Decentralized finance (DeFi) is all the rage in 2020 as projects in the field continue to explode. The total value locked in lending protocols has skyrocketed throughout the year.

And while there are plenty of exciting projects, one seems to stand out with its unique approach.

The project in question is Ampleforth (AMPL). It addresses a few problems that even Bitcoin, being the primary and most widely-adopted and perhaps, understood, cryptocurrency, has.

But for AMPL to make sense, let’s dive into some of the challenges that traditional fiat currencies and even Bitcoin have.

What’s Wrong With Fiat?

Fiat currency is currently what we’re used to when it comes to exchanging goods and services. If you want to buy an item or someone to do something for you, then you’d typically have to pay them using fiat currency. So far, so good.

According to Investopedia, the United States is currently the country with the highest GDP, meaning it’s the largest economy. Its currency, the US Dollar, is also known as the world’s reserve currency, and it accounts for about 88% of the daily trades in the foreign exchange market.

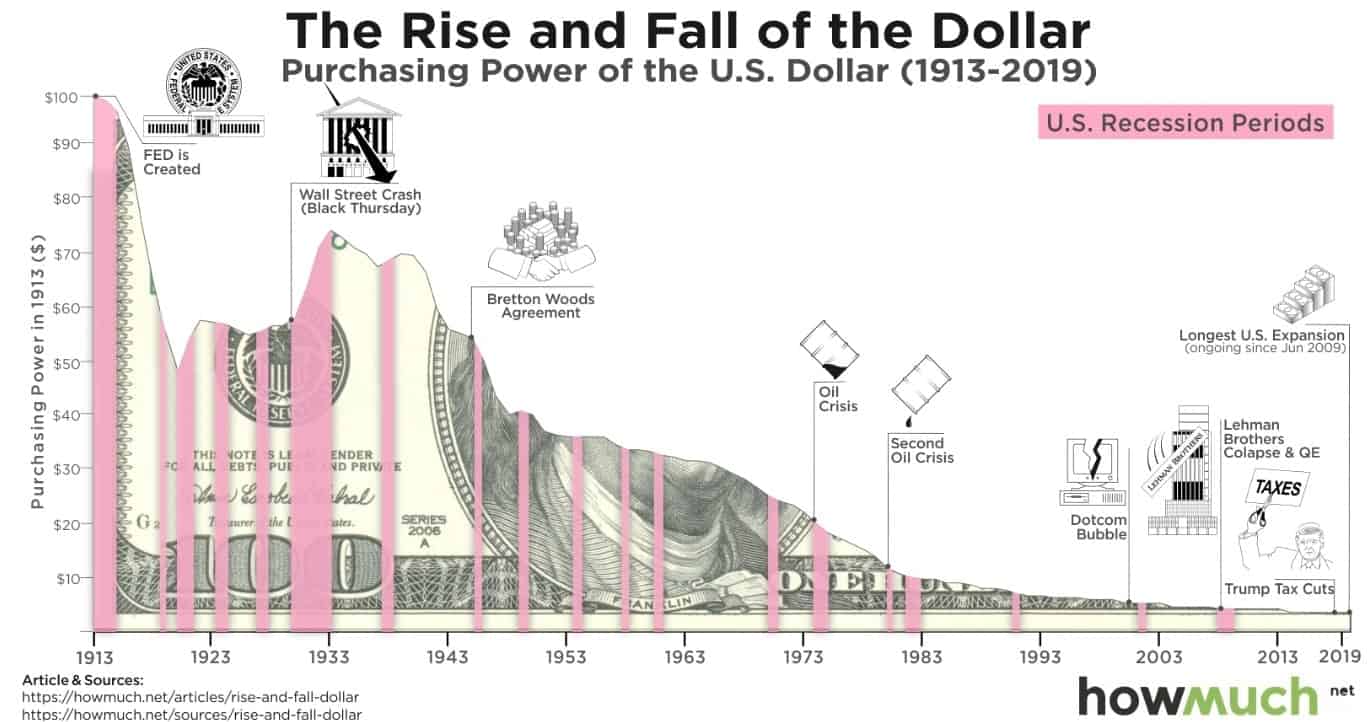

To anyone, this would sound impressive. But if you take a look at the dollar’s purchasing power, things become a little different.

This is perhaps one of the most popular images circulating the internet when it comes to visualizing how much the USD has been devalued over time.

Now, the reasons for this are various, but inflation has a lot to do with it, and it’s perhaps the main culprit. The consensus view among many economists is that sustained inflation occurs when a nation’s money supply growth manages to outpace the growth of the economy.

However, there are multiple factors that impact the supply of money. Most recently, the coronavirus demonstrated exactly how money could be printed to handle specific emergencies. The global economy tanked in a few short days in mid-March as most countries instituted mandatory lockdowns, causing a lot of industries to suffer.

In response, governments around the world, the US included, printed trillions of their respective currencies to support businesses and individuals.

While this may seem like a viable approach, what it does is devalue the money that’s already in circulation – it loses its purchasing power over time.

And it’s important to remember that the decision as to how much your cash is worth doesn’t belong to you – it belongs to a select group of people, occupying the important positions. This is what people refer to as centralization.

Enters Bitcoin

In 2008 a person or people using the pseudonym Satoshi Nakamoto filed a whitepaper that would forever change the way some people view money. Called Bitcoin: A Peer-to-Peer Electronic Cash System, it introduced a protocol that created an electronic form of new money where, instead of governments, the inflation was governed by code.

Because Bitcoin’s supply is predetermined, so is its inflation. In other words, there’s no central authority that can decide to create more bitcoins and to control inflation. No more than 21,000,000 bitcoins will ever exist, assuming the protocol continues to exist in its current form.

This paradigm-shifting invention was adopted by many as the solution to the world’s financial problems. And this became even more evident in the last few months.

However, as ingenious as Bitcoin is, it also has its issues.

For starters, Bitcoin’s protocol is not extremely scalable, and this stems from the nature of its consensus protocol (Proof of Work). Of course, projects are working to fix that.

However, the second issue might be seen by many as much more fundamental. The fixed supply of Bitcoin – a quality that most proponents treasure, is also a barrier when it comes to BTC being used as a medium of exchange. On the contrary, however, it makes it a great store of value – something that many authoritative figures, including the Chairman of the United States Federal Reserve, have pointed out.

In other words, the bitcoins you hold will always represent a certain percentage of the network’s total value, and it won’t be inflated away. But that doesn’t change the fact that if there’s more demand for Bitcoins than what’s already in existence – there wouldn’t be a way to get that.

This is something that all store of value accounts share, and it’s a phenomenon referred to as “inelasticity.”

To sum up, the issues of fiat are that they can be easily inflated through decisions of centralized authorities, the interests of which might not align with that of the general populace. The issue with Bitcoin is that there might simply not be enough of it to fuel the demand.

Moreover, because of Bitcoin’s scarcity, people who own it are incentivized to hold it rather than to spend it, if they believe its value will appreciate.

And this is precisely where Ampleforth (AMPL) comes into play.

What’s Ampleforth (AMPL)?

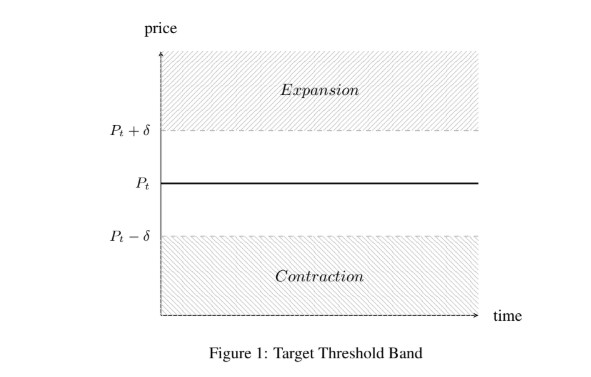

In straightforward terms, AMPL is a digital currency that adjusts its supply based on market conditions. It’s essentially a decentralized protocol that will inflate or deflate the existing AMPL tokens in circulation based on the current market conditions.

A common misconception is that AMPL is a stablecoin. It’s not. The protocol intends to keep the price relatively stable at around $1. Unlike existing stablecoins, however, its value isn’t pegged to the US Dollar. Instead, the protocol adjusts the supply of AMPLs on the market to either increase or decrease its current market price. This is easily explained as an example.

At the time of this writing, AMPL is trading at around $2.5, while its target price is $1.009.

This means that the protocol will have to issue more AMPLs to devalue the circulating supply and reduce the price to where its target threshold. To do that, the protocol uses two measures: an oracle price and the target price, both of which can be publicly seen here.

CryptoPotato got in touch with Richy Hayek, the project’s Chief Business Officer, who confirmed that the oracle price is a weighted average from market oracle providers. He also simplified the formula which gives the percentage of the daily adjustment to (Oracle Price – Target Price) / 10.

So, following the above formula, the calculations are:

( $2.843 (Oracle Price) – $1.009 (Target price) ) / 10 = 1,834. In other words, the protocol will issue 18.34% more AMPLs to adjust the price.

So if you’re holding 100 AMPLs, you will receive 18.34 AMPLs more in your account after the rebase.

If the price is below $0.95, the protocol will take tokens out of the supply under the same formula.

This adjustment, regardless of whether it’s positive or negative, is known as a “rebase.” It happens once every 24 hours.

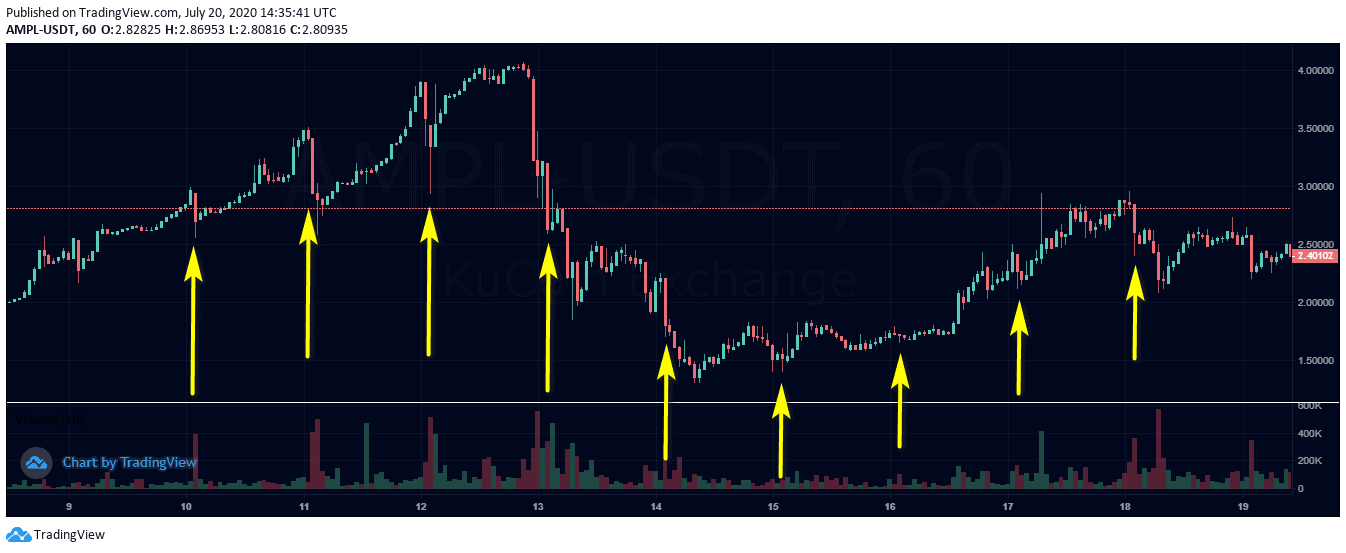

These changes are also reflected in the price. As you can see in the below chart, every single day at 2 AM UTC (when the rebase takes place), there’s a red candle that reduces the market price relative to the daily rebase.

However, since the demand is currently very strong, people are buying these dips which catalyze further increases and higher daily rebases.

In other words, your wallet balance will change based on the current price of AMPL every day. Currently, some of the major exchanges supporting AMPL trading are KuCoin and Bitfinex, and holding AMPL there or in any other ERC-20 wallet will allow you to take advantage of the rebase.

What this means for AMPL’s market capitalization is that as long as there’s a demand for it, the number will be going up. And as the protocol matures and increases in market capitalization, the price will fluctuate less and less.

The Problems AMPL Solves

The above mechanics, coupled with the overall elegance and soundness of the protocol, make AMPL a unique offering on the market.

There are a lot of problems that this solves.

Supply meets demand with no dilution

As we mentioned above, there are situations where more money is simply needed. However, unlike the fiat money-printing machine which dilutes those who hold cash, AMPL doesn’t do it.

If more AMPLs are needed, they will be supplied, but the adjustments are applied universally and proportionally across every wallet’s balance. This simply means that your percent ownership of the network remains fixed – much like Bitcoin.

It solves the inelasticity issue of Bitcoin and gold

On the other hand, there’s no predetermined amount of AMPLs to ever be in supply. This means that there can be as many as there’s a need for.

This tackles the inelasticity issue that store of value assets like Bitcoin and Gold have, making AMPL a viable means of exchange as well.

Scalability

According to the project’s Whitepaper, the Ampleforth Protocol is chain-agnostic. While it’s currently deployed as an ERC-20 standard token, it can exist simultaneously on many platforms.

What Are the Benefits of Ampleforth?

The inherent qualities of the protocol make AMPL a unique value proposition for a range of different purposes. Here are just a few.

Diversify Your Portfolio in the Short Term

Since the current DeFi market craze is attracting more and more interest, the demand for AMPL heavily outweighs the daily rebases. This has created a continuous cycle of perpetual rebases, fueling more and more AMPL tokens to the wallets of those who hold them.

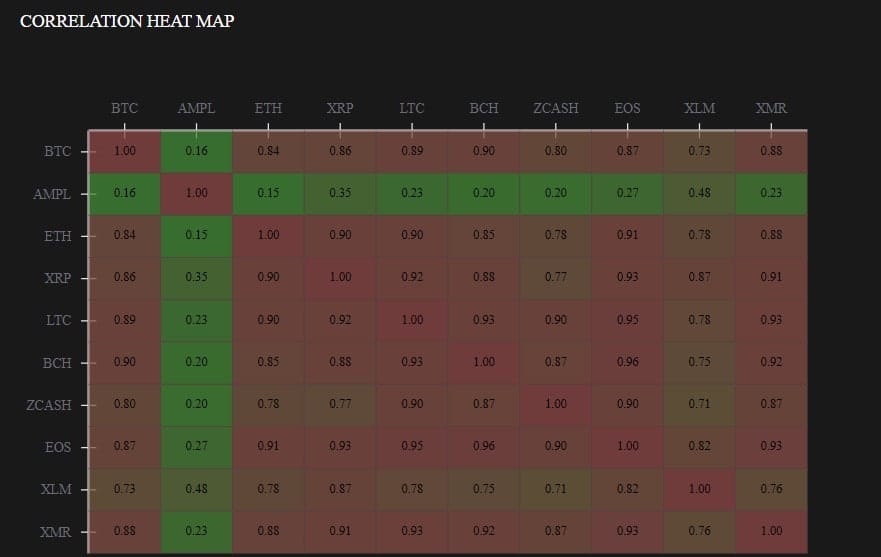

This apart, AMPL has demonstrated unique uncorrelation with the rest of the cryptocurrency market.

A Building Block in DeFi for the Medium Term

The purpose of AMPL is to act as a relatively stable currency, making it a lot less likely for DeFi liquidity providers to meet those hefty liquidations. Since the supply is entirely elastic, the price fluctuations in the medium term, once the market capitalization reaches a reasonable level, are expected to be minimal.

An Alternative to Fiat in the Long Term

AMPL has all the qualities of a medium of exchange, but it also takes away the trust issues that people have with centralized governments.

Its supply can be inflated to meet the increasing currency demand, but AMPL owners will never get diluted because of the proportionate amount they’ll receive as part of the readjustment.

What Challenges Lay Ahead?

While the concept behind Ampleforth might be one that’s worthwhile, the project will certainly have to overcome a lot of challenges.

- There’s a learning curve and a knowledge barrier

Understanding the mechanics of Ampleforth requires general economic awareness but also a more in-depth understanding of how the different monetary units work. A lot of people still don’t grasp the benefits of Bitcoin over fiat, and it’s the most widely-adopted and popular cryptocurrency. Ampleforth, while elegant in its design, is more complex than Bitcoin and, consequently, requires more research to grasp its full potential.

- Its value isn’t stable… yet

Until such time that we no longer denominate cryptocurrencies in fiat, AMPL’s value is unlikely to be 100% stable. Sudden shocks in demand, regardless of how large the market cap is, are likely to have an impact on its price. While this is exactly how the protocol is intended to work, it will likely face issues being adopted as a stable currency such as the likes of existing stablecoins.

Conclusion

Ampleforth has managed to create what used to be an imaginary perfect asset with infinite supply, the owners of which don’t have to worry about it getting devalued.

It’s also worth noting that the team behind the project consists of established professionals with years of experience in leading companies.

Ampleforth has the investment backing of some of the biggest names in the industry, including True Ventures, Pantera Capital, Huobi Capital, and even Brian Armstrong, the CEO of Coinbase himself.

The advisory board consists of professionals from Pantera, Facebook, the Hoover Institute, and the Libra Association.

Armed with a sound and innovative concept, a working technology, as well as some of the most trusted names in the field, it’s interesting to see how the protocol will develop in the future.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato