Bitcoin’s price has been under $9.5k since 25 June. Despite the sideways movement, a rise in selling pressure pushed the price of the coin between $9.2k and $9k, however, the dull movement of price cost the BTC network to lose many miners due to heavy operational costs. According to data, the BTC miner’s revenue slipped almost 23% just from May to June. The overall revenue generated in May was $366 million which dropped to $281 million in June.

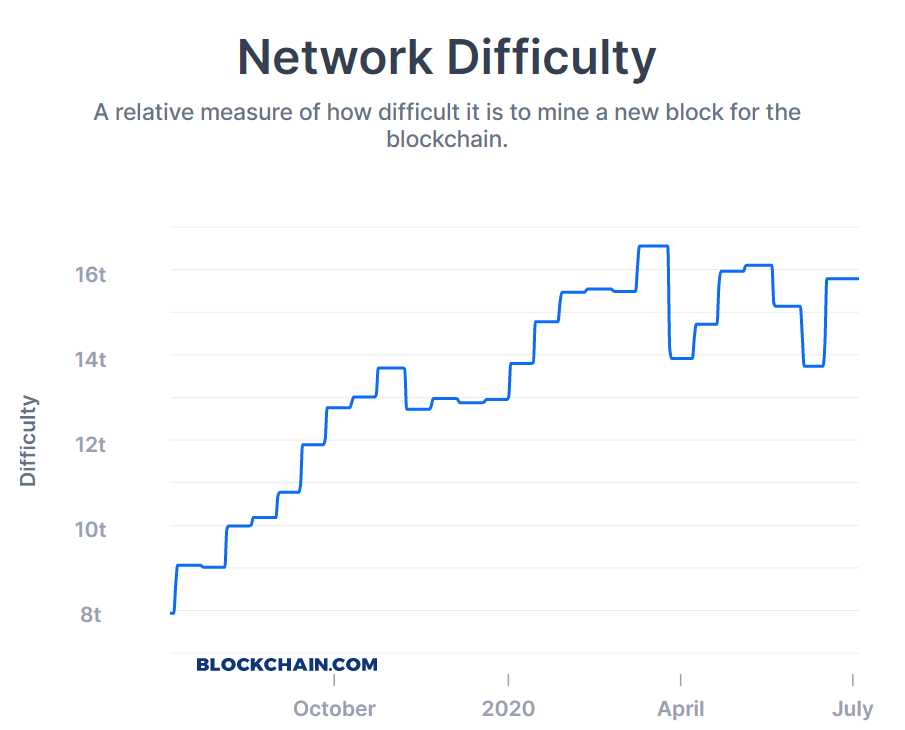

Source: Blockchain.com

As miners strived to generate economic revenue from mining, they focused more on acquiring updated mining equipment. This need for constant optimization also paved the way for industrialization of Bitcoin mining. As miners updated their systems from CPU to GPU to FPGA and finally switched to ASIC miners, the efficiency improved 74x between second and third halving, according to data provided by Coingecko.

Although the third halving weeded out the outdated players from the network, miners who had optimized systems, have been unable to break-even due to low BTC price. In order to profit, many miners moved out from the network to BTC fork coins like Bitcoin Cash and Bitcoin SV. As Binance launched its mining pool in April this year, it had noted an increase in BSV miners. It also became the top mining pool for the coin. In order to incentivize the BTC, BCH, and BSV miners, Binance Pool also announced the launch of profit-maximizing features on its “Smart pool.”

While moving to BCH and BSV was one option, many miners thought a geographical re-location could help them set the cost right. BTC network is heavily dominated by miners in China, and given the low cost of electricity in Sichuan province, miners gravitated towards it. Sichuan accounted for 54% of the global mining share in December 2019.

Apart from re-location, a more organic way to drive the miners back to the network was an adjustment in difficulty. When the month of June began difficulty dropped over 9% providing a relief to the miners and also saw a return of some old miners. According to data provider Glassnode, owing to the miners getting back in the game, blocks were being produced at a faster rate (almost 8 blocks per hour). However, when the next difficulty adjusted higher by 14.95%, one of the largest since January 2018, the network reached another stage of stagnation.

This pushed miners further away from BTC network and expected a turn around of the price to rejoin the network. Miners appeared to have shut their machines, for the time being.

Your feedback is important to us!

The post appeared first on AMBCrypto