Debit card provider and payment processor Wirecard AG, whose subsidiary issues visa debit cards for both Crypto.com and TenX, has failed to locate over $2 billion of lost assets.

The company’s stock prices continue plunging after the two banks supposedly holding the massive amount denied any business relationship with the German payments processor.

Wirecard AG In Trouble

The German-based firm revealed a worrisome issue on Thursday as the company’s decade-long auditor Ernst & Young was unable to confirm that €1.9 billion ($2.1bn) in company funds appeared on Wirecard’s trust accounts.

“There are indications that spurious balance confirmations had been provided from the side of the trustee respectively of the trustee’s account holding banks to the auditor in order to deceive the auditor and create a wrong perception of the existence of such cash balances or the holding of the accounts for the benefit of Wirecard group companies.” – the official statement explained.

The Financial Times claimed that the massive amount is equivalent to all the profits the group had declared since 2012. Wirecard said that if it fails to file the delayed audited financial statements by today – Friday, the company would be at the mercy of lenders who could terminate $2.1 billion worth of loans.

Analysts at Morgan Stanley estimated that the firm has available cash of around 220 million euros if it cannot locate the missing money.

Banks Deny Wirecard Connection While Stocks Nosedive

Another Bloomberg report noted that the two Philippines-based banks that were supposed to be holding the massive amount denied any business relationship with Wirecard. Nestor Tan, the CEO of the largest bank by assets in the country BDO Unibank Inc. said that “Wirecard is not even a depositor – we have no relationship with them.”

The report also indicated that The Bank of the Philippine Islands had issued a separate statement claiming again that Wirecard is not a client, but it will continue to investigate the problem.

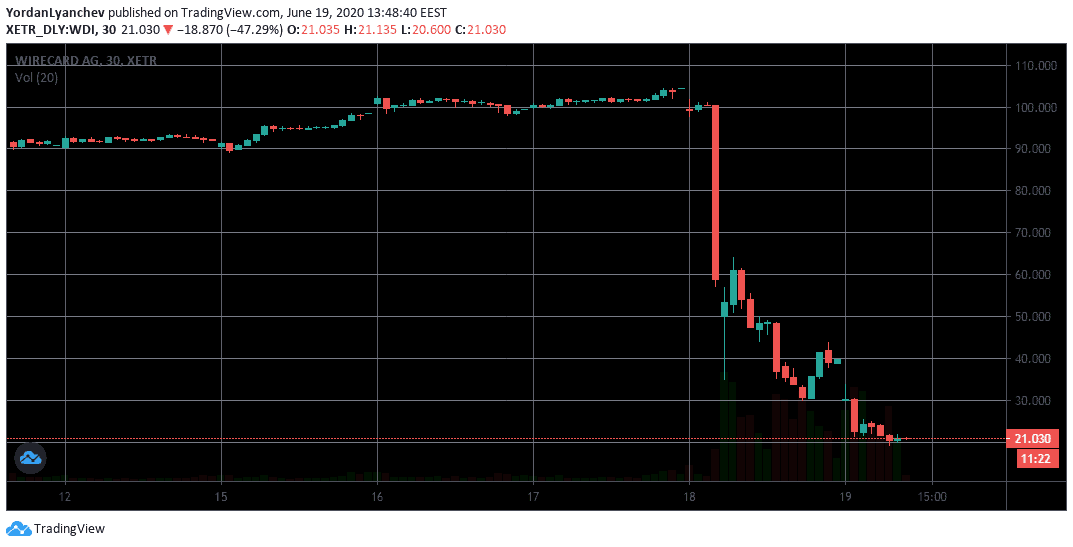

Somewhat unsurprisingly, the stocks of the company (WDI) felt the devastating effects of these events. At the start of the trading day on Thursday, WDI hovered around 100 euros per share. Shortly following the first batch of adverse news, they bottomed at 30 euros before recovering slightly to 40.

The bloodbath continues today, however, and the Wirecard shares are down to 21. This signifies a two-day plunge of nearly 80%.

As a result of the adverse developments, Wirecard CEO Markus Braun has resigned today with “immediate effect.” The interim CEO James Freis will replace Braun, who occupied the position for 18 years.

Crypto.com’s Visa Card Unaffected

As mentioned above, Wirecard has a presence in the cryptocurrency field. Its subsidiary Wirecard Card Solutions, issues TenX’s Visa Debit Card and Crypto.com’s MCO Visa Card.

While TenX hasn’t made an official announcement at the time of this writing, Crypto.com’s CEO, Kris Marszalek, took it Twitter to explain his company’s position. Ultimately, he refuted any assumptions that customers’ funds could be in any trouble at all, as they are held by an electronic money institution (EMI) regulated by the UK Financial Conduct Authority (FCA).

“Debit cards issued by Wirecard for Crypto.com are fully prefunded. These client fiat funds are held by an EMI institution regulated by UK FCA in segregated client accounts. The funds are held at another bank (not Wirecard) as required by the FCA.

To further clarify, Wirecard does not have custody of any crypto held by Crypto.com.”

The post Wirecard (WDI) Stocks Plunge 80% Following Cash Shortfall: Crypto.com’s Visa Card Unaffected appeared first on CryptoPotato.

The post appeared first on CryptoPotato