Bitcoin as a financial asset has drastically grown in popularity in the past few years. As adoption continues to grow and fiat on-ramps and off-ramps become easily accessible, Bitcoin’s user base has grown and diversified significantly. The past few years saw greater institutional interest. While the Hodl culture within the community continues to be dominant, users today are also wondering whether the asset can also be utilized for passive income.

Andreas Antonopoulos – popular Bitcoin advocate, in a recent discussion spoke about whether Bitcoin, as passive income, was a viable idea for many crypto users and the risks associated with crypto-based lending, DeFi, and other custodian services. He argued that while the community has always popularized hodling and has focused on price appreciation solely through market forces, Antonopoulos noted that appreciation can’t really be guaranteed. In terms of generating passive income via crypto assets without having to hand over your coin to another party, Antonopoulos highlighted,

“Another option without giving your coins to someone else is using a decentralized finance contract. What you could do is you could convert your Bitcoin into Ether or directly into Dai, which is a stable coin, and you could put it in a platform where you could lend out DAI and earn interest”

However, he noted that there is a level of risk users will have to undertake in such a scenario. He noted that the transition from Bitcoin to an Ethereum based platform comes with security risks, as both platforms aren’t necessarily the same in terms of security. Antonopoulos also pointed out,

“The underlying platform, which is Ethereum may have problems. It may have bugs. The consensus algorithm may have failures. You may have increases in the Gas price, which leads to other cascade problems. And all of those things can cause you to lose some or all of your invested capital.”

However, Ethereum’s DeFi ecosystem continues to be a highly active space for lending in recent years with earning mechanisms within DeFi; with Dai Savings Rate (DSR) Dai holders can earn a passive income by depositing Dai into the contract.

Earlier in the year, a report by DeFi Rate found that,

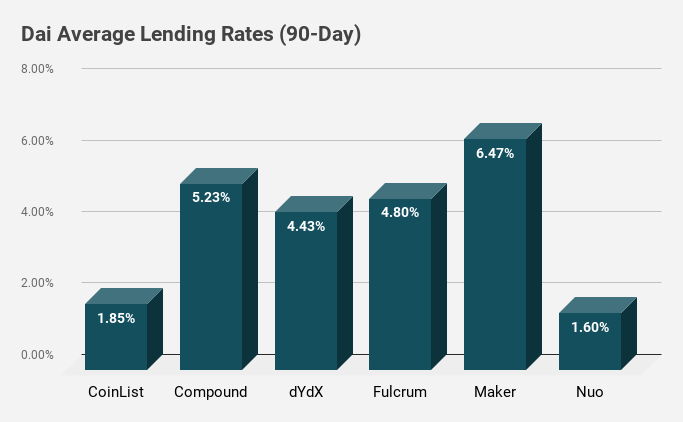

“Maker and the DSR have offered the highest yielding savings opportunity over the past three months – right when MCD was first introduced back in November 2019. Compound – the permissionless lending protocol – offered the second-highest returns on Dai holdings with a 90D average of 5.23%.

However, while the prospects of lending are lucrative, Antonopoulos noted that another major platform risk involves bugs in smart contracts, but noted that simply hodling crypto may not guarantee ROI and risks are inevitable.

Your feedback is important to us!

The post appeared first on AMBCrypto