With a bit of delay following the Twitter hack, Bitcoin finally sees a slight movement downwards to $9,100. Interestingly, this time the three major US stock market indexes decrease in value with a similar percentage.

The situation appears much more favorable in the low-cap altcoin market, as massive gainers include Aurora, Ampleforth, and Algorand.

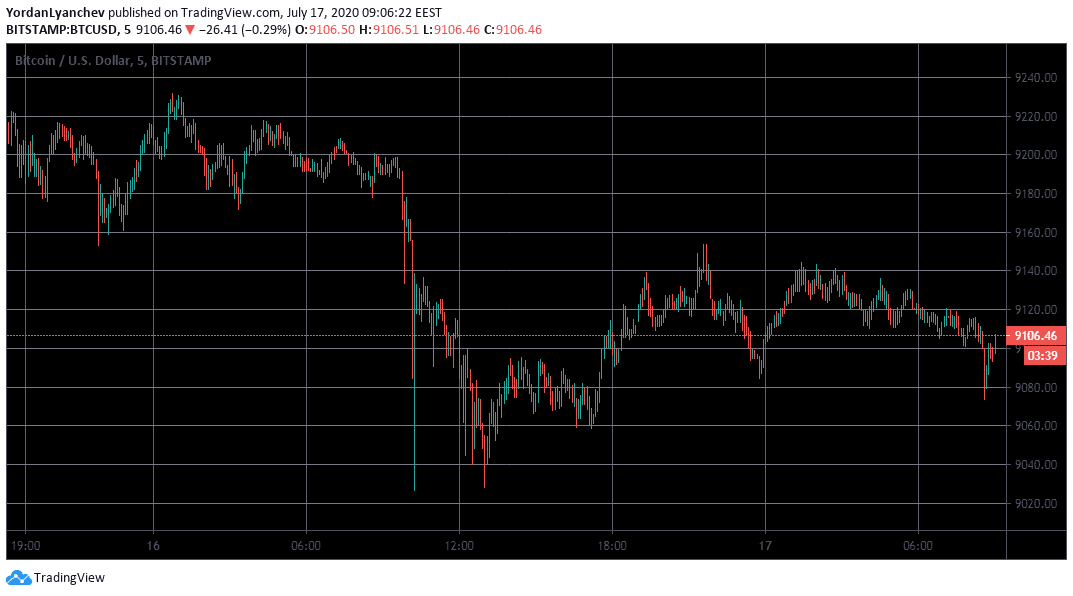

Bitcoin With A Quick Dip

Following the most discussed topic of the infamous Twitter hack from a few days ago, BTC’s involvement remained unnoticed, and the asset stayed at a familiar level of $9,200.

While media from all across the world covered the story and demanded answers from the social media giant, the company quietly inserted restrictions blocking users from posting tweets containing strings of letters and numbers.

Despite this being a precautionary measure against publications of cryptocurrency addresses linked to similar “giveaway” scams, it also blocks even legit digital asset addresses.

Adding the increasing attention from all the media coverage, BTC reacted by a brief dive from $9,200 to $9,040 on some exchanges. However, it has mostly recovered since then and is trading now at $9,100. Hence, Bitcoin’s position in this $9,000 – $9,300 range remains firm.

It’s worth noting that after such a massive hack and global exposure, Twitter’s stocks remained relatively stable. The 4% drop in the futures was quickly disbanded, and TWTR lost just 1% during yesterday’s trading session.

The most prominent US stock market indexes also charted some insignificant decreases. The S&P 500 is down by 0.34%, the Dow Jones by 0.5%, and Nasdaq lost 0.73%.

Low-Cap Altcoins Pump It Up

The majority of the top 20 coins also lose some value, similarly to Bitcoin. Those include Ethereum (-1%), Ripple (-1.3%), Cardano (-3.3%), BitcoinSV (-3.8%), and Monero (-4.26%). Naturally, exceptions exist, such as Chainlink and Stellar. LINK increases again by nearly 3% towards $8,44, while XLM goes up by 9% to above $0.1.

The situation with the low-cap altcoins, however, is significantly different. Aurora (AOA) is touching $0,020, after another notable increase of 37% today. Ampleforth (AMPL) is also a massive gainer. It skyrockets by 39% and is currently trading at $2.55.

The most popular US-based cryptocurrency exchange Coinbase announced the listing of Algorand earlier. Somewhat expectedly, the native cryptocurrency (ALGO) surged by 22% following the news to $0.35.

Other double-digit percentage gainers include Aave (19%), Flexacoin (14.5%), and Synthetix Network (13.95%).

In contrast, SwissBorg is losing the most substantial chunk of value today by 8%, after yesterday’s increase. Verge and Nexo are also dropping by approximately 6.5%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato