According to a recent report, three US-based cryptocurrency exchanges, namely Gemini, Coinbase, and Kraken, remain the platforms with the highest-ranking during Q2 2020.

The paper also added that only 15% of exchanges claimed that they store more than 95% of their digital asset holdings in cold wallets.

Top-Rated Cryptocurrency Exchanges

In its July report analyzing the performance of most cryptocurrency exchanges, CryptoCompare has utilized several features to separate and grade them. Those include security, legal/regulatory, KYC/transaction risks, the team behind the project, data provision, asset diversity, market quality, trading incentives, and negative events.

Each of those provides a certain number of points, ultimately leading to receiving a grade with AA being the highest to F being the lowest. The paper’s final data revealed that only two exchanges qualified for the AA grading – the two US-based platforms Gemini and Coinbase.

The document outlined that what prompted the two platforms to stand out from the rest were their regulations, as both of them have been licensed as money transmitters for years.

Coinbase is also registered as a money services business with the Financial Crimes Enforcement Network (FinCEN), while also having a specialized license for cryptocurrency businesses from the Department of Financial Services (DFS), called BitLicense.

Gemini obtained a trust charter from the New York State Department of Financial Services a year after its establishment. These precise qualities also helped Coinbase and Gemini become the first cryptocurrency-oriented clients of the giant US multinational bank – JPMorgan Chase.

The third spot goes to another US-based veteran exchange – Kraken. Other prominent cryptocurrency platforms graded with A include Bitstamp, Binance, and Bitfinex.

As far as decentralized exchanges (DEXs) go, the slightly different examination methodology has placed Binance DEX at the first spot. Switcheo, IDEX, DDEX, Uniswap, and Bisq follow.

Top-Tier Exchanges Are Outperforming Lower-Tier

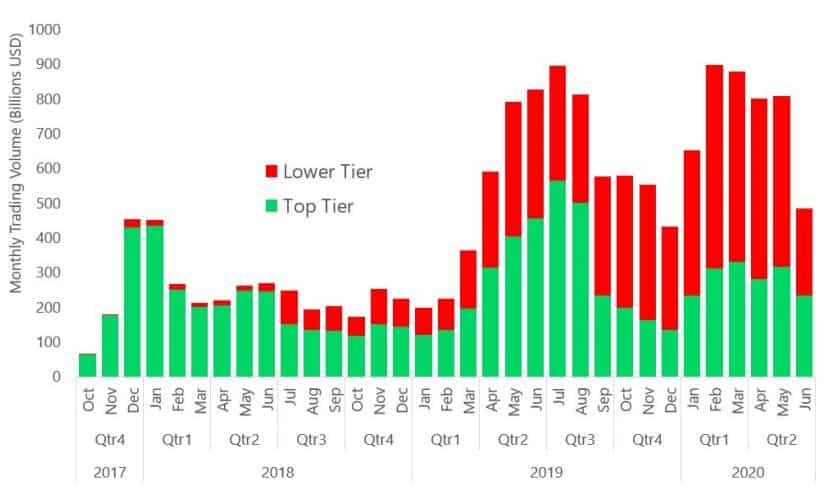

CryptoCompare also classifies digital asset platforms into two groups by their grading. Those rated as AA/A/BB/B, like the ones mentioned above, are categorized as Top-Tier, while the others with C/E/F are the so-called Lower-Tier.

Ultimately, the research concluded that “Lower-Tier exchanges have continued to lose market share to Top-Tier exchanges quarter on quarter.” During Q4 of 2019, Top-Tier platforms accounted for approximately 32% of the total trading volume. In Q1 2020, the percentage went up to 36, while in Q2 2020 – it’s at 40%.

Consequently, this means that despite Lower-Tier exchanges being a lot more, their trading volume market share has dropped from 68% to 60% from the end of 2019 to Q2 2020.

One slightly worrying statistic from the most recent report revealed that “only 15% of exchange state that they hold more than 95% of crypto in cold wallets.” Yet, 12% have noted that they use a third-party custody provider to store users’ funds, which has increased from 9% in Q4 2019.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato