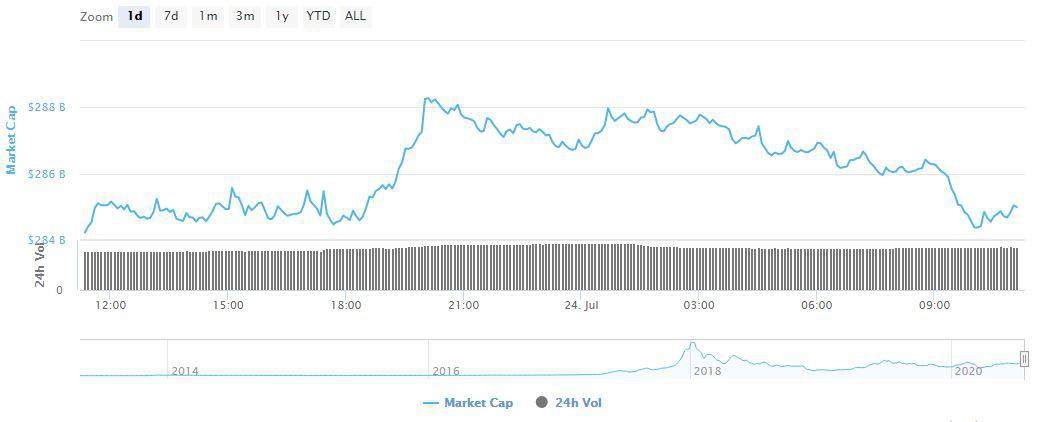

The total market capitalization has lost about 4 billion of its value in the past few hours, and the question is if this is simply a correction or a trend reversal.

At the same time, the precious metal market continues to soar with record gains, particularly silver.

Crypto Market Retraces By $4B

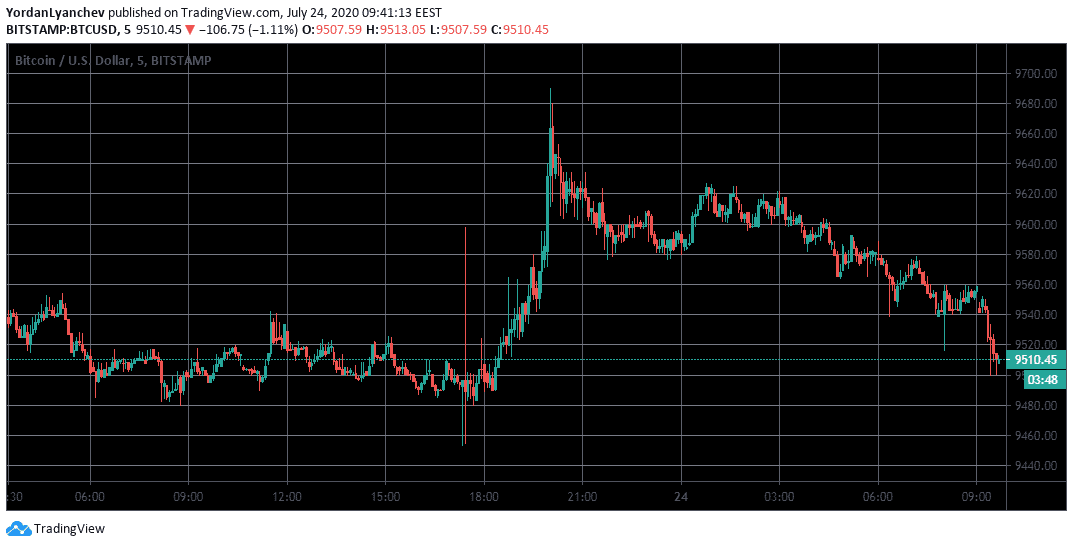

Volatility returned to some extent for Bitcoin this week. Following weeks of stagnation, BTC firstly broke the resistance at $9,300 and then continue towards conquering $9,500.

Bitcoin’s intraday high went to $9,680 on Bitstamp, where it got rejected by the next resistance. After failing to reclaim that level, BTC began its descend towards $9,500 again, which serves as support now.

Ethereum is another digital asset that felt a sudden burst of energy back to its performance lately. After being mostly stuck at $230-$240 for a few weeks, ETH jumped yesterday to $262 and continued rising today to nearly $277. The second-largest coin by market cap couldn’t keep up the bullish run and retraced to $270.

Most other large-cap altcoins, however, are slightly in the red. Bitcoin Cash, Bitcoin SV, Litecoin, and Cardano have dropped by over 1.5% since yesterday. EOS and Stellar have lost more than 3% of their value.

Other significant losers from the past 24 hours include Reserve Rights (-11%), Digitex Futures (-10.5%), Bancor (-10.2%). Consequently, the entire market cap has dropped from over $288 billion to about $284 billion in a few hours.

Nevertheless, there are still some impressive gainers. Flexacoin remains highly volatile, and after yesterday’s dump is up by 48% today.

DigiByte is another double-digit representative with an increase of 10.15%. DxChain Token (9.54) and Horizen (7%) are next, while Maker is up by 4.72% after being listed on Binance.

Blood On Wall Street, Green For Precious Metals

Bitcoin may be following yesterday’s price drops among the most prominent US-based stock market indexes. The S&P 500 went down by 1.23%, and the Dow Jones slumped by 1.31%. Yet, Nasdaq’s lost the most substantial by 2.3%.

According to Tom Lee, Managing Partner and Head of Research at Fundstrat Global Advisors, these adverse results on Wall Street are rather expected. He warned that similar developments could continue, as “there’s a lot to be worried about.”

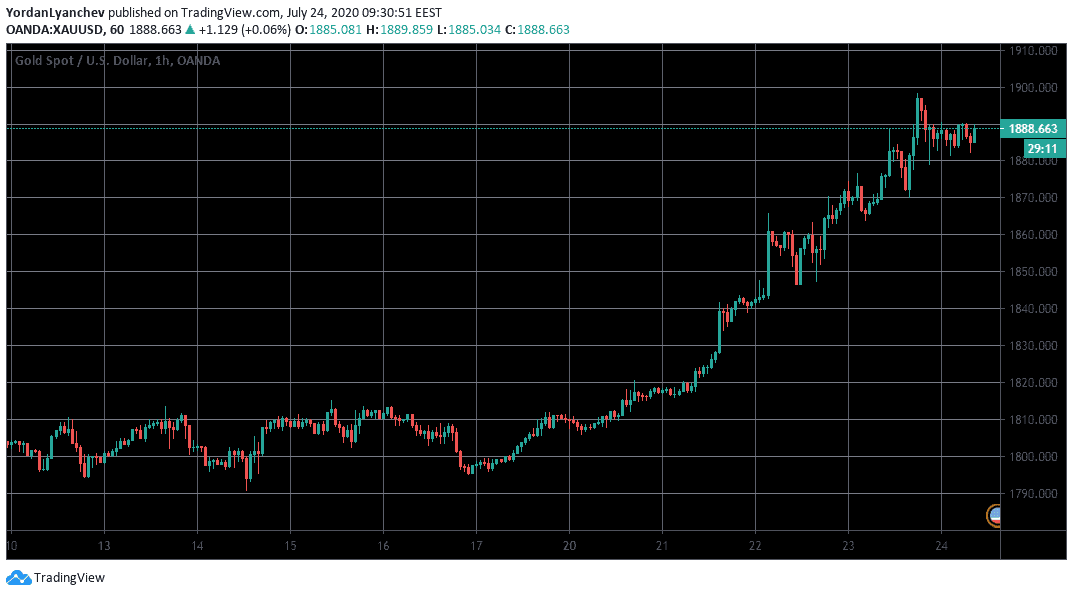

And while stocks dumped, the recent performance from gold and silver keep impressing investors. The two precious metals, typically regarded as safe-haven investments, have soared lately. Interestingly though, silver’s gains are outperforming its more expensive relative. This week alone, silver is up by 18%, while its YTD increase is nearly 30%.

Gold is also increasing lately, especially after it shot past $1,800 per ounce last week. It now trades at $1,888/oz, which marks a 25% rise since the start of 2020. Several experts believe that gold will pass by its all-time high of $1,920 before the year ends.

The latest interest boom towards the two precious metals could be attributed to the increasing fears about the global coronavirus recession. Simultaneously, the USD keeps losing its value, and a weaker dollar makes it cheaper for foreign investors to purchase gold and silver.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato