Crypto Volumes Plummet in June

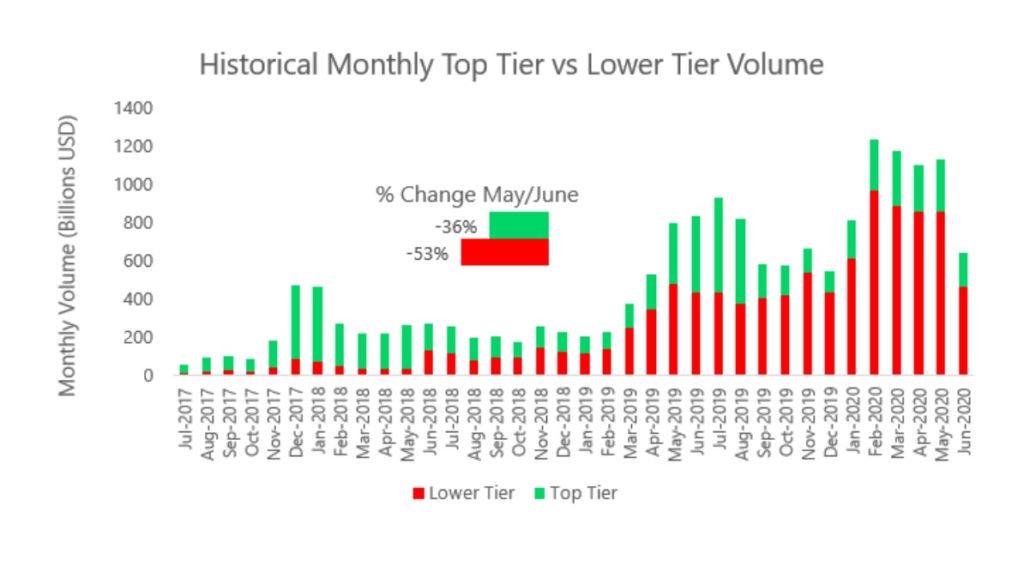

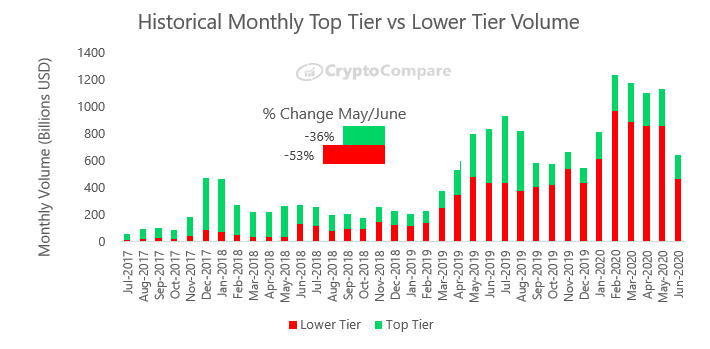

In June, both Top Tier volumes and Lower Tier spot volumes decreased drastically to $177bn (-36%) and $466bn (-53%) respectively.

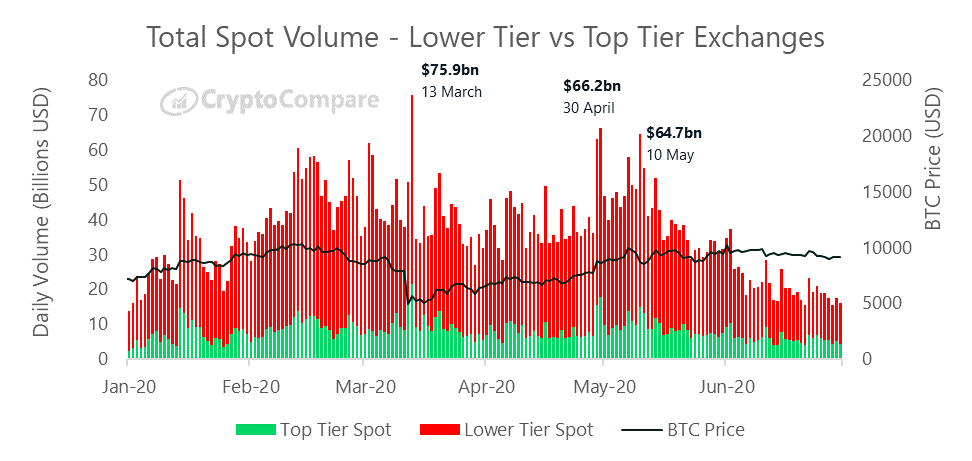

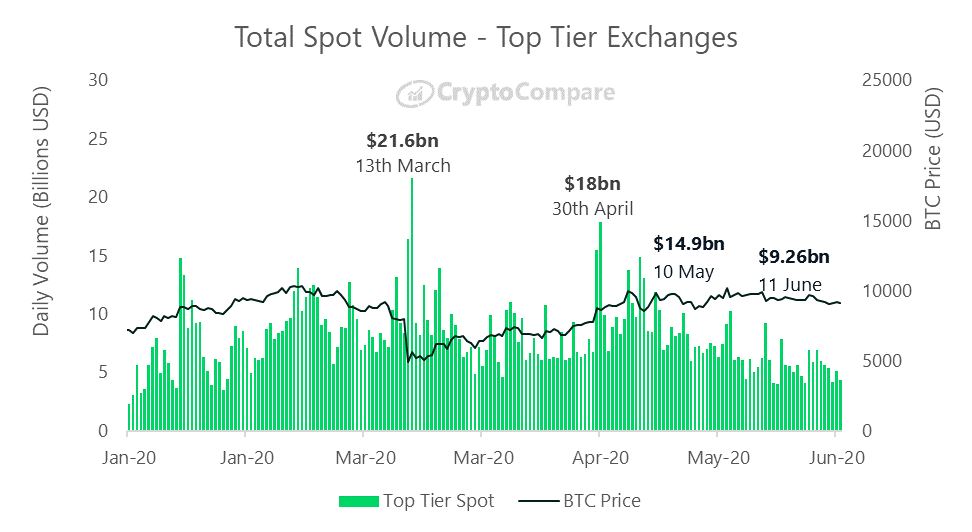

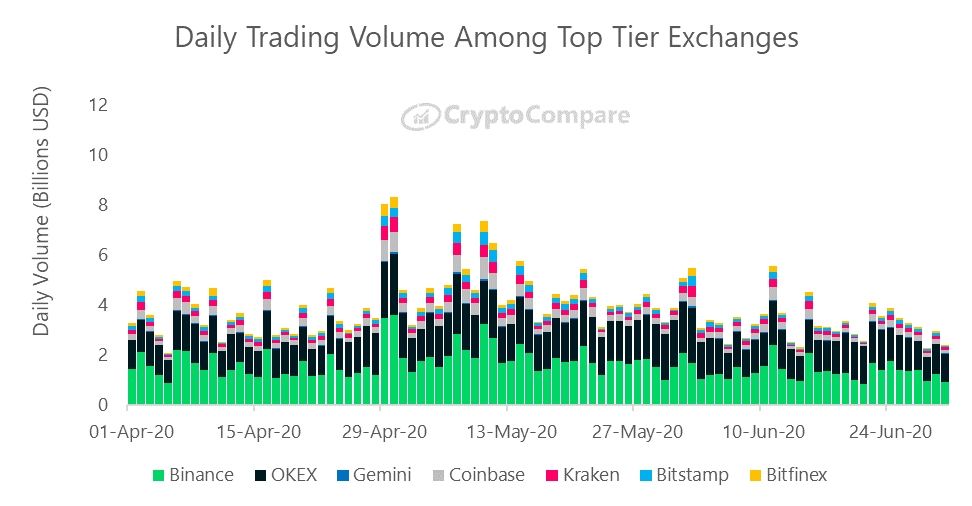

Spot volumes have gradually dwindled throughout the month of June, now representing roughly half of the daily volumes seen in the previous month.

Institutional Options Volumes on CME Hit New High

In June, CME total options volumes once again reached an all-time monthly high of 8,444 contracts traded up 41% since May, where 5,986 options contracts were traded.

In contrast, CME futures volumes have decreased since May by 23% (number of contracts) to reach 128,258 in June.

Crypto Derivatives Volumes See 2020 Low

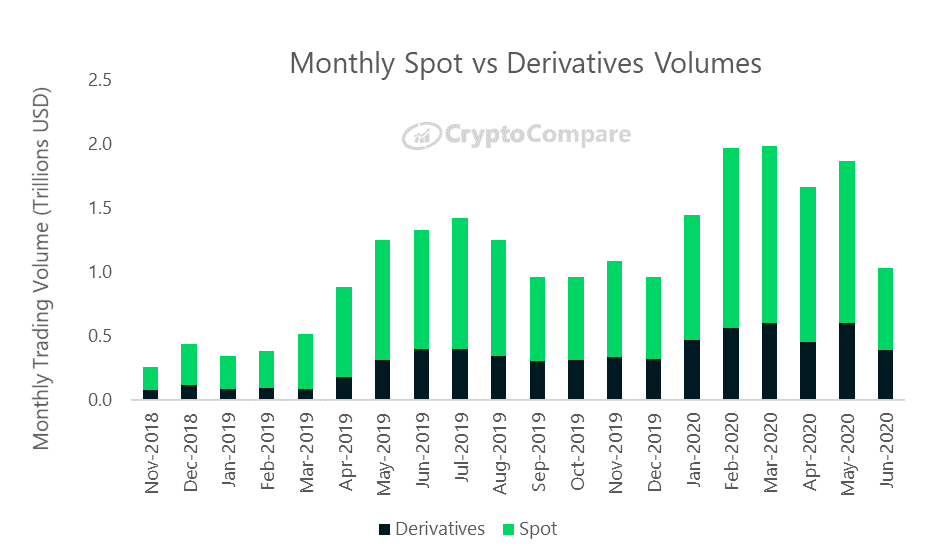

Crypto derivatives volumes dropped 35.7% in June to $393bn – the lowest monthly volumes in 2020. Meanwhile, total spot volumes have decreased by 49.3% to $642.6bn. As a result, derivatives have gained market share and represented 37% of the market in June (vs 32% in May).

Binance and OKEx Remain Top Players in Spot Market

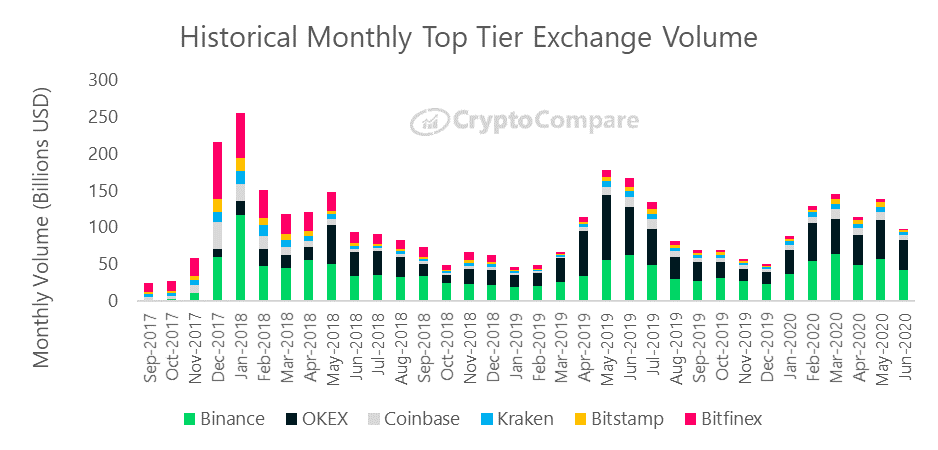

Binance and OKEX remained the top players in terms of volume in June relative to other Top Tier exchanges. Among the top 15 top tier exchanges, they currently represent approximately three quarters of spot volume.

Binance was the largest Top Tier exchange by volume in June, trading $41.8bn (down 19.6%). This was followed by OKEx trading $40.6bn (down 29.0%), and Coinbase trading $6.86bn (down 38.5%).

CryptoCompare’s Exchange Benchmark aims to serve investors, regulators and crypto enthusiasts by scoring exchanges in terms of transparency, operational quality, regulatory standing, data provision, management team, and their ability to monitor trades and illicit activity effectively. Rather than drawing attention specifically to bad actors, we instead highlight those that behave in a manner that is conducive to maintaining an efficient and fair market, ensuring greater safety of investors. We have hence introduced the notion of “Top-Tier” vs “Lower-tier” volumes.

In June, both Top Tier volumes and Lower Tier volumes decreased drastically to $177bn (-36%) and $466bn (-53%) respectively.

Spot volumes have gradually dwindled throughout the month of June, now representing roughly half of the daily volumes seen in the previous month. This has effected both Top Tier and Lower Tier volume.

Top Tier exchange volume, selected based on our rigorous Exchange Benchmark methodology, has decreased 36% overall in June. The highest recorded volume during June was $9.26bn.

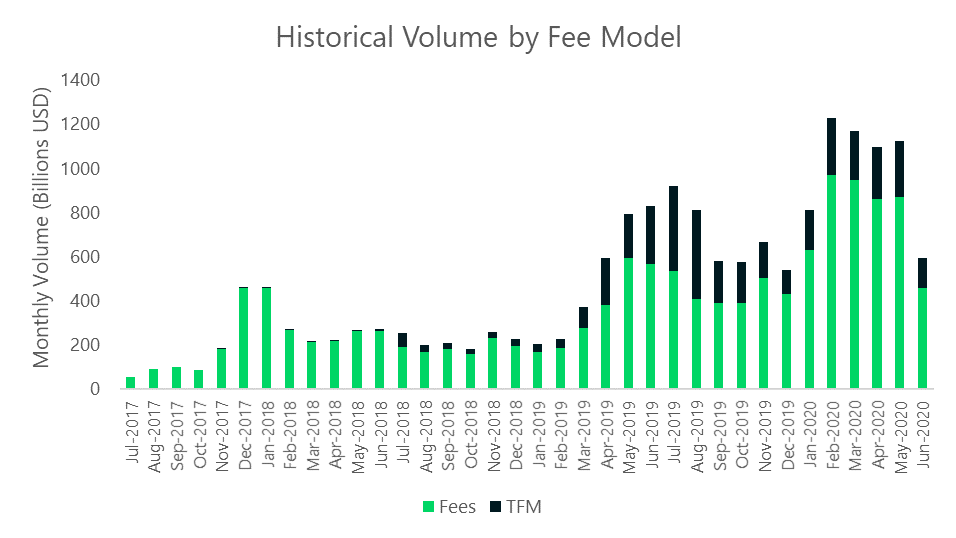

Exchanges that charge traditional taker fees represented 76% of total exchange volume in June, while those that implement Trans-Fee Mining (TFM) represented less than 23%. In May, fee charging exchanges represented 77% of total spot volume.

Fee-charging exchanges traded a total of $455bn in June (down 48% since May), while those that implement TFM models traded $141bn (down 45% since May).

In June, volume from many of the largest Top Tier exchanges decreased 35% on average (vs May).

Binance was the largest Top Tier exchange by volume in June, trading $41.8bn (down 19.6%). This was followed by OKEx trading $40.6bn (down 29.0%), and Coinbase trading $6.86bn (down 38.5%).

Binance and OKEx remained the top players in terms of volume in June relative to other Top Tier exchanges. Among the top 15 Top Tier exchanges, they currently represent approximately three quarters of the volume.

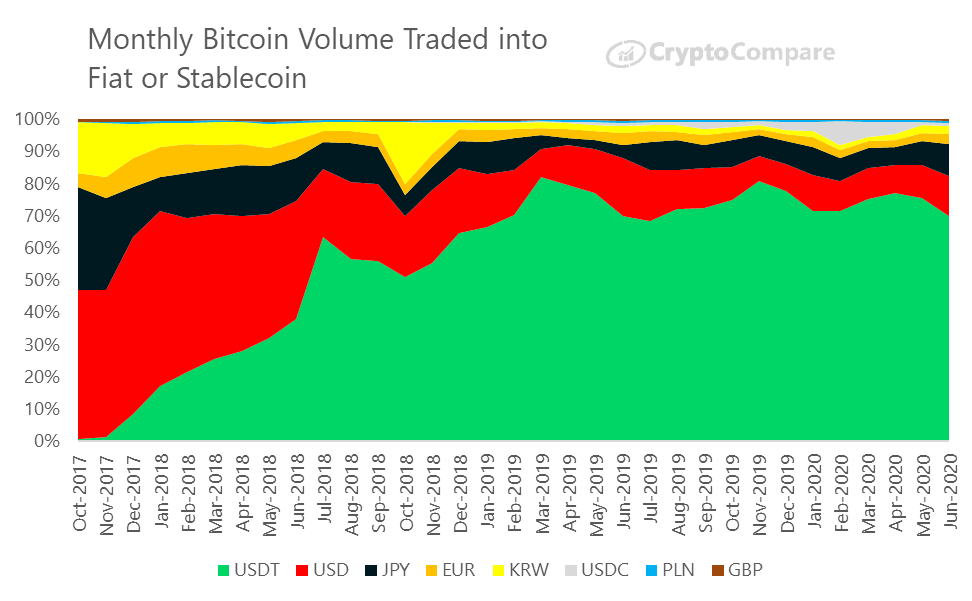

BTC trading into USDT decreased 56% in June to 6.47mn BTC vs 14.9mn BTC in May. Trading into USD and JPY also decreased to 1.12mn BTC (down 44%) and 0.92mn BTC (down 38%) respectively. The EUR and KRW markets decreased 45% and 50% respectively.

Stablecoins USDC and PAX also saw large decreases in total volume traded into BTC. BTC/USDC and BTC/PAX markets traded 76.9k BTC (down 57%) and 13.5k BTC (down 54%) respectively in June.

The BTC/USDT pair still represents the majority of BTC traded into fiat or stablecoin in June at 69%. However, its proportion of total volume in May was 75%.

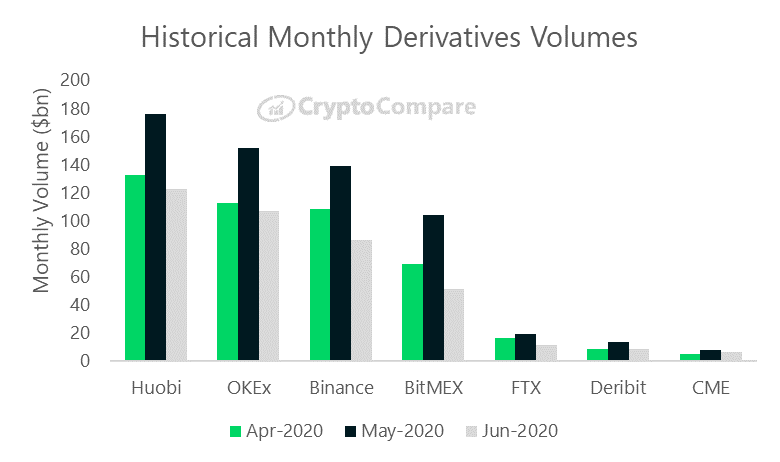

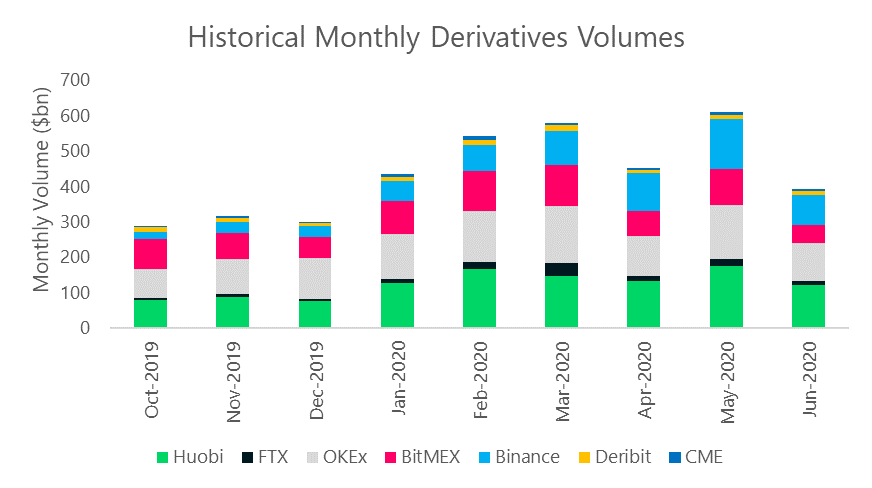

Derivatives volumes dropped 35.7% in June to $393bn – the lowest monthly volumes in 2020. Meanwhile, total spot volumes have decreased by 49.3% to $642.6bn. As a result, derivatives have gained market share and represented 37% of the market in June (vs 32% in May).

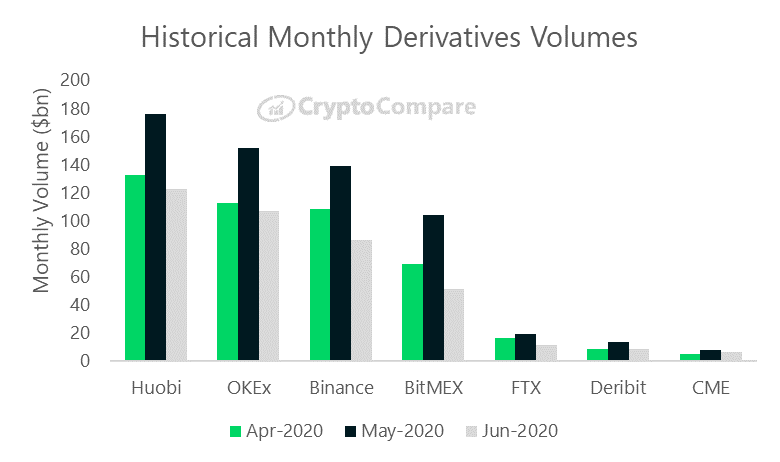

All derivatives exchanges saw large decreases in trading volume in June, with BitMEX decreasing the most proportionally (-50.3% to $51.6bn). In contrast, institutional player CME decreased the least (-16.6%) totalling $6.65bn in June.

Huobi maintained its status as the largest derivatives exchange in June by volume, and traded $122.4bn (down 38.3% since May). OKEx and Binance followed with $106.9bn (down 30.4%) and $85.9bn (down 34.2%) respectively, while Deribit saw a decrease of 43.4% to $8.8bn.

The maximum daily trading volume in June was $23.8bn, which occurred on the 1st. This represents over 50% of the highest volume in April ($39bn on 30th of April), and 32% of the highest volume in May ($35bn on 10th May).

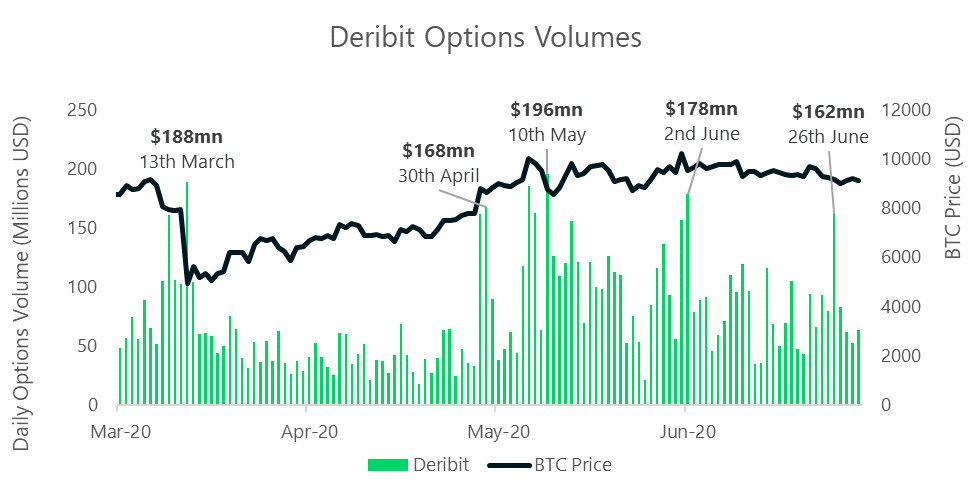

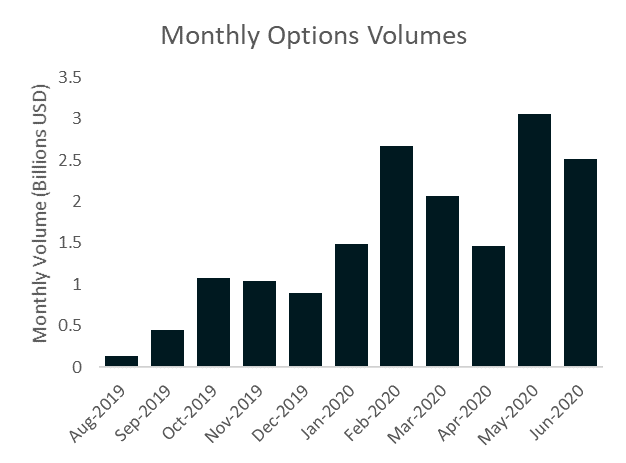

Deribit monthly options volume saw a 17.8% decrease in June, but this is less of a decrease than seen on other derivatives exchanges that only offer futures products. In June, there were two major peaks in volume – the 2nd ($178mn) and the 26th ($162mn). These volumes are comparable to the daily records seen in previous months.

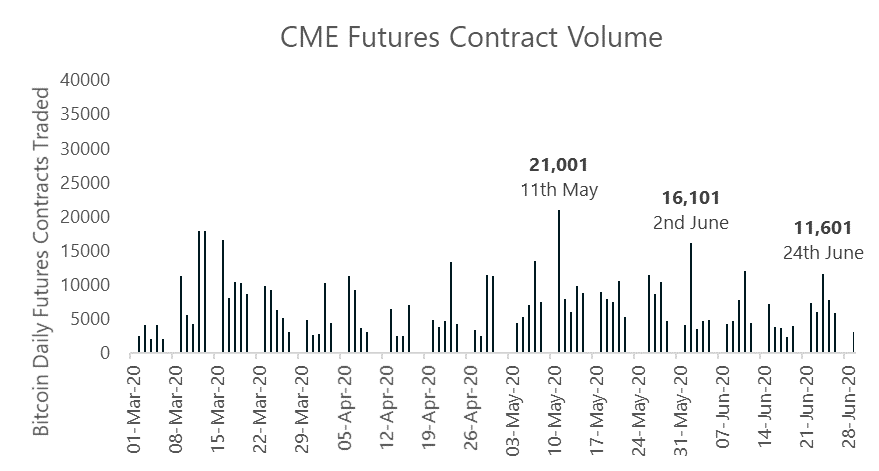

CME futures volumes have decreased since May by 23% (number of contracts) to reach 128,258 in June. Futures contract volume reached a daily high of 21,001 contracts traded on 11th May, while June saw a maximum of only 16,101 contracts traded on the 2nd of June.

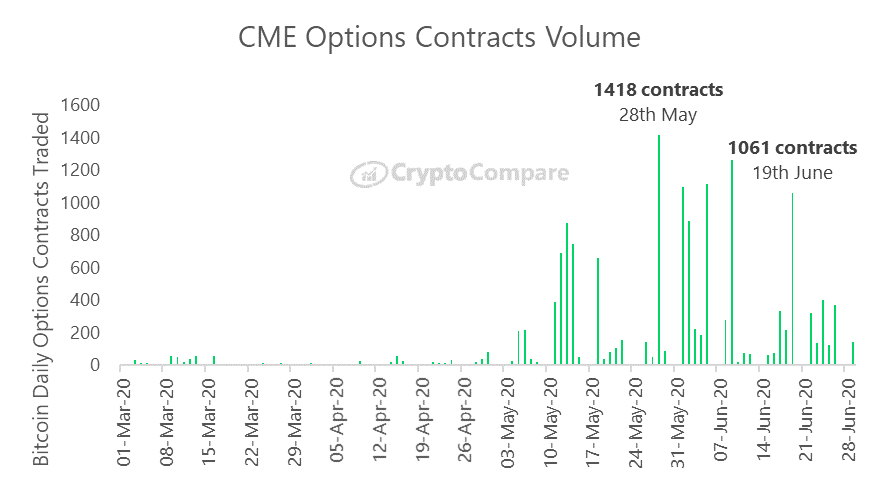

Meanwhile, in June CME total options volumes once again reached an all-time monthly high of 8,444 contracts traded (up 41% since May). In May, 5,986 options contracts were traded. Despite the monthly record, daily options contract volumes did not reach an all-time high. The highest daily volume recorded in June was 1,061 contracts on the 19th (vs 1,418 on 28th May).

In terms of total trading volume in June, CME’s volumes have decreased 16.6% to reach $6.7bn. This is a less significant decrease than any other derivatives exchange in June.

Related

The post appeared first on Blog BitMex