Bitcoin’s price hasn’t really made the breakthroughs most investors were expecting it to make after the block reward was halved for the third time this year. Despite Bitcoin’s lackluster price action, investor confidence in the coin hasn’t taken a significant beating, with the same evidenced by the overwhelming holding sentiment within the Bitcoin ecosystem.

Interestingly, in a recent interview, Rafael Schultze-Kraft, CTO of Glassnode, argued that while investor confidence seems to be strongly behind the price action of the king coin, whale accounts continue to play a significant role in determining that sentiment. Schultze-Kraft, while expanding on what he meant by whales (Accounts with over 1000 BTC), also spoke about the age of the UTXOs that hadn’t been moved and his personal analysis of HODL waves. He said,

“Those that haven’t been moved in two years is 45%. Almost half of the circulating Bitcoin supply – so 9 million or so haven’t been moved in in the last two years, which really shows you a really good indication of how much is actually hodled.”

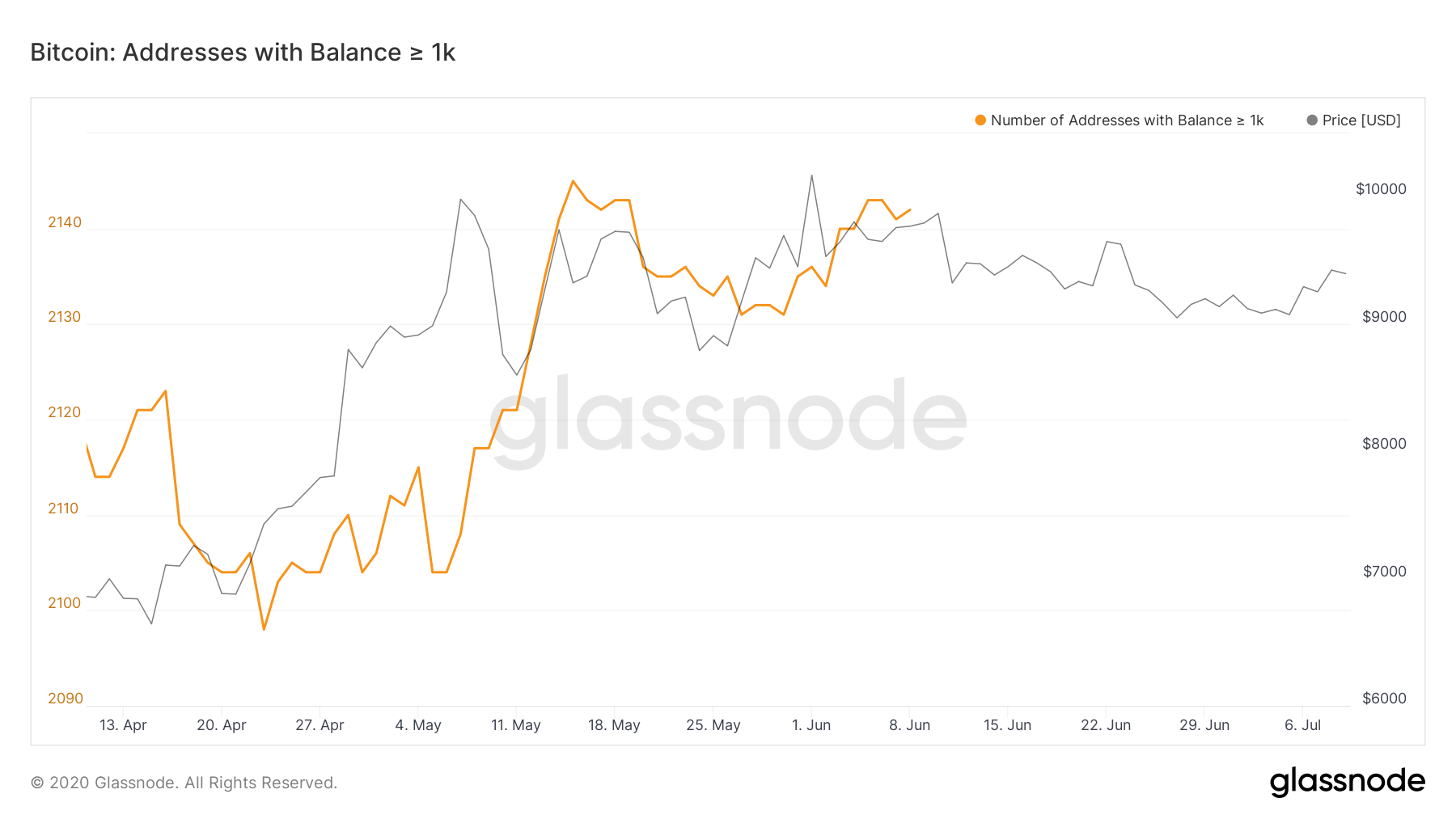

Schultze-Kraft also noted that whale accounts within Bitcoin had been decreasing slightly over the past couple of years. However, 2020 saw the same noting a small reversal, with the charts noting a marginal increase. He added,

“I think the more interesting part of all of this is that it is essentially inversely related to the amount of, Bitcoins that are being withdrawn from exchanges. It’s not just that those are inversely related, but that we actually see that those Bitcoins are going into entities that hold that are essentially classified as whales.”

Source: Glassnode

Interestingly, while Bitcoin did take a substantial hit in terms of its price a few months back on 12 March, whale accounts have recorded substantial growth since. Despite Bitcoin being stuck well below the coveted $10k price level, accounts with over 1000 BTC seem to be increasing and backing the coin, normally taken to be a sign of the price appreciating in the coming months.

However, the rise in the number of whales raises a few concerns, most notably the risk of centralization and possible price manipulation. Speaking on the former, Schultze-Kraft, while noting that investor confidence is always a boon, said that the growth in whales accounts does pose a risk of centralization within the Bitcoin community.

“Roughly 1800 whales and those are holding over 5 million Bitcoin. So there is, there is quite, quite some centralization within, those big players. That doesn’t show the decentralization that we would want to see going forward at the same time it shows confidence in big players who hold on to these large stashes of Bitcoin.”

The post appeared first on AMBCrypto