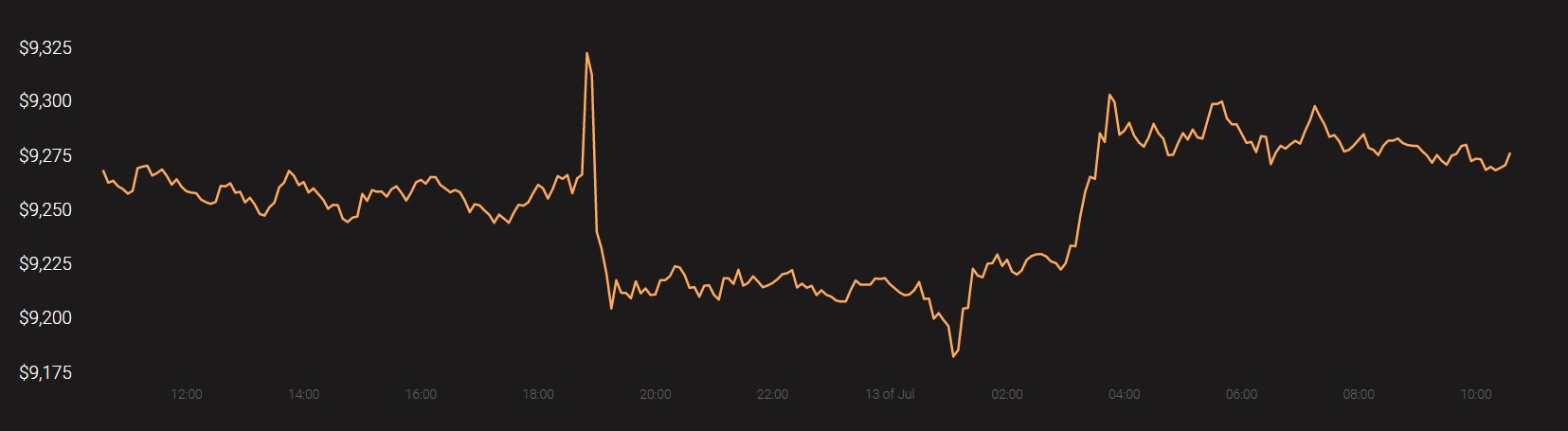

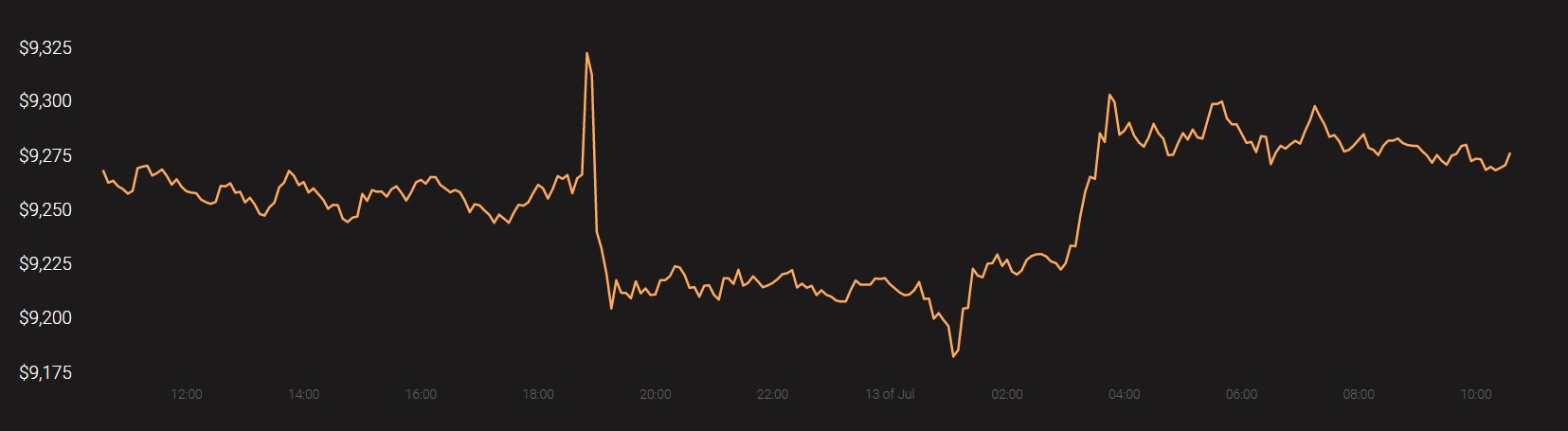

Bitcoin, the world’s largest and most-recognized cryptocurrency, continues to trade with low market volatility on the charts, with BTC, at the time of writing yet to breach its longstanding resistances. The crypto’s movements over the last 2 weeks or so have been very contrary to the expectations many had from the king coin, especially since it has been a few months since its third block reward halving.

Source: Coinstats

While usually, one would expect the market’s altcoins to take their cue from the performance of Bitcoin, overwhelmingly, many of these cryptocurrencies seem to be defying that trend. The likes of Ethereum Classic, Dogecoin, and Chainlink are among those to buck this trend.

Ethereum Classic [ETC]

Source: ETC/USD on TradingView

Ethereum Classic, the fork of the market’s largest altcoin, has been on a steady downtrend for a long time now, one extending since it hit its immediate resistance right before June. However, Bitcoin’s brief hike on the 6th of July was heaven-sent for the crypto, with ETC climbing by over 17% on the back of the aforementioned pump. Unlike Bitcoin, not only was its hike more significant, but it had also gained on its price levels from over two weeks ago.

The effect of Bitcoin’s uptick on the 6th was still being felt by the ETC market at the time of writing. While the mouth of the Bollinger Bands continued to remain wide, MACD line was climbing over Signal line on the charts.

The popular fork was in the news recently after Ethereum Classic revealed that over 69% of all accounts bought ETC near its 2018 all-time high. So much for buy low, sell high, right?

Chainlink [LINK]

Chainlink, now the 10th largest cryptocurrency in the market, has been one of the market’s best-performing cryptos this year, noting YTD returns upwards of 345%, at the time of writing. Such a rate of return would be incredible for any cryptocurrency, let alone one that is in the top-10 of the market and has a liquid market cap of $7.8 billion, only behind Bitcoin and Ethereum.

While Chainlink has been on a steady uptrend since the month of April, the same gained steam in the month of June, before shooting up exponentially in the month of July. In fact, in the last 7 days alone, LINK had hiked by over 49% on the charts.

The magnitude of the crypto’s rise was evidenced by its indicators. While Parabolic SAR’s dotted markers were well below the price candles, Chaikin Money Flow could be seen surging on the charts, highlighting increasing capital inflows into the market.

It has been speculated that LINK’s price movement was driven by news that the recently-launched Blockchain Service Network in China had integrated Chainlink’s Oracles, with the crypto’s daily active addresses peaking in the process too.

Dogecoin [DOGE]

Source: DOGE/USD on TradingView

The Internet’s favorite meme-coin seemed to have taken the crypto-community by storm after a TikTok-driven effort saw DOGE climbing the charts exponentially. However, this wasn’t to last as at the time of writing, DOGE had fallen by over 25%, after noting a hike that was worth almost 85%.

Dogecoin’s market indicators underlined the trend reversal in the market. While Awesome Oscillator was picturing some bearish momentum, Relative Strength Index had plummeted towards the oversold zone, before stabilizing, as soon as corrections began.

On the development front, not only was DOGE listed as MegaDogecoin on Bitfinex, but Binance announced Dogecoin perpetual Futures contracts with 50x leverage too.

The post appeared first on AMBCrypto