About an hour back, Bitcoin’s price clocked a new 2020 by hitting the $11,000 mark. This comes after BTC zoomed past the psychological $10,500 barrier earlier today. Is this a trap for bulls or the beginning of another bull market?

Bitcoin Price Has Officially Clocked a New 2020 High, Bull Market Here?

When a U.S. federal court declared Bitcoin as ‘money’ on Friday, and it responded by showing signs of life by breaking out a sideways trading range, the crypto community certainly didn’t expect a run to $11K.

But after a green weekend and a run past the $10,500 mark, here we are. BTC jumped another 5% to round it off. The top cryptocurrency is now up about 53 percent year-to-date (YTD).

According to some analysts like Bitazu Capital’s Mohit Sorout, the Bitcoin market supposedly was preparing for this huge move in response to the multi-year descending trendline pattern since 2017’s bull rally.

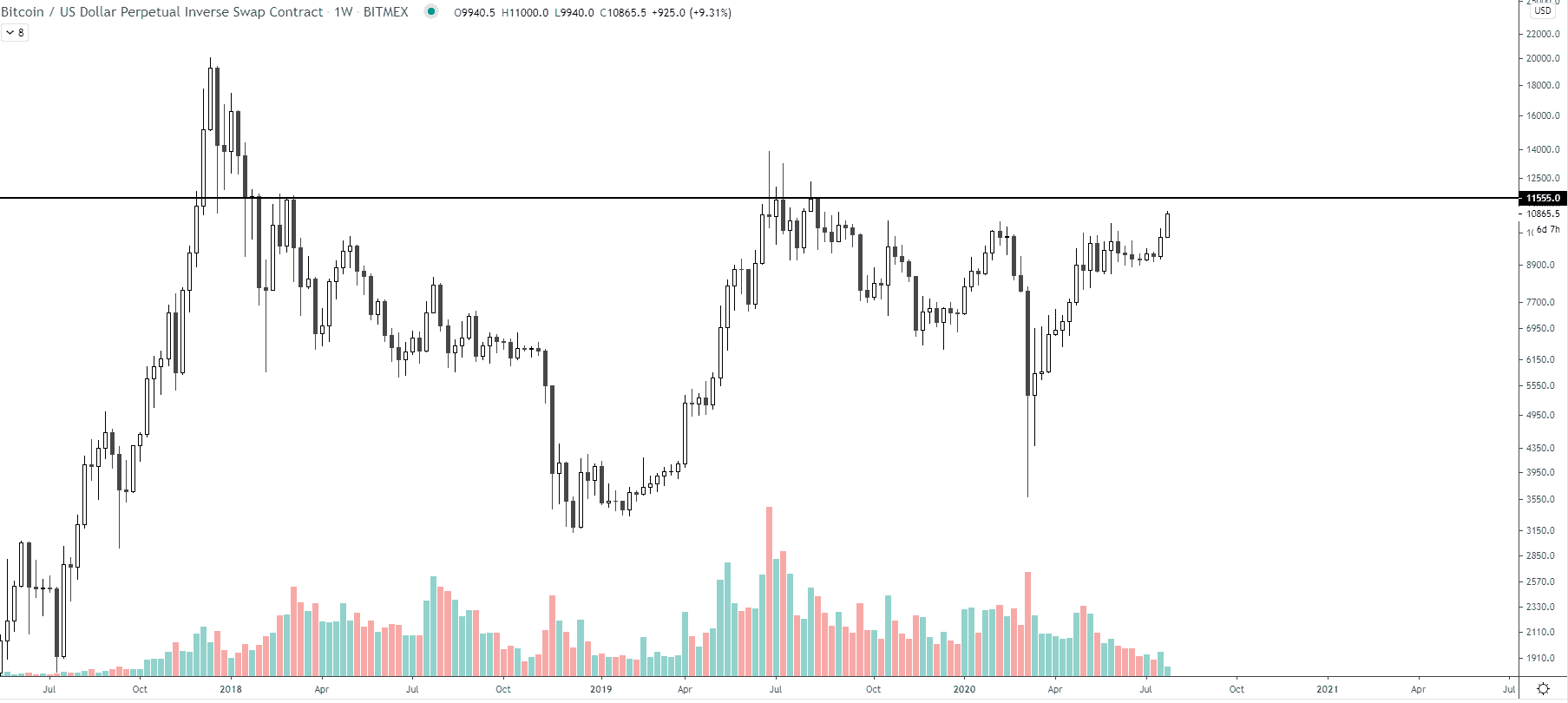

He also thinks that this could be ‘the beginning of something truly massive.’ Commenting on the rally, reputed crypto trader and analyst, Josh Rager stoked a possibility of Bitcoin price closing above the $11,555 mark this week.

That, according to him, would be an explicit confirmation of a new bull market.

BTC – imagine if Bitcoin closes above $11,555 on the weekly chart this coming week (yes it could pullback before or close under).

But a close above that level on the weekly would be clear and total confirmation

What About CME Futures? Is it a Bull Trap?

Bitcoin’s latest rally to $11,000 has left a massive CME futures gap between the $9600 – $9900 area. Industry observer Chris Dunn was quick to point it out. According to him, if the gap closes, it could result in a lot of hopium sedated retail players getting destroyed.

So here’s the big question – Is this gonna be the first CME gap that doesn’t close, or are we gonna get a deeper pullback to trap retail investors destroying the market buy button? pic.twitter.com/xF0cgGLTu2

— Chris Dunn (@ChrisDunnTV) July 27, 2020

But a Bloomberg Crypto Market report that came out last month says otherwise. As per the official literature, analysts at the mainstream media house think that ‘favorable trends in Bitcoin futures trading on the CME’ will support BTC price above the $10,000 level. To quote from the report:

A stabilizing premium in the Bitcoin futures price is supporting the market and indicates more institutional buy-and-hold interest. The 30-day average of the CME-traded Bitcoin futures vs. the Bloomberg-disseminated price has recovered from the recent dip, which bottomed above the previous trough. Our graphic depicts futures averaging just over 1% above the Bloomberg price (XBTUSD).

Overall, according to Bloomberg, there is an evident appreciation of institutional interest in Bitcoin as a profitable investable asset. Any activity on CME will only support the long-term bull case.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato