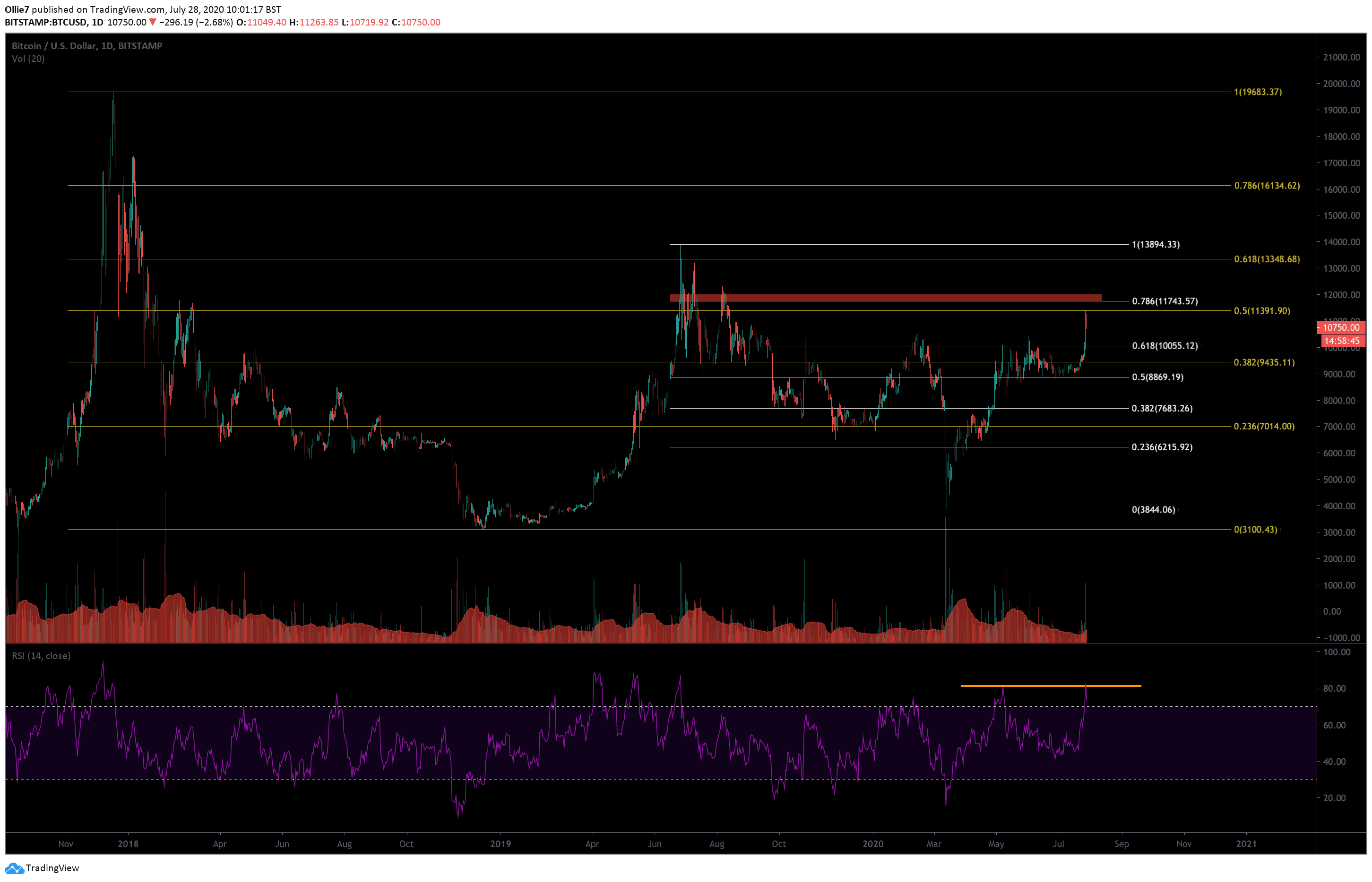

Bitcoin bulls appear to be resting right now after ricocheting off a major Fibonacci resistance at $11,390 (yellow Fibonacci levels on the daily chart).

This is the first time this level has been testing in almost a year and is one of the major hurdles standing in the way of BTC prices breaking above the psychological $12,000 mark.

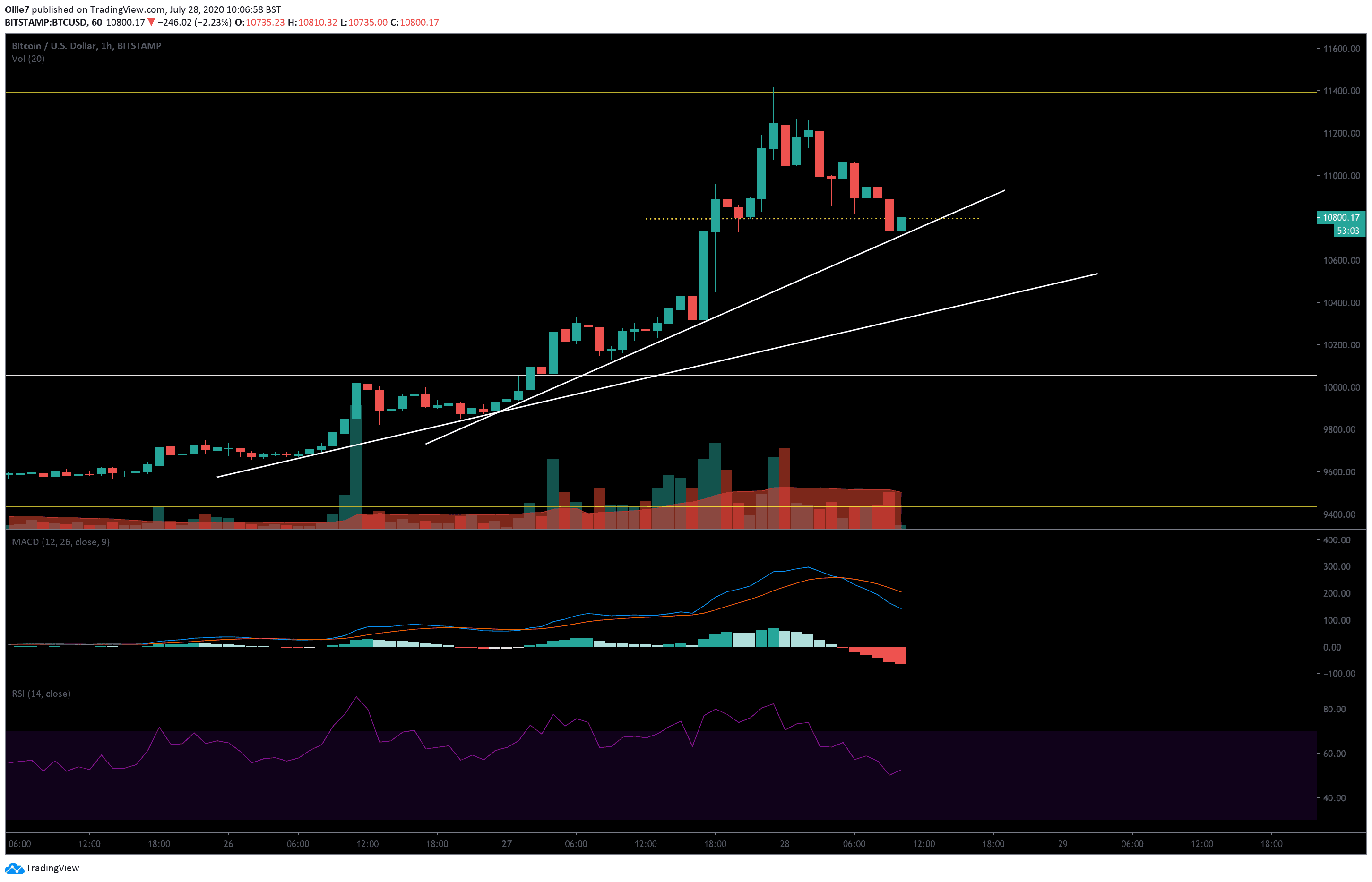

On the 1-Hour BTC/USD Bitstamp chart, we can see that up-trending momentum has stalled. Could this an early sign of a bearish reversal, or are bulls just recharging before they make another strong move?

The Technicals

On the daily BTC/USD chart, we can see that the leading crypto is wildly overbought right now on the RSI. This is usually a strong indication that a correction is due.

The last time bitcoin was overbought on the daily RSI was back on May 11, right before prices tanked 19% over three days.

On the 4-Hour MACD, it’s showing that buying volume is falling on the histogram. The 12-day moving average is also starting to arc down towards the 26-day moving average. If these two lines converge, it could be construed as an early signal of a short-term bearish reversal.

While this may all seem favorably bearish, it should be noted that the global crypto market capital has recently set a new higher high above $300 billion. This tends to be an excellent sign that we have entered into a bull market, at least in short to mid-term.

Price Levels to Watch in the Short-term

Right now, the aforementioned 0.5 Fibonacci level (yellow) at approx $11,400, is the first major target for bullish traders. This is followed by a historically key weekly resistance at $11,490, and then the psychological $12,000 target above.

Looking at the 1-Hour chart (below), we can see that the $10,798 level (yellow dotted line) is creating some intraday resistance for bullish traders. The price is, however, being supported by one of two up-trending supports (see white lines on 1H chart).

The first support is keeping bitcoin above $10,730. If this fails, then we could see prices tumble down to the second uptrending line approximately near the $10,400 mark (depending on when it breaks and meets the line).

Beneath that, we have the 0.618 Fibonacci level (white line) at $10,055, which could provide a foothold for bulls to rebound from if bears try to take over.

BTC/USD Bitstamp Daily Chart

BTC/USD Bitstamp 1-Hour Chart

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato