The controversy surrounding Binance’s acquisition of the leading cryptocurrency prices aggregator platform CoinMarketCap (CMC) has become more heated due to recent changes made by CMC.

Following the update in CoinMarketCap’s exchange ranking algorithm, several major crypto exchanges were stripped of their high rankings to unimaginable positions on the market table. CoinMarketCap is the world’s leading ranking platform and also one of the biggest websites in the industry. This is why positions on it matter a lot.

However, Binance has the perfect score and is currently ranked in the first position. This has raised eyebrows as many crypto users think that CMC is playing favoritism with Binance because of their ties.

Binance Reports Half Trading Volume

In response to a recent accusation of wash trading, Changpeng Zhao (CZ), the CEO of Binance, revealed what he described as a “little secret” about Binance to put an end to the continuous finger-pointing.

1 It’s the standard way in traditional exchanges

2 We like to “hide” our volume so that we are not seen as that much bigger. But we choose this from our day 1, when we were very small.Do we do wash trading? No.

2/2

— CZ Binance 🔶🔶🔶 (@cz_binance) June 8, 2020

According to CZ, while most cryptocurrency exchanges report 1 BTC trades as 2 BTC in volume (1 buy and one sell), Binance reports it as 1 BTC volume. It is not a new development for the exchange as the CEO further revealed that Binance has been doing so since it launched in 2017.

This would mean that Binance only reports half trading volume compared to what other crypto exchanges have been reporting. Even with that, Binance still has the highest trading volume and Binance Futures is quickly establishing itself as a leading derivatives platform.

Zhao said that they chose to do so because it is the standard method for reporting volumes in traditional exchanges. He also added that it helps them to “hide” their volume so that they “are not seen as that much bigger.”

CoinMarketCap’s New Metrics

Barely two months after Binance acquired CoinMarketCap for an undisclosed sum, accusations started flying around that the exchange is abusing the crypto data aggregator site to manipulate exchange rankings.

CMC decided to replace its default ranking of exchanges by Website Traffic Factor with new metrics to provide more accurate data.

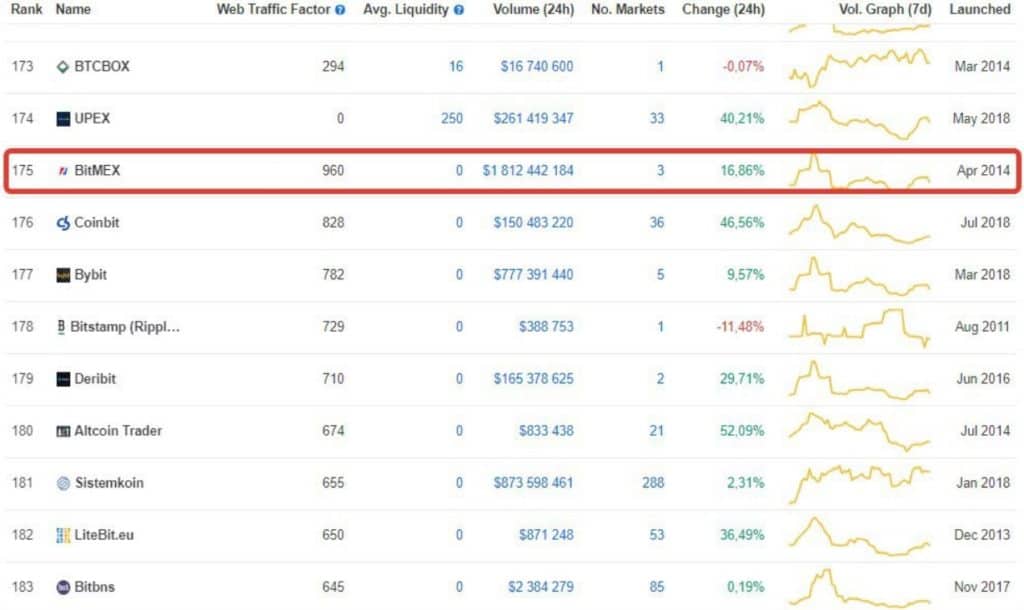

CoinMarketCap reported last week that it had completed the first phase of a new upgrade, but the result was not very pleasant as major exchanges, including BitMEX, now rank at the bottom of the table.

BitMex, one of the most popular exchanges and the king of the derivatives market, was pushed from the top of the ladder to 175th positions with zero liquidity on CMC’s exchange ranking table.

Other major trading platforms affected by the update include Deribit and Bybit as they currently rank 177 and 179 respectively, with both also having a liquidity score of zero.

CMC: New Metrics Do Not Apply to Derivatives Exchanges

The surprising deranking has raised concerns among members of the crypto community who are now questioning CoinMarketCap’s integrity.

Following the continuous backlash, the data tracking company quickly moved to clarify that the exchange ranking algorithm change only applies to spot trading pairs and exchanges. The aggregator claims it will make a separate page for derivatives exchanges like BitMex and Deribit.

The post CZ Reveals Shocking Secret About Binance Trading Volume As CoinMarketCap Controversy Gets Heated appeared first on CryptoPotato.

The post appeared first on CryptoPotato