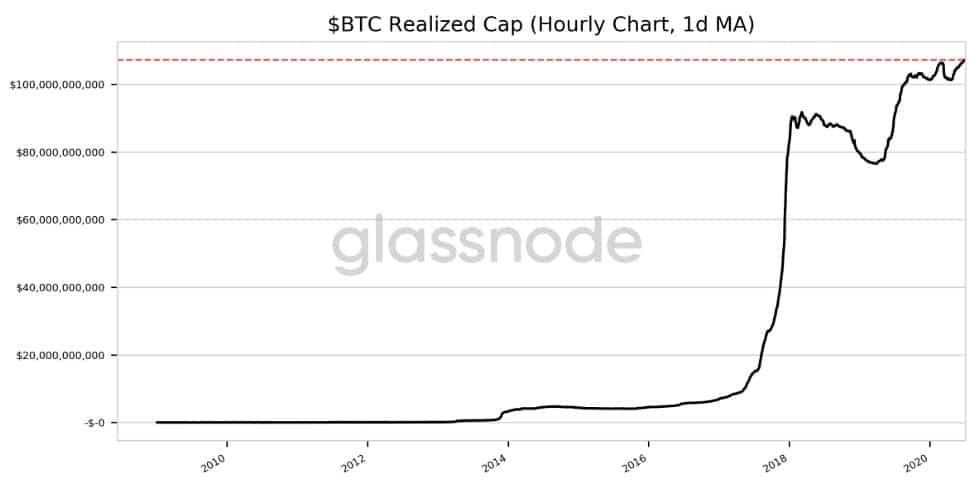

Bitcoin broke past its stagnant price trend dropping to sub-$9000 levels a few hours ago. But all is well as a V-shaped recovery quickly followed the fall, and Bitcoin’s realized cap hit a record of $107 billion today.

BTC’s Realized Cap Clocks New High, Tops $107 Billion

As per data from Glassnode alerts, the company’s Twitter account for on-chain crypto alerts, Bitcoin’s realized cap hit an all-time high of $107 billion.

This comes two weeks after the metric registered its earlier high on June 19.

Bitcoin Realized Cap (1d MA) just reached an ATH of $107,264,291,327.14.

Previous ATH of $107,263,226,837.97 was observed earlier today. – Reads the statement.

Unlike Bitcoin’s market cap seen on crypto ranking sites, the realized cap differs in perception as well as calculation.

Market cap is calculated by multiplying the current circulating supply by the latest market price. It does not rule out lost or unretrievable coins. The realized cap does that.

As per Glassnode, “realized cap values different part of the supplies at different prices (instead of using the current daily close). Specifically, it is computed by valuing each UTXO by the price when it was last moved.”

What Appreciating Realized Cap Actually Means?

Bitcoin’s realized cap achieving new highs on the same day when price registers a near $300 drop can mean only one thing. Investors are bullish and have a firm conviction in BTC’s long term growth.

Consummate cypherpunk, and one of Satoshi’s associates, Nick Szabo, said this when the realized cap metric touched the $100 billion mark last year in August:

The long-term chart reflects the superior deep safety, global seamlessness, and monetary soundness of Bitcoin.

Other On-Chain Metrics Show Bitcoin’s ‘Fundamentally Strong’

As reported by CryptoPotato, Bitcoin’s on-chain activities pertaining to transaction counts, new addresses, active addresses, and spent outputs reached new highs on July 1.

Glassnode CTO, Rafael Schultze-Kraft, pointed out four BTC statistics in a tweet. All these metrics charted new highs.

Quite the on-chain activity on #Bitcoin today –

Hourly New Addresses: 2-year high

Hourly Active Addresses: 1-year high

Hourly Transaction Count: 10-month high

Hourly Spent Outputs with Lifespan 24h: All-time high— Rafael Schultze-Kraft (@n3ocortex) July 2, 2020

Also, according to the latest update by the on-chain analysis firm, the number of Bitcoin addresses holding more than 0.1 BTC touched an ATH of 3,092,315.

Amidst all the institutional investment frenzy, this shows that retail investors are not staying behind.

Such impressive growth in on-chain metrics corroborates the aforementioned affirmation of investor trust in Bitcoin. Strong demand is paving the way for strong fundamentals.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato