days, oil prices are still down on a macro scale.

Aside from cheap gasoline, Antonopoulos noted that the effect will not pass by Bitcoin mining. He argued that the declining oil prices will decrease electricity costs worldwide but “not equally worldwide.” Antonopoulos explained that the Bitcoin farm in Rockdale, Texas, opened by the Chinese manufacturer of computing chips Bitmain in October 2019, could benefit the most.

“One of the biggest new mining operations opened in the United States, in the state of Texas. I can’t imagine that this is a coincidence. It probably had a lot to do with the fact that the US had 12,000 barrels per day, and it is the largest oil producer in the world because of fracking.

Therefore, there may be really good opportunities for cheap power. This could suddenly make the US-based miners much, much more competitive and powerful.”

Effects On Chinese Miners

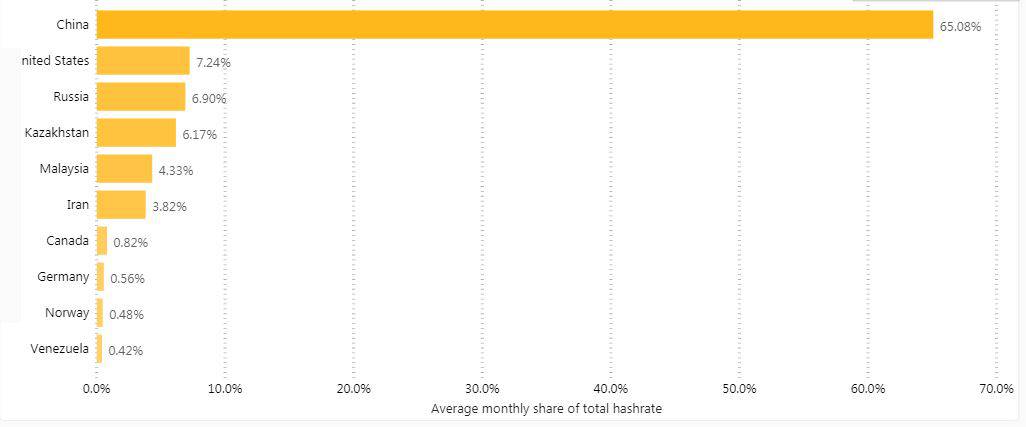

According to the Bitcoin Mining Map recently launched by a team from Cambridge University, the most populated nation in the world is responsible for 65% of Bitcoin’s hashrate.

Antonopoulos indicated that Chinese miners use primarily rigs powered by coal plants. However, he believes that the low cost of gas-fired or oil-fired power plants will urge coal-fired power plants to drop their prices as well, because “energy and electricity is a fungible commodity.” Therefore, declining oil prices could also benefit Chinese miners.

It’s also worth noting that the Chinese region Sichuan recently published a reform aiming to assist Bitcoin mining. It planned to utilize the vast water resources in the area and the advantages of hydropower resources to lower electricity prices even more.

The post Low Oil Prices Could Make US Bitcoin Miners More Competitive, Antonopolous Says appeared first on CryptoPotato.

The post appeared first on CryptoPotato