Bitcoin has been consolidating on the charts for over 40 days now, with its present movement in a way similar to the pattern traced just before a crash. However, while the community continues to remain optimistic due to the recent surge in the price of the market’s altcoins, BTC’s fate, at least in the short to mid-term, seemed bearish, at the time of writing. With Bitcoin’s dominance on the backburner for now, altcoins seemed to have taken over the crypto-ecosystem.

Bitcoin Daily Chart

Source: BTCUSD on TradingView

From the attached chart, the formation of a descending triangle, one forming since early-June, can be clearly observed. As the price nears the end of the triangle, it gets more congested and coiled, which only prepares it for the breakout. With the pattern’s inherent bias towards the bears, the breakout will likely push the price of Bitcoin down.

As for how much or how far BTC will drop, there are 3 targets – $8,109, $7,469, and $6,433. Out of these, the first and second targets have more chances of being achieved, while the last target seems unlikely considering the depth from the press time level. The first two levels would mean a drop of 13% – 21% from current levels. Therefore, it is better to wait until the price retraces back into the pattern as, at the time of writing, BTC’s price had broken out of the pattern.

Further, the RSI indicator also seemed exhausted as it approached the 50-level, signifying the buyers running out of steam. A small retracement seemed more likely, a development that will push the price back into the consolidation pattern.

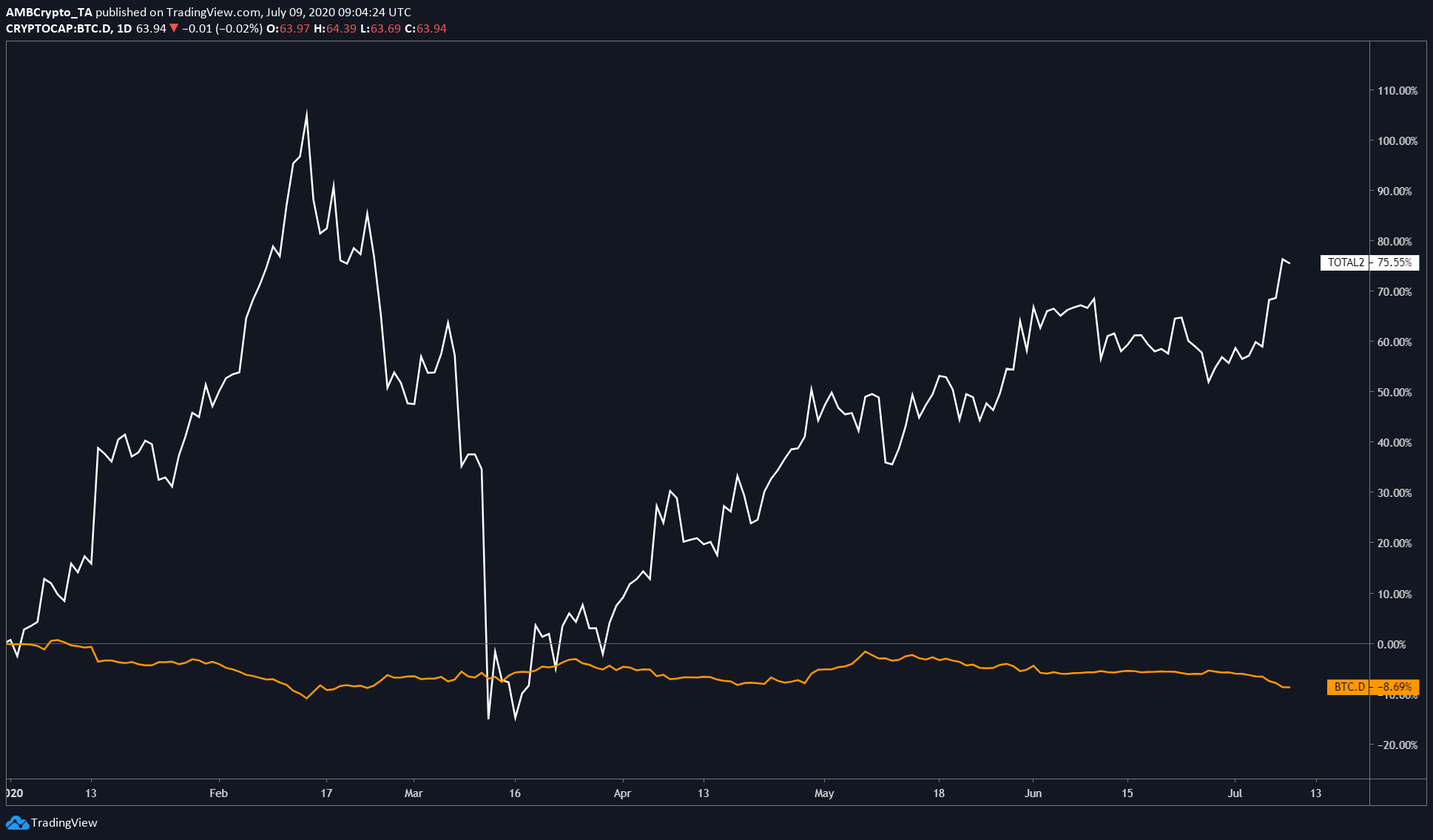

Bitcoin’s dominance

Source: BTC.D on TradingView

Bitcoin’s diminishing market dominance stood at 62%, at press time, a decline which allowed the market’s altcoins to surge. As seen above, since the start of 2020, BTC’s dominance has noted a -8.69% performance while altcoin dominance [white] has soared through the roof by improving by 75.55% This finding highlights the emerging trend of altcoins.

The retracement many of these altcoins are registering could be a good time to start accumulating one’s bags with shitcoins. That is, at least until Bitcoin wakes up from its hibernation and begins its much-awaited uptrend.

The post appeared first on AMBCrypto