Disclaimer: The findings of the following analysis should materialize over the next 24 hours

Since 24 June, XRP’s value has dropped under multiple short-term support levels on the charts, with bearish pressure having taken over the crypto-asset. Here, it should also be noted that of all the top 5 crypto-assets in the ecosystem, XRP continued to register the highest depreciation in value since reaching a June-high of $0.21.

With the 3rd quarter of 2020 now commencing, XRP could be looking at an extended downturn on the charts with more lower range consolidation.

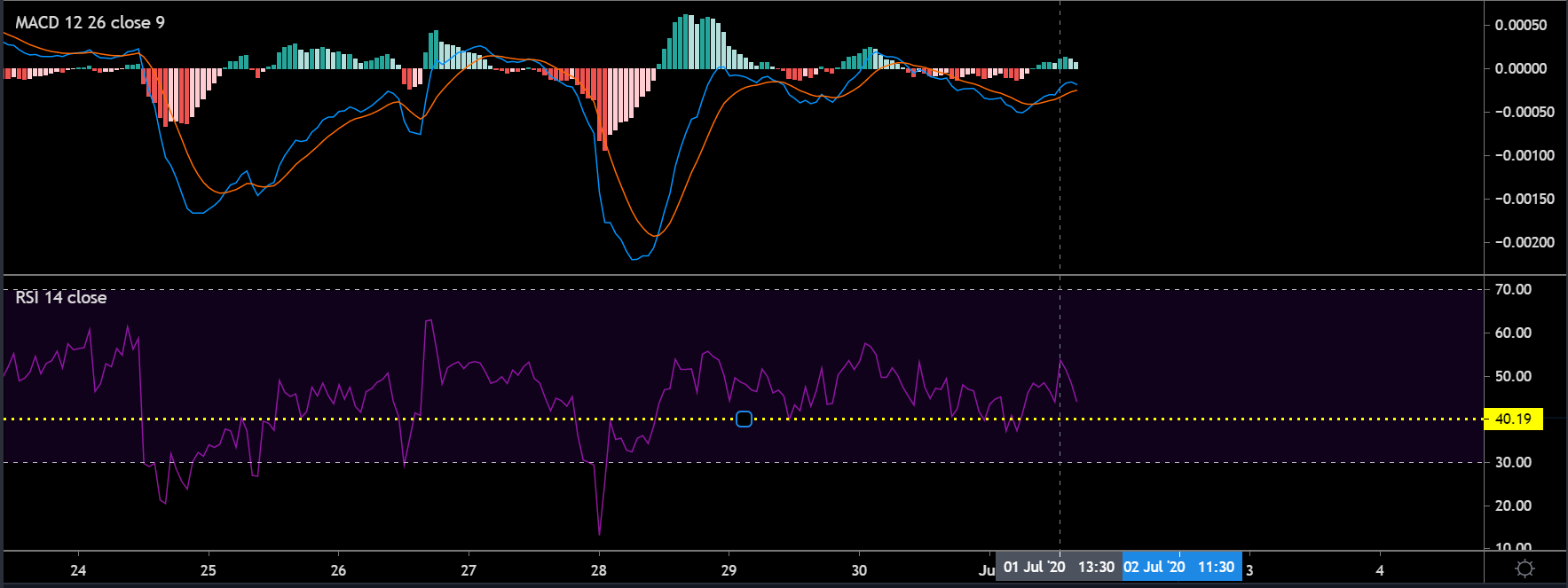

XRP 1-hour chart

Over the past 1 week, XRP has breached and tested a total of five short-term supports. The first decline came on 24 June, with the price falling below the $0.186 and $0.185 support levels. On 28 June, the crypto-asset collapsed under $0.181 and $0.178, following which, finally, a final re-test transpired at $0.173. Multiple support breaches are usually indicative of a strong bearish move. However, here, it is interesting to note that the token noted a bullish breakout after every falling pattern.

As illustrated, XRP briefly broke away from a falling wedge pattern to trigger a minor rise and something similar was observed, at press time. XRP appeared to break away from a descending channel pattern and the most likely re-test will be at the immediate resistance of $0.178. However, with strong overhead resistance provided by the 50-Moving Average, a re-test may possibly be difficult.

On the other hand, the MACD pointed to a bullish trend for the token as the blue line hovered over the signal line on the charts. Further, the selling pressure imbued in the market was evident by the falling figures registered by the Relative Strength Index or RSI.

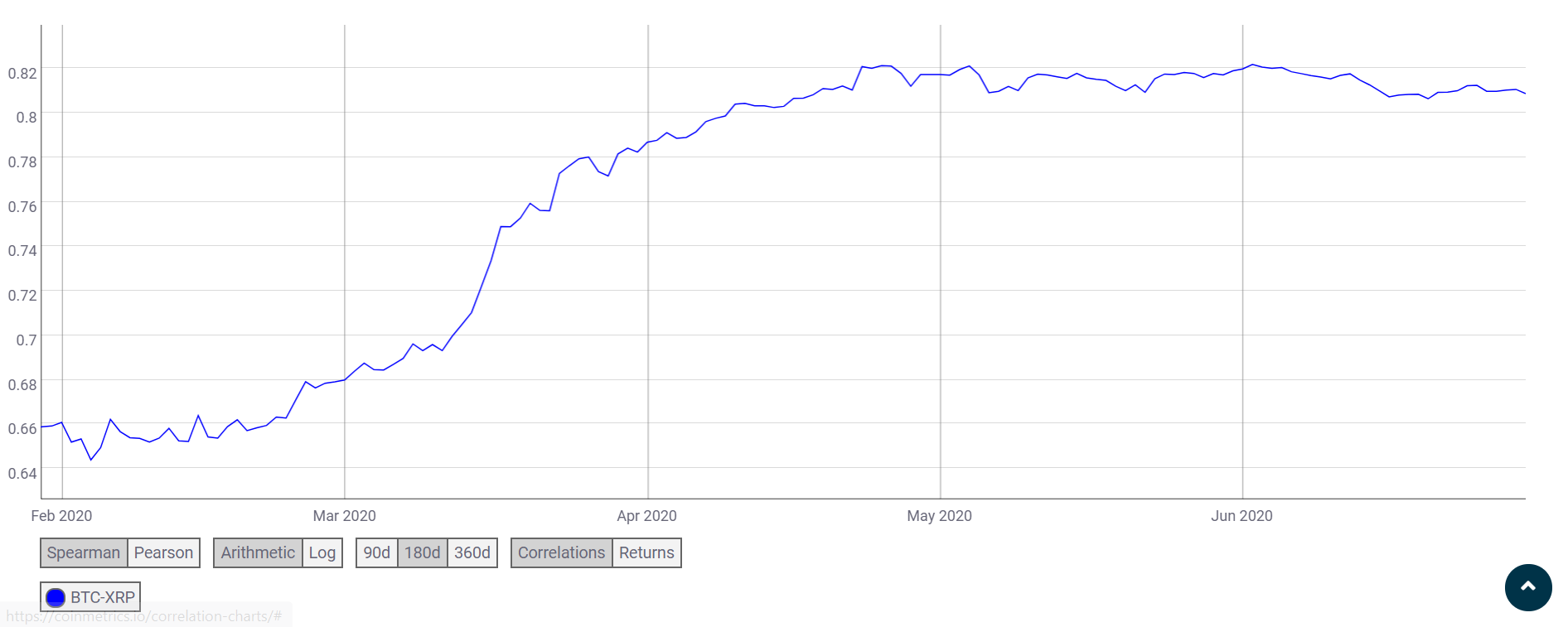

Source: Coinmetrics

The correlation indices between Bitcoin and XRP suggested that the world’s largest cryptocurrency was hardly dictating XRP’s present price movement, with the correlation index appearing more or less the same since May 2020.

Conclusion

XRP faces a re-test at $0.178 over the next 24-hours, but strong bearish selling pressure might stop the token in its tracks.

Your feedback is important to us!

The post appeared first on AMBCrypto